ANNUAL REPORT 2023-24

Annual Report 2023-24

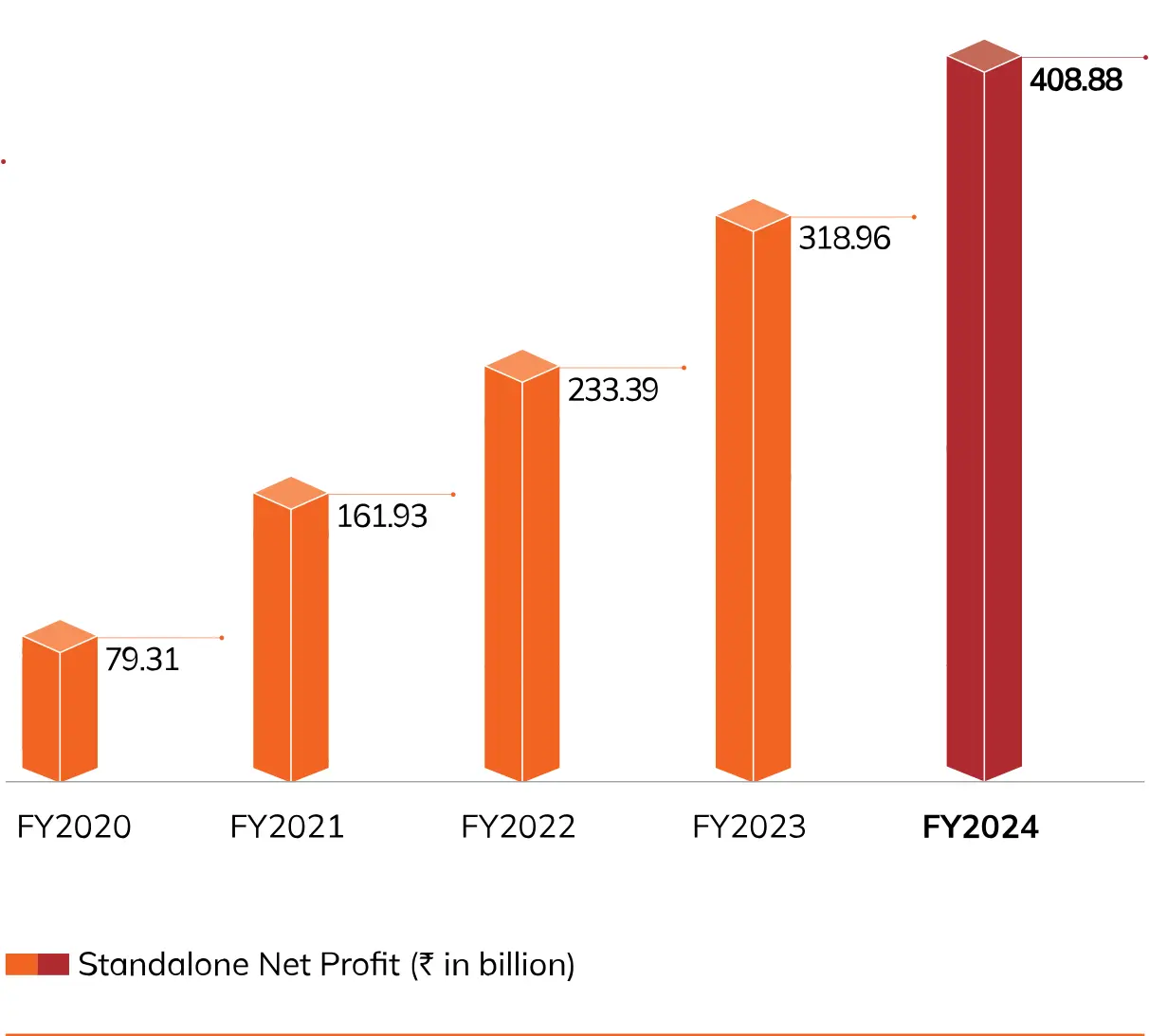

Profit After Tax*

