ANNUAL REPORT 2023-24

Strengthening our operational resilience and enhancing delivery systems to achieve sustainable growth.

ICICI Bank's digital transformation journey involves integrating digital technologies and platforms to enhance customer experience. Providing a diverse range of services like mobile banking, internet banking, UPI payments, and digital wallets, the strategy emphasises accessibility and security for all users. This inclusive approach underscores the Bank's dedication to offering convenient and secure banking solutions for everyone utilising the Bank’s platforms. The open architecture platforms have enabled the Bank to extend banking services to non-ICICI Bank account holders. Digital channels continue to account for over 90% of financial and non-financial transactions.

ICICI Bank’s iMobile Pay app strategy focusses on delivering a seamless, secure, and personalised banking experience. The app prioritises accessibility with a userfriendly interface for easy navigation and access to a wide range of banking services including account management, fund transfers, bill payments, and investments. The app also embraces innovation by integrating emerging technologies like AI-powered chatbots for customer support and biometric authentication for login. The coverage of iMobile Pay app has expanded to standalone loan customers, credit card customers and non-ICICI Bank account holders. Video KYC continues to empower retail customers to complete ‘Know Your Customer’ (KYC) process through video interaction within a few minutes. Video KYC is live for 22 products, and is also available for re-KYC.

Security is paramount and it is ensured through advanced encryption, multi-factor authentication and other enhanced security measures such as limit on number of payee addition, customised transaction limits for internet banking and additional factor of grid card authentication. The Bank has also implemented an Enterprise Fraud Risk Management (EFRM) solution, a real-time transaction monitoring system which identifies transactions anomalies based on customer behaviour patterns and variety of data attributes. For the transactions qualifying the risk rule condition, an alert is generated which either declines the transaction or challenges customers with step up authentication or customer is called for transaction confirmation through interactive voice response call.

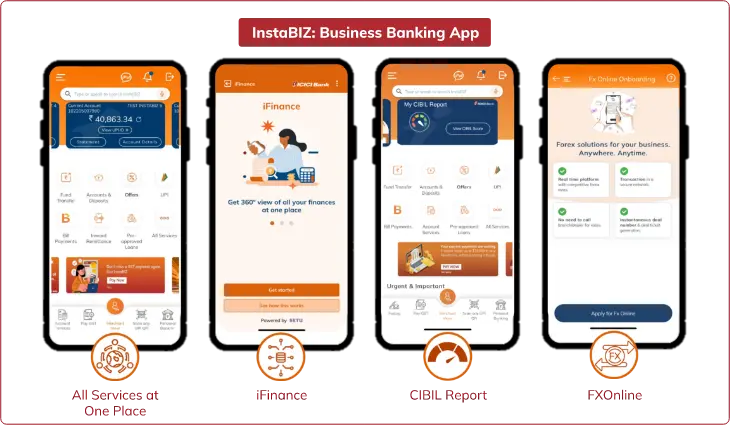

The iMobile Pay app’s addition of ‘My Investment Portfolio’ features a dedicated section offering ICICI Bank customers a unified view of their investments. Furthermore, the introduction of iFinance (powered by account aggregator) presents a comprehensive solution, accessible to all users across the Bank’s digital platforms, enabling a consolidated view of all bank accounts. The addition of UPI for NRIs and smart scan capabilities simplifies transactions, complemented by its extensive range of 400+ services, with the unique voice search that makes navigation across these services quick and convenient. This holistic approach redefines digital banking standards, fostering deeper user engagement and loyalty. These advancements reflect ICICI Bank’s commitment to ensuring a seamless and convenient personalised banking experience for its customers that evolves with growing needs in the digital era.

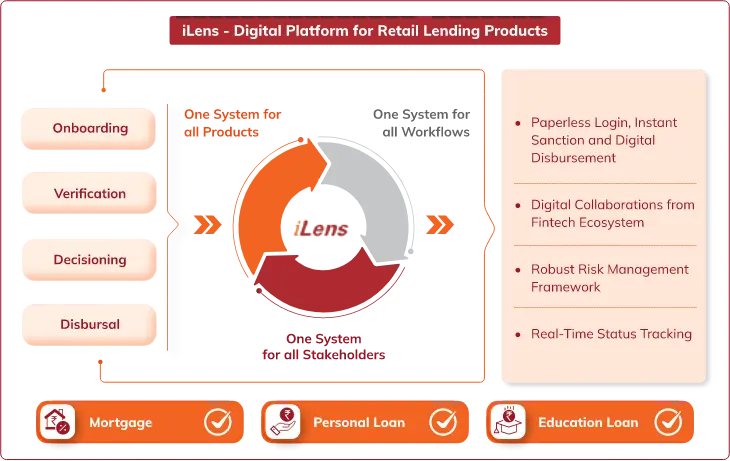

iLens - ICICI Bank’s Lending Solution, is an integrated loan processing platform for retail loans. It is an industry-first end-to-end digital lending platform covering the entire loan life cycle, starting from onboarding to disbursement with the objective of providing superior transaction experience and enhanced operational efficiency.

