ANNUAL REPORT 2023-24

The Bank’s success is anchored by its people and a culture of ‘One Bank, One Team’ driving its business.

The Bank’s human capital strategy is underpinned by key anchors of Fair Compensation, Learning and Growth, and Care. Our human capital strategy is designed with our focus on maximising risk-calibrated core operating profit based on the opportunities available across micromarkets and ecosystems. To capture the 360° banking needs of customers, every employee is encouraged to identify opportunities and drive business for the Bank.

The Bank has aligned the organisation around micromarkets and customer ecosystems by increasing the density of leadership in key markets. The integration of the Bank’s businesses happens closer to the customer. This enables better understanding of customer needs at a micromarkets level. The corporate office operates as a service centre and the purpose of the central team is to serve the employees. The Bank encourages its employees to experiment and innovate to deliver services and create solutions for customers within the guardrails of risk and compliance.

The Bank’s hiring philosophy is drawn from the cultural anchors of the Bank. The Bank believes in hiring for attitude and training for skills. Wherever required, the Bank uses personality inventories to better understand the work preferences/behaviours along with cultural fitment with the Bank’s values.

The Bank follows a prudent compensation practice under the guidance of the Board of Directors and the Board Governance Remuneration & Nomination Committee (the BGRNC or the Committee). The Compensation philosophy of the Bank is aligned to reward team performance. The Bank’s approach to compensation is intended to drive meritocracy within the framework of prudent risk management. The total compensation is a prudent mix of fixed pay and variable pay, which takes into account a mix of external market pay and internal equity. The fixed pay offered by the Bank, largely reflects pay for the role. The variable compensation is in the form of share-linked instruments or cash or a mix of cash and share-linked instruments. The cash component of variable pay (performance bonus) is aligned to the philosophy of ‘One Bank, One Team’ as it is based on overall performance of the Bank and reflects reward for team performance. The grant of share-linked instruments to eligible employees, reflects individual potential and criticality of position/employee. During fiscal 2024, the Bank deepened the number of employees who were allotted share-linked compensation to around 18,350 employees. The compensation of staff engaged in all assurance functions like Risk, Compliance & Internal Audit depends on the achievement of key results of the respective functions and is independent of the business areas they oversee.

The focus on a 360º customer-centric approach with an objective to serve customers in a holistic manner has underpinned the Bank’s operations. To deliver superior customer value, the Bank has invested in training its employees and enhancing their ability to comprehensively serve customers. This has enabled teams to be agile in responding to requirements of customers, and work collaboratively to create innovative and personalised products & solutions for customers.

The Bank has a capability building architecture spanning across functional training, leadership development, digital and industry academia programmes to equip employees with the required skillsets.

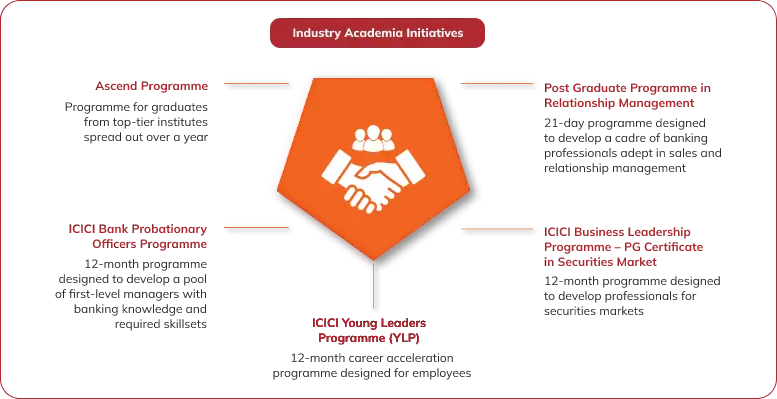

The Bank has collaborated with academia partners to onboard a high quality, job-ready workforce. One of the key aspects of the industry academia programmes is the skills it builds in the banking, compliance, financial and digital services domains. These industry academia programs align new hires to the culture of the Bank and impart functional knowledge in banking and related subjects.

Apart from fresh graduates, existing employees at frontline levels can also enrol in ICICI Bank’s Probationary Officer programme and get inducted as Probationary Officers after completing the programme at ICICI Manipal Academy. The Bank has a Young Leaders Programme (YLP), where existing employees have the opportunity for higher education (Post Graduate Programme). Those who successfully complete this programme are deployed back into the Bank in managerial roles.

The Bank is an employer of choice at premier management and engineering campuses across the country.

The Bank continued its focus on Capability Building through its various academies. During April 1, 2023 to March 31, 2024, the Bank delivered an average of around 12 learning days of training per employee.

