ANNUAL REPORT 2023-24

Strengthening our operational resilience and enhancing delivery systems to achieve sustainable growth.

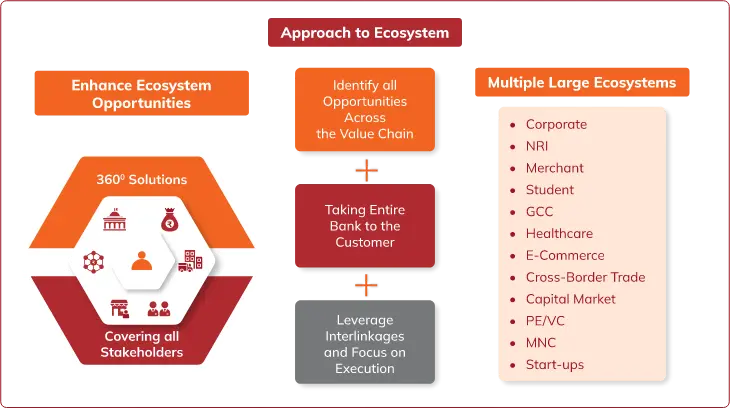

Customer-centricity is core to our strategy in growing our business and delivering customer delight. We have sought to adopt a solution-oriented approach in meeting financial needs of a customer and designing solutions that are product and segment agnostic. We seek to take the entire bank to the customer and offer solutions that are holistic in nature and build trust that translates into a long-term relationship with our customers.

Delivering on the Customer 360º approach also requires enhancing delivery systems and simplifying processes for better outcomes. The Bank is continuously making efforts to streamline processes and leverage technology-based solutions for more meaningful customer engagement. Underscored by strong governance, controls and risk management, the endeavour of the Bank is to deliver products and services to customers in an appropriate manner. As part of our Customer 360º approach, the Bank continues to strengthen its franchise in terms of enabling constructive customer engagement, decision-making and accountability. This has led to transformation of branches into customer-oriented business centres.

The Bank's objective is to serve the entire value chain of corporate clients including their channel partners, dealers, vendors, employees and other stakeholders, by taking the full bank to the customer. The Bank’s commitment is to deliver holistic solutions and provide seamless digital customer journeys.

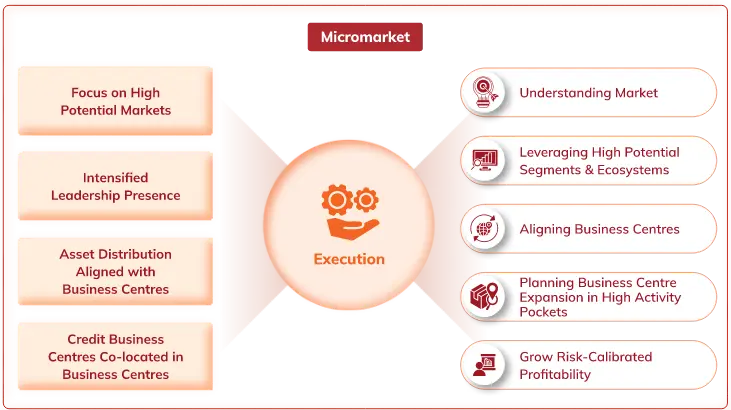

ICICI Bank continues to uphold its customer-centric ethos through an in-depth analysis of micromarkets, leveraging data analytics and market intelligence. This comprehensive understanding enables the Bank to deliver tailored solutions to customers across various segments, empowering frontline teams to devise localised strategies with tailored propositions. Micromarket insights allow the Bank to focus on aligned distribution and relevant delivery models. These insights are utilised in optimising business centre locations, ATM placements and build distribution networks to better align with customer needs and market dynamics thereby driving value creation through appropriate planning, resource allocation, channel alignment and marketing in every market the Bank serves.

The localised branding, resourcing, capacity building and service offerings further enhance customer engagement and satisfaction, while focussed marketing campaigns cater to specific segments, complemented by alliances with relevant partners in each micromarket. Moreover, our commitment to innovation is exemplified through the implementation of Virtual Relationship Management (VRM), an AI-powered platform facilitating efficient and personalised customer interactions with the help of service and solution-based engagement. This cloudbased platform empowers our relationship managers to deliver meaningful solutions and services, thereby enriching customer experiences and helping to build robust relationships.

We have strategic digital tie-ups to empower our frontline teams with detailed local insights and structured catchment texture. Available at individual business centre level, the insights allow the teams to focus on the requirements of the catchment, develop localised strategies, allocate resources and provide customers with a personalised experience and relevant solutions.

The Bank continues to strengthen the organisational structure with ‘State Business Heads’ to capture the 360° opportunity in these geographies and ‘City Business Heads’ covering the full spectrum of the ecosystem in cities with large concentrated market opportunities. Credit Business Centres (CBC) continue to be placed closer to important markets to facilitate faster processing and delivery.

