ANNUAL REPORT 2023-24

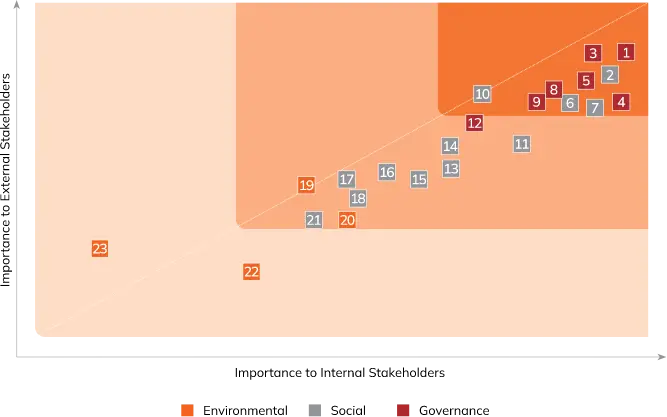

To determine the most material topics, a materiality assessment exercise was conducted by the Bank to identify key material topics for our stakeholders and business.

Our latest materiality assessment was carried out in fiscal 2022. The five-step approach for assessing material issues involved:

Process for capturing internal and external perspectives by identifying key internal and external stakeholders by mapping their interests and role for the organisation

List of 23 topics identified based on discussions with internal stakeholders, peer review and benchmarking, sector research, media reports and secondary sources

Developed a survey for capturing responses from diverse stakeholders

Analysed the data and level of priority of every material topic for every stakeholder

Developed a materiality matrix to prioritise the topics into high, medium and low categories based on the order of preference listed by stakeholders

The Bank recognises the importance of maintaining a strong focus on issues material to its stakeholders. The nature and potential impact of these material issues may vary and change over time. The top 13 areas and the risks and opportunities are as given below:

Being a domestic systemically important bank and among the top five listed entities (by market capitalisation) in India, we are exposed to various compliance requirements. The Bank has to ensure robust policies and processes, and there are no deficiencies in meeting evolving requirements on an ongoing basis. Any deficiency could lead to reputation risks and a breach of trust.

There is an opportunity to engage constructively with policy makers and advocate adoption of best practices for building resilience in the financial sector and supporting a growing economy.

We strive to be a responsible organisation with continued efforts at embedding a strong risk and compliance culture. The Bank remains vigilant of the evolving regulatory landscape, while ensuring that operations follow standards established by regulatory bodies.

The Bank’s control functions ensure that businesses and operations are aligned with best practices.

For more details click here

The increasing volume of digital transactions requires us to ensure availability and scalability of systems. A misalignment between business and IT strategies is a risk. An elongated period of downtime in the Bank’s digital channels could lead to operational and reputation risks for the Bank.

Digital innovations provide an opportunity to differentiate our offerings, with seamless and secure customer experiences. This can provide competitive advantage and gain customer confidence.

We aspire to create digital innovations with rich need-based features and functionalities for customers. The Bank’s digital platforms have transformed to provide seamless digital journeys.

For more details click here

Lack of robust data governance practices could increase the risks of non-compliance, regulatory fines, financial losses and reputation risk. The cybersecurity landscape is also highly dynamic and exposes the Bank to significant challenges to ensure safety and security of customers’ money and personal identity.

Strong governance and a robust cybersecurity and data privacy strategy can create confidence in the institution and also differentiate us as a responsible organisation with customer interest paramount.

Dealing with cyber risks form an integral part of the Bank’s enterprise risk management framework. The Bank is committed to working towards aligning itself with the changing landscape and has a dedicated team for cyber/information risk management. The Bank will continue to invest in building resilience and to effectively respond to cyberattacks; the Bank has significant focus on data privacy and data loss prevention mechanisms.

For more details click here

Ensuring strong governance practices and communicating the same across all levels in the Bank is important to build a culture that ensures business outcomes are delivered in the right manner and with responsibility. Banking is a business of trust, and failures caused by ethics, values and behaviours can cause reputation risk and could create significant costs to the Bank.

Embedding the right culture takes time to establish and begins with strong corporate governance and business ethics, which will ensure long-term sustainability of the organisation.

We have established effective policies and frameworks that encourage employees to act in accordance with the highest professional and ethical standards. Regular communication and training of employees is also undertaken.

For more details click here

Transparency is integral to good governance. Ensuring transparency in our engagement with customers and providing information of our products and services can enable customers to take sound financial decisions. The Bank recognises the responsibility and importance to be honest in its dealings with stakeholders.

The Bank seeks to engage constructively and responsibly in its area of operations. This is critical to build trust in the Brand, and with direct consequences to our business. The Bank also aims to ensure fair and balanced disclosures of its financial performance, with additional relevant disclosures made as and when required.

We recognise the criticality of transparency and disclosures, whether about the products we offer, our engagement with stakeholders or our contribution to society. The Bank aims to maintain robust governance and ethical and transparent relationship with all stakeholders.