Customer 360º (C360) programme is designed for all Relationship Managers who join the Bank to inculcate C360 mindset. The objective is to take the entire Bank to the customer and provide end-to-end solutions to address customer needs. The programme provides comprehensive understanding of C360 focussing on product knowledge, building C360 in customer engagement through various scenarios, pertaining to relationship management, customer service, digital propositions and process & compliance.

Once employees in relationship management roles complete the C360 programme, they have options to further deepen their knowledge in areas like trade products, business banking, asset products, etc.

Risk and Compliance workshops are conducted for employees in business centres and other retail banking groups, Compliance Group and Wholesale Banking Group (including for Business Heads & Regional Heads) to equip them with the necessary skills to make decisions based on the principles set out in the risk and compliance framework of the Bank. The programme discusses various scenarios where the learners understand the approach in line with the risk and compliance framework. The session is also conducted as part of Branch Leadership Programme for new Branch Managers.

Branch Leadership Programme is the Bank’s flagship training programme for new Branch Managers and Deputy Branch Managers. It is an instructor-led classroom programme focussed on inculcating the cultural framework of ICICI Bank along with detailing key aspects of their roles. The programme revolves around Customer 360º, ecosystem and micro-market concepts.

Each programme provides opportunity to engage with senior management to build perspectives around Customer 360º, service orientation and operating within the risk and compliance norms of the Bank. The training covers ‘Go to market’ approach, branch profitability, risk and compliance, micro markets strategy, selling skills and relationship management, ecosystem banking, customer service, trade, transaction banking, institutional banking, business banking, overview of products and solutions with focus on digital adoption

In order to nurture talent and build domain-specific skills, ICICI Bank has deployed a wide range of functional academies which conduct several programmes. These academies cover new joinees to the Bank, new joinees to various roles and also refresher programmes for existing employees. These are designed around ICICI Bank cultural framework, business and functional skills, and also impart behavioural training as a part of the programme. The focus of functional induction programmes is to ensure that all employees who join the Bank have sufficient learning inputs which they can put into use on the field and supplement their on-the-job learning.

In line with the vision of building a scalable, future-ready and data-driven organisation, the Bank continues on its journey of transformation from Bank to BankTech. To meet this objective, identified employees have been trained in skill domains like API (application programming interface) & micro services, cloud computing, data engineering, software engineering and project management. Programmes on cybersecurity, technology infrastructure, UI/UX design, artificial intelligence and software testing have also been rolled out for identified employees.

In addition to the above programmes, the Bank conducted refresher programmes for employees in the areas of product, processes, compliance & on various technology systems. The Bank also conducted behavioural skilling in areas of personal effectiveness, interpersonal skill building, presentation skills and leading teams for identified employees.

In line with regulatory expectation around Capacity Building in Banks, eligible employees in the areas of credit, accounting, risk and treasury, have been enrolled for certification with accredited institutes.

Leadership Development Programmes and Leadership Engagement Sessions are conducted on a regular basis at the Bank. The ‘Ignite’ series is an ongoing initiative designed to keep the employees abreast with breakthroughs in the domains of leadership, digital transformation, data science and behavioural economics. The sessions provide an opportunity to teams to engage with domain experts and thought leaders in these areas.

ICICI Bank also partners with thought-leaders across a wide spectrum of fields ranging from academia, management to sports, to engage with and build leadership perspectives.

Under the umbrella of Leadership Academy, the Bank organises formal leadership development programmes on four identified themes of Technology, Data Science, Design Thinking and Project Management.

The objective of conducting learning assessment is to understand how design and delivery of training content may be improved. The Bank’s learning culture places a strong focus on confirming whether learners are indeed able to demonstrate understanding and application of basic concepts learnt in online and instructor-led functional programmes. This is generally in the form of an application-oriented test which is administered through Learning Matrix – the Bank’s internally managed learning platform. The universal passing criteria for all assessments is 80%. The performance of employees on assessments is continually evaluated to fine-tune training content and for giving feedback to our internal facilitators.

The Bank has constituted academic councils comprising senior leaders from various functions to meticulously design and oversee the curriculum and delivery of its key training programmes. These councils bring together a wealth of knowledge and experience from diverse areas such as retail banking, corporate finance, risk management, and technology, thus ensuring a holistic approach to employee development. By incorporating insights from different business units, the academic councils ensure that the training programmes are not only comprehensive but also aligned with the Bank’s strategic goals and dynamic needs of the business. Through continuous feedback and review mechanisms, the academic councils also play a pivotal role in the ongoing refinement and enhancement of the training initiatives, fostering a culture of continuous learning and professional growth within the organisation.

