ANNUAL REPORT 2023-24

Incorporating sustainability into the Bank’s operations and business is an ongoing process that supports our objective of minimising environmental impact and contributing towards a sustainable future.

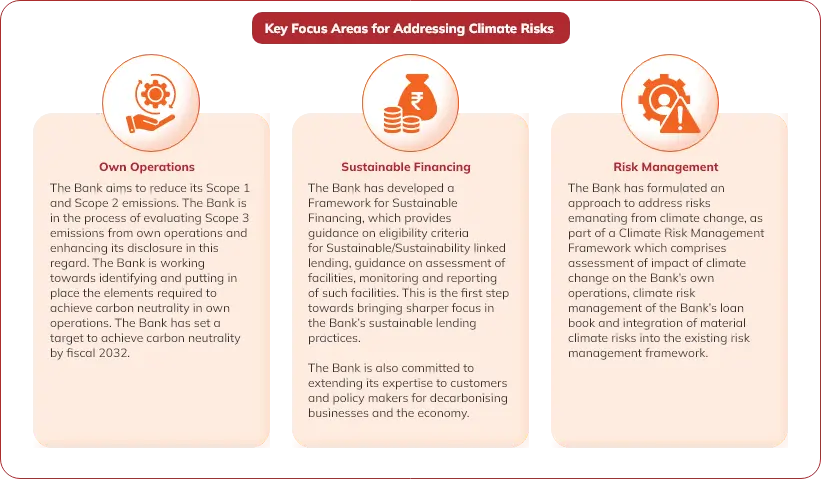

The Bank’s ESG Policy emphasises its commitment to conduct business sustainably and efficiently, thereby reducing the environmental impact. The Bank’s efforts in promoting environmental sustainability is in three strategic areas including sustainable financing, in its own operations and corporate social responsibility.

The Bank recognises the role a financial institution can play in driving sustainable socioeconomic development that benefits all stakeholders. Consideration of ESG in the Bank’s lending decisions and risk management framework are important factors and various approaches have been implemented. The Bank’s sustainable lending portfolio, defined based on the Bank’s Framework for Sustainable Financing, continued to grow in fiscal 2024. At March 31, 2024, the Bank’s outstanding portfolio to sectors like renewable energy, electric vehicles, green certified real estate, waste management, water sanitation, positive impact sectors like lending to weaker section under priority sector norms was about `685.28 billion. The Bank’s green financing portfolio grew during fiscal 2024 and accounted for 28.3% of the total sustainable lending portfolio.

The various approaches to assessment of ESG risks include social and environmental evaluation of project financing proposals, integrating climate change and ESG issues into the credit evaluation process, establishing framework for consistent and comprehensive tracking of sustainable lending by the Bank, and evaluating climate change impact in operations and business. Policies and frameworks are periodically reviewed for relevant amendments.

The Social and Environmental Management Framework (SEMF) evaluates specific environmental and social risks as part of the overall credit appraisal process for assessing new project financing proposals. Key elements of the assessment include screening through an exclusion list drawn broadly from the lists published by the International Finance Corporation (IFC) and list of highly polluting sectors published by the Ministry of Environment, Forests & Climate Change (MoEFCC) in India, seeking a declaration from borrowers of compliance with applicable national environmental guidelines/approvals for qualifying proposals subject to threshold criteria defined in the SEMF, and due diligence by an independent agency for large-ticket project loans identified as per the criteria defined in the SEMF.

Acknowledging the inherent risks posed by climate change and ESG issues, these aspects are being integrated into the credit evaluation process in the Bank. As part of the credit evaluation process for large corporate lending proposals, borrower ESG scores from external agencies, if available, are considered. Additionally, the Bank has developed specific risk assessment tools for 16 sectors to gauge the ESG maturity and associated risks of borrowers with exposures exceeding a certain threshold. This risk assessment tool has been developed with a focus on hard-to-abate sectors that are challenging to transition to low carbon pathways and sectors with substantial exposure within the Bank’s portfolio.

One of the key elements of the Bank’s ESG policy is its commitment to responsible lending practices and fostering a positive impact on the environment and society. Aligned with this philosophy, the Framework for Sustainable Financing has been formulated to provide guidance on green, social, sustainable, and sustainability-linked lending, outlining the methodology and associated procedures. The Bank has taken inputs from the Government of India’s Framework for Sovereign Green Bonds issued in December 2022 and the RBI’s guidelines on Framework for Acceptance of Green deposits issued in April 2023. The Bank has further classification of proposals into (i) dedicated sustainable lending and (ii) sustainability-linked lending based on the underlying characteristics of the transaction. The framework specifies the eligibility criteria, applicable due diligence requirements, and the verification process for sustainable finance. The framework also aims to establish a consistent and comprehensive methodology for the classification and reporting of the Bank’s credit facilities as sustainable.