For more details click here

Customer demands are evolving and digitisation has created new dimensions in banking services. Continuous value creation and superior banking experiences have become important considerations for customers. Lack of innovation and a customer-first approach could result in obsolete service delivery, meeting limited needs of customers and a loss of trust.

Digitisation and the rapid adoption of smartphones has given banks an opportunity to explore new ways of banking and providing customers ith unique offerings and with convenience.

Our Customer 360º approach and digital capabilities have strengthened the Bank’s value propositions for customers. Actively listening to our customers has helped improve the Bank’s offerings to customers, and reflects in the advocacy scores for the Bank.

For more details click here

Failure to serve customer with appropriate product offering and conduct can lead to loss of trust and risk the reputation of the Bank.

Banking is a business based on trust, and requires high level of customer-appropriate conduct. Generating business while protecting the interests of customers contributes to attracting depositors and growth in business.

The Bank’s philosophy of ‘Fair to Customer, Fair to Bank’ emphasises the need to deliver fair value to customers, including selling products and offer services which meet societal needs and are in the interest of customers.

For more details click here

The Bank’s performance is closely associated with the growth in the Indian economy. Any significant challenges posed by the external environment and rapidly evolving regulations could pose a risk to the financial performance of the Bank.

The Bank’s approach is to identify opportunities across ecosystems and micromarkets by efficiently serving customers with 360º solutions as well as continue to engage with all key stakeholders. Consistent financial performance can encourage stakeholders to remain associated and help the Bank deliver on its vision to be a trusted financial partner for our customers.

Our strategic focus is to grow the profit before tax excluding treasury within the guardrails of risk and compliance. The Bank is fostering a strong risk and compliance culture to ensure a balance of risk and rewards and ethical engagement with its customers. We are investing in areas that are critical for improving productivity and operational efficiency.

For more details click here

The Bank is exposed to several risks and the ability to manage various types of traditional and emerging risks is critical for sustainable growth of the Bank.

Dynamic risk management and understanding the opportunities and challenges associated with participating in strategic opportunities is the bedrock for robust growth of business.

The Bank continuously reviews the operating environment and closely monitors significant risks that could impact business. The Bank’s Enterprise Risk Management and Risk Appetite Framework articulates the risk appetite, and drills down the same into a limit framework for various risk categories under which various business lines operate. Further, detailed and periodic reviews are conducted at various Board Committees on the portfolios and operations of the Bank.

For more details click here

Strong management development and succession planning are important for the successful implementation of our strategy and stability of the organisation.

Leadership development and commitment to attracting, developing and retaining a diverse and inclusive workforce can enable the Bank to deliver strong and consistent results.

The Bank has institutionalised a succession planning and leadership development initiative to identify and groom leaders for next-level roles. The Bank through the Senior Management Cover Index, tracks the depth of leadership bench at the senior management positions. The Bank has a strong bench for key positions and for critical leadership roles.

For more details click here

The climate challenge and a fast transition to a low carbon economy could give rise to new types of risks that may not be fully understood.

Using our financial expertise to provide capital to low carbon sectors and new business opportunities in this space, based on appropriate risks and return assessment. We are committed to supporting customers as they decarbonise their business.

The Bank has been supporting capacity creation in environment-friendly areas, such as renewable energy, use of electric vehicles and development of green buildings, with an appropriate risk-return assessment. There is also a focus on promoting biodiversity and protecting our ecology through the Bank’s CSR initiatives.

For more details click here

Assessing the environmental impact of the Bank’s own operations and facilities will be necessary to develop the Bank’s own roadmap towards carbon neutrality/net zero in own operations.

Being in the service industry, the carbon footprint from own operations is not expected to be significant and would be manageable.

The Bank is committed to minimising the environmental impact of its operations and facilities by adopting best practices and certifications for green building standards. It has committed to become carbon neutral in Scope 1 and 2 emissions by fiscal 2032.

For more details click here

The impact of climate change poses tangible risks to the Bank’s own operations as well as business resilience of its borrowers. The consequences of climate change include both incremental effects (a long-term change in the mean and variability of climate pattern) and acute effects (increase in frequency and severity of extreme weather event). Assessing physical and transition risks are important to understand the impact of climate change events that can be felt across the Bank’s own operations as well as business models of its borrowers.

Significant opportunities are likely to emerge as efforts gain traction to meet commitments towards sustainable growth and transition to become carbon neutral or net zero. The Bank has been supporting sustainable and sustainability-linked projects in areas like renewable energy, electric vehicles, green buildings, sanitation, waste management, etc. based on an appropriate risk-return assessment.

The Bank has established adequate policies and frameworks for evaluating climate-related risks in the lending book. At the same time, assessment of the portfolio for climate risks, both physical and transition risks, for top corporate counterparties has been included as part of stress testing as well as capital planning exercise.

For more details click here