It is a future-ready solution which harnesses digital collaborations with the fintech ecosystem. It is cloud native, device responsive and has micro services enabled open architecture which not only allows flexibility to integrate with multiple internal and external systems through APIs, but also facilitates faster time to market and adaptability.

In addition to mortgage which was introduced in fiscal 2023, product enhancements to iLens platform were made during fiscal 2024 to include personal loan and education loan. This is expected to further enable the Bank to provide enhanced customer experience and increase its ability to capture the entire Customer 360° ecosystem in a simplified, frictionless and digital manner, thereby creating value for the customers and the Bank.

iLens acts as a common interface across all users required in a retail loan journey. It has an inbuilt customer interface ‘TrackMyLoan’ through which the customers can track real-time status of their loan application, submit documents, respond to queries and access various communications and documents like sanction letter and fees acknowledgement. It offers a wide range of digital solutions like instant approval for products to existing as well as new-to-bank customers, digital disbursements (e-sign and e-stamp) and digital KYC verifications. Besides catering to digital loan applications, it also caters to ‘phygital’ and physical loan applications. It is enabled with an in-house robust rule engine facilitating efficient decisioning and standard implementation of various policy, process and regulatory norms.

InstaBIZ is a one-stop solution for all banking needs of business banking customers. Our ‘All-in-One Business Banking’ app provides all services to help the customers with their daily business needs. Customers can apply for loans, avail instant overdraft, open a current account, manage export-import transactions, get merchant banking solutions, make instant bill and tax payments, and do a lot more with the business banking app on the go.

The Bank strives towards continuous improvement by actively seeking and incorporating customer feedback into developing new & enhanced features to provide better customer experience through simplified journeys and intuitive UI/UX.

ICICI Bank’s digital offerings for large corporates and their ecosystems include digital platforms for domestic and international trade, and industry-specific solutions across the value chain. The Bank has created several industry-specific STACKs, which provide bespoke and purpose-based digital solutions to corporate clients and their ecosystems. The four main pillars of ICICI STACK for corporates include digital banking solutions for companies; digital banking services for channel partners, dealers and vendors; digital banking services for employees; and curated services for senior client personnel. The Bank is investing in areas that are critical for delivering enhanced customer experiences, boosting productivity, improving operational efficiency and creating simplified customer journeys.

The Bank commenced its journey to digitise the end-to-end Bank Guarantee (BG) issuance process across all touchpoints, from receiving a request to processing and delivery, providing an uninterrupted digital experience to the customers. Trade Online, the flagship platform for trade transactions, provides a digital channel to place BG requests online. The Bank has enhanced its BG offering by introducing Smart BG Assist, a first-of-its-kind solution, that makes the BG text creation process seamless by empowering the customers with a Do-it-yourself (DIY) experience, providing real-time feedback. Smart BG Assist is enabled across channels and business centres. The Bank has enabled digital execution of BGs using e-stamping and e-signing solutions, through empanelled agencies, that make BGs paperless and help in their digital transmission. The Bank also provides a digital repository of BGs for the beneficiaries on Trade Online which helps them in managing their incoming BGs. The entire process is crafted in a manner that provides operational efficiency to all the stakeholders.

Supply chain financing is an increased requirement from corporate clients for bringing in efficiency and scale within their supply chain ecosystem. The Bank’s wide range of supply chain and structured trade products offer a one-stop solution to corporate clients and their supply chain partners, helping in optimising their working capital financing needs and thereby increasing efficiencies in their ecosystem. These supply chain solutions are offered digitally through various secured platforms namely OneSCF, Financial Supply Chain Management (FSCM), CorpConnect and DigitalLite, wherein corporates can seamlessly manage their supply chain requirements of payments, collections, data reconciliation and customised dashboards in a paperless environment.

Non-Resident Indians (NRI) banking continues to be a key growth driver for the Bank’s international banking business. The focus continues to be on improving customer experience through enhanced service architecture, value propositions and seamless processes, with the objective of capturing Customer 360° and market share.

The Bank was amongst the first few to launch UPI facility for NRI customers. Currently this facility is available in ten countries – Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA. In addition, the welcome kit to on-board new customers on product and service offerings is now digital to add to the green initiatives. Simplified servicing at contact centres through voice biometrics eliminates the need for subsequent authentication.