The combination of micromarket insights and digitisation continues to drive growth and efficiency, enabling us to serve more customers effectively. As of March 31, 2024, ICICI Bank’s network comprised 6,523 business centres.

Business Centres

ATMs/Cash Recycling Machines

Insta Banking Kiosks

In line with the objective of creating customer-oriented ecosystems, the Bank has developed sector-specific solutions. These solutions focus on understanding industry and sector nuances and addressing specific requirements, which help to support businesses at every step of their journey. It provides comprehensive digital solutions for cash management, cross-border/domestic trade and supply chain finance as well as for their employees. These solutions cater to broking, custodian services, real estate, education, FMCG, healthcare, hospitality, NBFC, pharmaceutical and retail sectors among others.

The Bank is focussing on enhancing the cross-border trade ecosystem through various initiatives. It leverages the power of digitisation to enable decongestion and simplification of customer journeys. The Bank captures the end-to-end customer transaction lifecycle and through AI-driven trade rules, provides cross-selling opportunities at different stages of trade transaction within the Bank and across. The entire proposition is powered by technology solutions built on strong infrastructure and in a secure environment. These solutions consist of services such as Instant Export Packing Credit (InstaEPC), trade accounts (Exchange Earners’ Foreign Currency Account and One Globe Trade Account), paperless export & import solutions i.e. e-Docs, i-Docs and e-Softex, foreign exchange solutions, digital letter of credit facility, electronic bill of lading (e-BL) and Trade Online i-BOE.

The Bank has broadened its digital payment solutions to capture opportunities presented by the fast-growing merchant ecosystem, thereby facilitating seamless transactions across various payment platforms. Strategic partnerships with leading payment partners have further expanded the Bank's merchants’ market reach. Additionally, the focus is on enabling the merchants with relevant payment solutions fostering their digital transformation.

As of March 31, 2024, the Bank had 13 exclusive business centres for ecosystem banking across Mumbai, National Capital Region (NCR) and Kolkata. These ecosystem business centres are full-service centres that house multi-functional teams with expertise required to meet the needs of corporate customers and bringing the entire bouquet of services of the Bank to these corporates and their ecosystems.

Collaborating within and outside the organisation and building partnerships across the value chain is a key focus area. Partnerships with technology companies and platforms with large customer bases and operational excellence offer unique opportunities for growth and enhancing service delivery and customer experience in a safe banking environment.

The Bank has key partnerships with Amazon, MakeMyTrip and Emirates to offer co-branded credit cards. Amazon Pay credit cards continued to see healthy traction with over four million credit cards issued till March 31, 2024. The Bank aims to provide 360° solutions to the new-to-bank customers that have been acquired through Amazon Pay credit cards. The growth in credit card transactions was driven by higher activation rate through digital onboarding of customers, acquiring progressive profile customers and automated and effective portfolio management.

The Bank has not only pioneered the usage of FASTag for payments at various national and state highways, toll plazas but also expanded use cases to parking payments at airports, ports, malls, temples, hospitals, hill stations, forest and border check posts across the country. The Bank continues to grow in value of UPI acquiring transactions by growing faster than the ecosystem.

Over the recent years, we have witnessed the emergence of a vibrant startup ecosystem that leverages technology to simplify payment processes and lending, among other financial services. ICICI Bank is committed to harnessing these emerging technologies to add value in four key areas: generating new revenue streams, enhancing cost efficiency within existing systems and processes, managing our risk portfolio more effectively, and elevating the overall customer experience. In order to achieve these goals, the Bank is actively building a comprehensive ecosystem through strategic partnerships with startups.

The Bank focusses on innovation anchored partnerships in the early/growth stage startup ecosystem that align with the Bank’s digital roadmap and possesses the potential to address developments in the financial services space effectively. As a part of this process, we also make equity investments in select startups. To foster these relationships, we initiate a comprehensive engagement plan, ensuring that the ideas, products, and services offered by these startups align with the Bank’s core values, identify measurable goals and set timelines. The key to successful and timely engagement lies in fostering internal connections that amplify synergy.

Partnerships with start-ups help enable quicker adoption of new-age technologies at scale such as Artificial Intelligence and Machine Learning, blockchain, computer vision, cloud computing and more. Our collaborations with startups span various business verticals and domains, encompassing retail banking, Non-resident Indian (NRI) banking, corporate banking, treasury solutions, customer service, internal risk management and compliance/legal management. In this context, the Bank has adopted a technology-based approach that enables it to respond to the changing dynamics in an agile and responsive manner.

EXPLORE MORE ON THE CHAPTER - OUR BUSINESS STRATEGY