Exposure of financial institutions to potential negative impacts of climate change on operations, assets and overall financial stability are critical. The Bank’s approach to analysing climate risks include developing methods to integrate climate risk in the risk management framework and begin testing the resilience of the lending portfolio to climate risks which can be categorised into transition and physical risks. The Bank is also in the process of understanding biodiversity and nature-related aspects that could manifest as risks in the Bank’s business.

The Bank has formulated a Climate Risk Management Framework (CRMF) for integration of climate risk into the overall risk management framework. CRMF comprises guidance on assessing impact of climate change on the Bank’s own operations due to physical risk events. Additionally, it guides in identifying and analysing the impact of both physical and transition risks on the lending portfolio.

The Bank conducts climate scenario analysis to quantify the impact of climate-related financial risks and assess the potential impact on capital and provisions requirement. Climate scenario analysis is performed to assess the potential impact of physical risks on the top counterparties of wholesale banking portfolio, retail lending, and impact of transition risk on the top counterparties of wholesale banking portfolio. The output of the exercise has been incorporated in the Bank’s financial planning as a part of ICAAP.

To facilitate the above initiatives in the Bank, developing proficiency in understanding ESG-related risks and opportunities, and evaluation of ESG/climate related risks has been embedded into the training imparted to a core team within the risk management group and other critical functions

The Bank’s efforts in minimising environmental impact of its activities is driven through sustainable practices in areas like energy efficiency, green building certification, sustainable procurement, waste reduction and recycling, water conservation and reducing paper consumption. During fiscal 2024, there was progress across these areas with a focus on decarbonising the Bank’s operations. Some key efforts during the year included:

The Bank advocates the use of environment-friendly consumables at its premises with the aim of promoting sustainable practices.

To facilitate the above, engagement with vendors is an ongoing effort to create awareness about the Bank’s approach on adoption of sustainable practices and to communicate the Bank’s intent to evaluate them on environmental and social factors.

The adoption of green tariff power resulted in reduction in the Bank’s Scope 2 emissions by 19.7% year-on year during fiscal 2024. The Bank’s total Scope 1 and 2 emissions declined by 15.7% during the year. The practice of independent assurance of Scope 1 and Scope 2 emissions continued. For fiscal 2024, reasonable assurance was conducted by Grant Thornton Bharat LLP as part of the SEBI mandated Business Responsibility and Sustainability Report. For fiscal 2023, limited assurance for the same was undertaken by DNV Business Assurance India Private Limited and, in fiscal 2022 it was conducted by TUV India Private Limited.

During fiscal 2024, the Bank assessed and has disclosed additional categories under Scope 3 emissions. These include capital goods and employee commute, apart from business travel.

The Bank advocates the use of environment-friendly consumables at its premises with the aim of promoting sustainable practices.

The Bank’s GHG emissions in its own operations in fiscal 2024 were:

Scope 33 emissions pertaining to Business travel was 17,735 tCO2e in fiscal 2023. In fiscal 2024, evaluation of the Bank’s Scope 3 emissions in own operations was expanded to include capital goods and employee commuting, apart from business travel. Total Scope 3 emissions in fiscal 2024 was 161,250 tCO2e.

As part of CSR initiatives, the Bank extensively supports efforts for environmental protection and improving biodiversity. Projects have been executed in the areas of water conservation, forest conservation and afforestation and protecting biodiversity, which are contributing towards restoring ecological balance in the country. ICICI Foundation is also working in villages to reduce their carbon footprint by promoting adoption of sustainable practices like composting, garbage recycling, efficient cooking, drinking water solutions, among others.

Footnote:

1. Scope 1 emissions include CO2 emissions from the combustion of fuel in diesel-generating sets and company-owned vehicles, emissions due to loss of refrigerants and emissions due to CO2 based fire extinguishers. The emissions from diesel-generating sets was estimated based on expenses on procurement of diesel and applying the lowest diesel price in the country to estimate quantity of diesel consumed. The emissions from fire extinguishers and owned vehicles was based on actual consumption.

2. Scope 2 emissions are due to electricity purchased from the grid. The estimation was based on actual consumption of electricity, and using the grid emission factor published by the Central Electricity Authority, India.

3. Scope 3 emissions for Capital goods have been estimated in accordance with the GHG Protocol. For the purpose, EXIOBASE 2019 emission factors have been considered. Scope 3 emissions for business-related travel by employees through modes like aircraft, train, buses, and cars have been estimated. Emissions from hotel stay during such travel is not included. For the purpose, DEFRA (Department for Environment, Food and Rural Affairs) 2023 emission factors have been considered. Scope 3 emissions for employee commuting have been estimated based on an survey conducted. The Average-data method has been used for extrapolating to all employees. For the purpose, latest India GHG Program emission factors have been considered.

4. tCO2e - Tonnes of carbon dioxide equivalent is a standard unit for counting GHG emissions.

5. FTE: Full Time Equivalent.