The Bank believes in investing in its employees to take up challenging assignments and responsibilities early in the career. The Bank’s ‘customer-oriented’ approach known as Customer 360°, encourages employees to take up new roles and not restrict themselves to specific areas. As a part of their career and skill development, the Bank offers opportunities to employees to explore diverse roles and functions. This provides employees the chance to explore and develop learning and expertise in different domains.

The Bank has institutionalised a succession planning and leadership development initiative to identify and groom leaders for next level roles. The Bank has a robust succession planning process which, through the Senior Management Cover Index, tracks the depth of leadership bench at the senior management positions. The Bank has a strong bench for key positions and for critical leadership roles.

Employees play a pivotal role in the success of the Bank’s strategy and growth of the organisation. The Bank believes in providing an enabling work environment that helps employees to achieve aspirational goals. The Bank is an inclusive and a caring workplace, driven by meritocracy and equal opportunities for all.

Employees at the Bank imbibe Officer Like Qualities (OLQ) at the workplace and in all internal and external engagements. These include respect for Brand ICICI, dignified behaviour in dealing with everyone, managers in position of authority can be demanding but not demeaning, being humble & service-oriented and having an attitude of learning. The Bank has a 24x7 emergency helpline, accessible to all employees of the Bank. This helpline facility has, over the years, provided crucial support to employees and their immediate family members during exigencies. To cater to emergencies, the Bank also has a dedicated Quick Response Team (QRT) to assist employees if they are in any distress.

To facilitate quick medical attention for employees in medical emergencies, the Bank has tie-ups with more than 100 hospitals in key cities across the country. The Bank also provides comprehensive insurance coverage for all employees, across all grades. Group insurance facility includes both the Personal Accidental Insurance Scheme as well as the Group Life Insurance Scheme. The Bank also facilitates a Parental Insurance Scheme at preferential rates for its employees.

ICICI Bank has also set in place a robust grievance handling mechanism to ensure that it is accessible to all employees. Known as I-Care, this centralised and dedicated team is equipped to handle employee queries and strives to provide a speedy resolution.

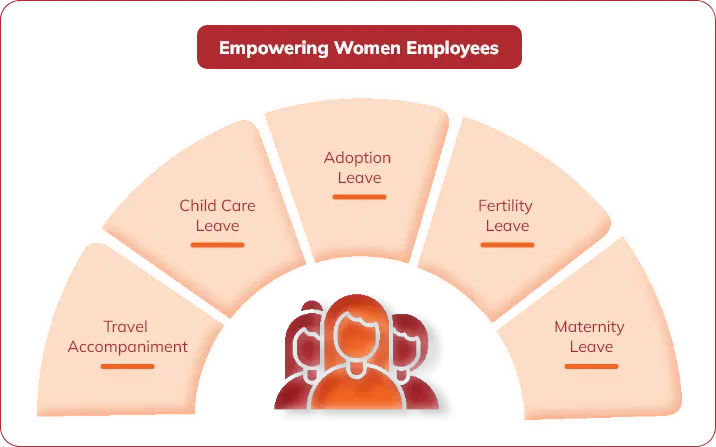

The Bank’s philosophy of meritocracy and equal opportunity has led to a significant number of key positions being held by women employees over the last two decades. Conscious of life stage needs and safety of women employees, a range of benefits and policies have been curated. In addition to maternity leave, employees have access to child care leave and adoption leave. The Bank has a Travel Accompaniment Policy which allows women with young children to be accompanied by their child and a caregiver during official travel, with the cost borne by the Bank.

The Bank also has a policy designed to provide financial support to employees who have children with special needs. Under this policy, the Bank covers expenses incurred on improving the quality of life of employee’s children with special needs through specialised education (at home or through a special-needs school), specialised therapy, specialised equipment and periodic treatment, if required (at hospital or at home).

At the Bank, sexual harassment cases are handled as per the guidelines set under The Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013. The Bank has created awareness about the Act through mandatory e-learning at the time of induction. The Bank also regularly communicates with employees regarding the mechanism for raising complaints and the need for right conduct by all employees. The policy ensures that all such complaints are handled promptly and effectively with utmost sensitivity and confidentiality and are resolved within defined timelines.

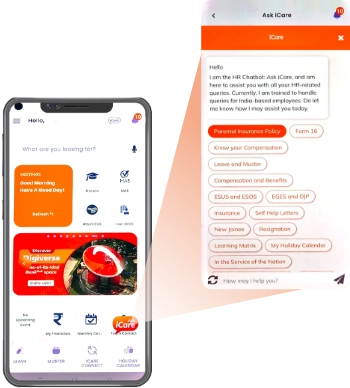

For other workplace issues, the Bank has a structured mechanism to resolve them. The iCare provides employees with a platform to deal with their queries and concerns.

