ANNUAL REPORT 2023-24

Strengthening our operational resilience and enhancing delivery systems to achieve sustainable growth.

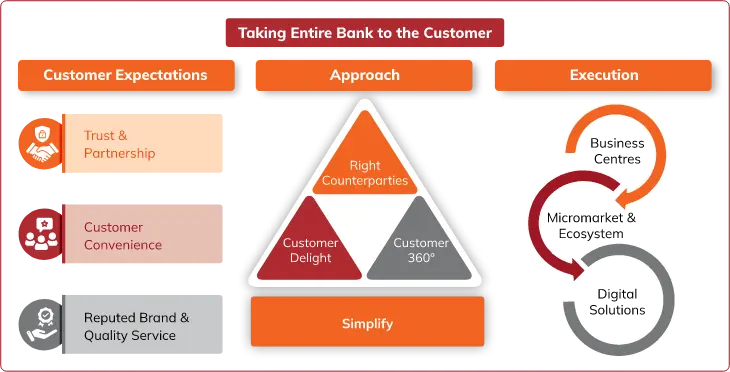

During fiscal 2024, the Bank continued to advance in terms of profitability, its franchise as well as building capabilities for sustainable and resilient growth. On the back of core principles of ‘Return of Capital’, ‘Fair to Customer, Fair to Bank’ and ‘One Bank, One Team’, the Bank has sought to maintain a strong culture while pursuing its business objectives. Emphasis was laid on deepening coverage and enhancing delivery capabilities while continuing the focus on appropriate risk and reward. The Bank’s strategic objective of risk-calibrated growth in profit before tax excluding treasury continued to drive businesses, anchored by a 360º customer-centric approach and exploring opportunities across ecosystems and micromarkets. The Bank’s profit before tax excluding treasury grew by 28.3% year-on-year during fiscal 2024 to ₹ 544.79 billion. The Bank saw broadbased loan growth across segments with a growth of 16.8% year-on-year in the domestic loan portfolio to ₹ 11,509.55 billion. The Bank continued to maintain its competitive advantage in cost of funds while enhancing the liability franchise and maintaining a stable and healthy funding profile. During fiscal 2024, the Bank continued to maintain a strong balance sheet with adequate liquidity, prudent provisioning and healthy capital adequacy.

Building trust with all stakeholders is critical to the Bank’s strategic objectives. The Bank re-iterates its focus on a strong risk and compliance culture that underpins dealings with our customers. We believe in serving our customers with integrity and transparency while offering suitable banking solutions. At the same time, the approach of right counterparty selection has provided an impetus to resilient growth in business. Remaining agile and aligning the organisation structure to evolving opportunities has helped in better serving our customers and exploring the potential across micromarkets and ecosystems.

The Bank has laid strong emphasis on continuously strengthening its operational resilience for seamless delivery of services to customers. It is also evolving in line with the growing and emerging requirements of our customers. We continue to focus on simplifying banking services to deliver an improved customer experience and enhance advocacy. As we continue to enhance our digital capabilities, which are integral to our operations, we remain invested towards strengthening our delivery systems, technology platforms and cybersecurity to sustain scalability and resilience.

EXPLORE MORE ON THE CHAPTER - OUR BUSINESS STRATEGY