Facilitating frictionless cross-border remittance solutions has been the core strategy in re-designing the Bank’s solutions for both inward and outward remittance needs of NRIs and resident Indians. On Money2India-US, the remittances platform has been upgraded and integrated for increasing the instant account verification of remitters. For inward remittances, the Bank continues to focus on partnerships with other banks and exchange houses as well as, synergies with the channel teams to enhance offline remittance flows and service.

On retail outward remittances, focus continues on leveraging iMobile Pay channel for existing and new customers. As an industry-first initiative, full value transfers (Guaranteed Delivery Product) have been enabled for all retail outward remittances in USD and GBP currencies facilitating the beneficiaries to get full value for their underlying remittance transaction. Automation of final credit confirmation to remitters through an SMS based on the SWIFT Global Payments Innovation (SWIFT GPI) integration has also been implemented.

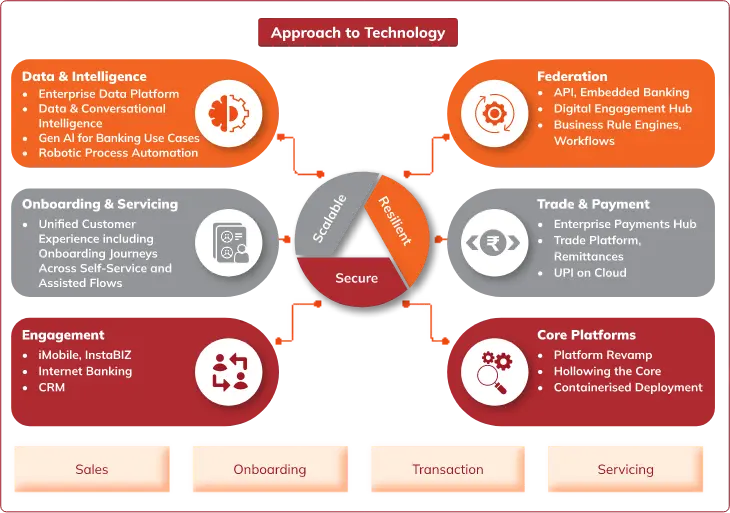

In fiscal 2024, the Bank to BankTech journey has progressed with increased focus on technology platforms, embedded banking, cloud adoption, data platform and analytics. The Bank’s efforts continue to be guided by the three pillars of scalability, resilience and security across technology solutions.

As a part of the Bank’s technology strategy, the Bank has created an enterprise architecture framework across digital platforms, data and analytics, micro services-based architecture, cloud computing, cognitive intelligence and other emerging technologies. Each facet of the architecture considers basic foundational elements of scalability, modularity, agility, availability and resilience besides being cloud native and digitally native.

The Bank has also been reviewing the Generative AI framework and solutions for possible integration with applications currently used. The Bank has done an assessment of the opportunities and risks arising out of the Generative AI tools and models with initial focus towards creating internal tools to assist employees to serve customers better.

The Bank has more than 4,600 APIs, of which close to 1,800 APIs are consumed internally for communication across applications. The Bank has about 2,600 APIs for Retail banking and about 200 APIs for Corporate banking. The Bank has been managing more than 160 million financial and non-financial transactions per day.

The Bank has expanded its data centres across regions and is moving towards enabling Availability Zones across application clusters. The Bank has been investing in observability platforms which are critical towards ensuring preventive and proactive responses across application and infrastructure landscape.

Over

APIs for Retail Banking

Over

APIs for Corporate Banking

Over

Financial and Non-Financial Transactions Per Day

The fast-moving technology landscape along with various channels of interaction also means increased focus on information security across various aspects of technology beginning from data centre to the cloud to the entire technology supply chain. The Bank has adopted an integrated security architecture based on zero trust principles across data centre and cloud implementations.

The Bank leverages technology to automate and redesign processes, building end-to-end digital journeys, removing redundancies and using public digital infrastructure (PDI) to strengthen operational resilience and deliver seamless customer service.

In the fiscal year 2024, the Bank focussed on better customer engagement and relationship building at business centres by consolidating their operational activities and releasing their capacity through OpsServe initiative. The Bank has also initiated programs like UDAAN for NRI, senior citizen campaign for reaching out to customers proactively for timely servicing.

The Bank is leveraging the changing technological landscape and the power of subtraction to give a Customer 360º product onboarding experience to customers with initiatives such as One KYC, savings account with home loan, co-branded cards with minimum data and documentation. The Bank has also focussed on rationalising variants and removing complexity for its Business Banking Customers through end-to-end unified and automated disbursement journeys which has resulted in leaner processes and reduced turnaround time.

The Bank focusses on simplification of processes and building digital journeys to create faster and seamless delivery of services to its customers. The Bank has upgraded to a single enterprise-level Customer Relationship Management (CRM) platform with enhanced capabilities for all servicing needs of the customers.

EXPLORE MORE ON THE CHAPTER - OUR BUSINESS STRATEGY