Service and innovation lie at the heart of our commitment to employee satisfaction and operational efficiency. To deliver superior service at scale, our ethos of care and our strength of technology came together to craft an intuitive and seamless experience for our employees. Our proprietary system, iCare was launched in fiscal 2024 which has changed the way we manage employee enquiries and service requests. iCare integrates different channels, email, phone, chatbots and call centre over the same platform. Furthermore, it offers a ‘zero drop-off’ experience, ensuring that employee issues are attended to even if their assigned HR manager is on leave or busy. By harnessing the power of automation and AI, iCare has decreased turnaround time and improved access to employee services. Employees can avail these services through email, phone calls, or through ICICI Bank’s proprietary app – Universe on the Move.

ICICI Bank believes in creating a culture of free and open conversations. Forums of engagement have been created where employees can engage with senior leadership of the Bank and seek clarification on policy and strategy.

The Bank’s senior management regularly engages with employees physically and virtually to emphasise the Bank’s cultural anchors including ethical conduct, adherence to regulations and compliance. Business centre visits are also an important part of the communication agenda. Employees are also kept updated on the strategy and performance and progress of the Bank through quarterly engagement on financial performance by the Executive Director with the leadership team.

Through Conversation sessions, the Leadership Team engages with employees to emphasise on Bank’s cultural anchors. It helps in aligning employees to the ethos of the Bank. These sessions are also forums for employees to engage with Business leaders and serve as listening posts for the employees.

Onboarding sessions are conducted by Business and HR managers to induct all new hires to the Bank’s culture and systems.

ICICI Bank is committed to nurturing and promoting a culture of diversity, equity and inclusion (DE&I). Our inclusive culture, free from any biases, enables employees to work effectively.

To maintain our culture of diversity and equity, the objectives of our DE&I initiatives are:

The Bank is also committed to promote and respect human rights. The Bank has put in place policies to provide an enabling and harassment-free work environment that respects and upholds individual dignity.

The Bank’s Human Rights Policy is aligned with the United Nations Guiding Principles on Business and Human Rights (UNGP) and International Labour Organisation’s Declaration on Fundamental Principles and Rights at Work.

As an integrated workplace technology solution for HR and business transactions, the ‘Universe on the Move' (UOTM) mobile application makes life simple for employees every day – helping employees complete HR and business transactions on the go. Most employee services are available easily through the Universe on the Move app at the click of a button. What makes UOTM unique is that it also integrates business transactions – such as facility to provide business approvals or logging customer leads – in a seamless manner.

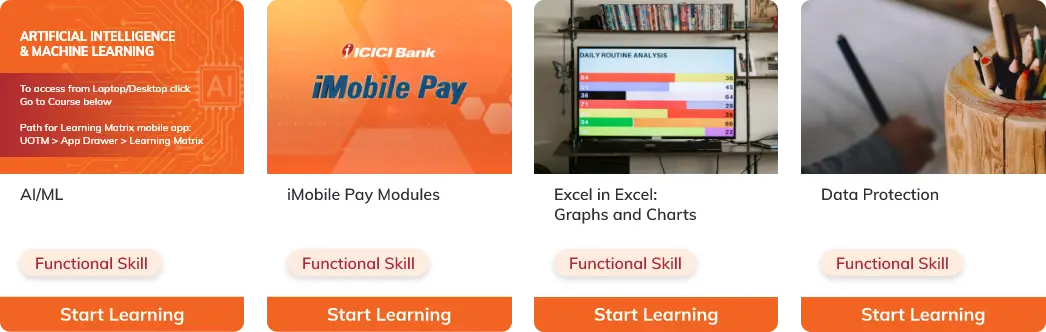

For any learning-focussed organisation, constant skilling, re-skilling, up-skilling and capability building are key factors to enable employees to serve evolving customer needs. The Learning Matrix is an AI-enabled digital learning platform with a rich online library and with features like leaderboard, social learning and access to curated open content. This AI-powered platform recommends personalised learning programmes and helps curate content based on in-platform feedback. The Learning Matrix offers an intuitive and engaging learning experience to employees on the go.

To attract the best talent, the Bank has created a digital careers platform to provide aspirants a seamless experience from the application stage to the onboarding stage. Candidates can easily apply for relevant jobs at the click of a button and be updated with real-time progress of their job application. At any juncture, candidates can reach out for support – through a comprehensive service platform integrating chat, calls and emails offering a seamless journey to aspiring ICICIans.

The ICICI Bank Alumni Portal is a digital platform which provides ex-employees with a smooth relieving experience and access to important documentation after their exit from the Bank. With the evolving employee needs, the Bank is committed to serve employees with passion and care.