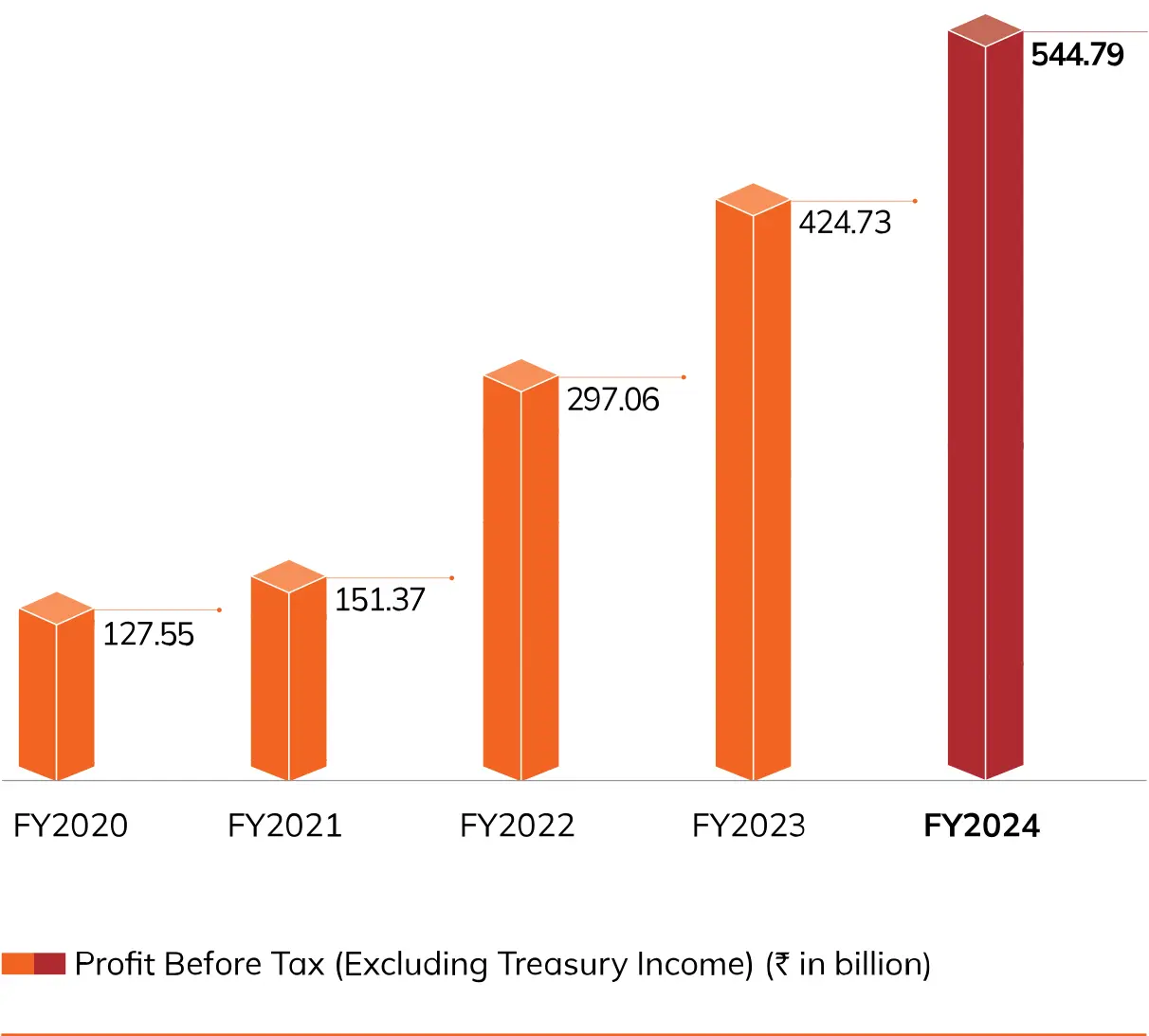

Profit Before Tax Excluding Treasury*

Consolidated Profit After Tax*

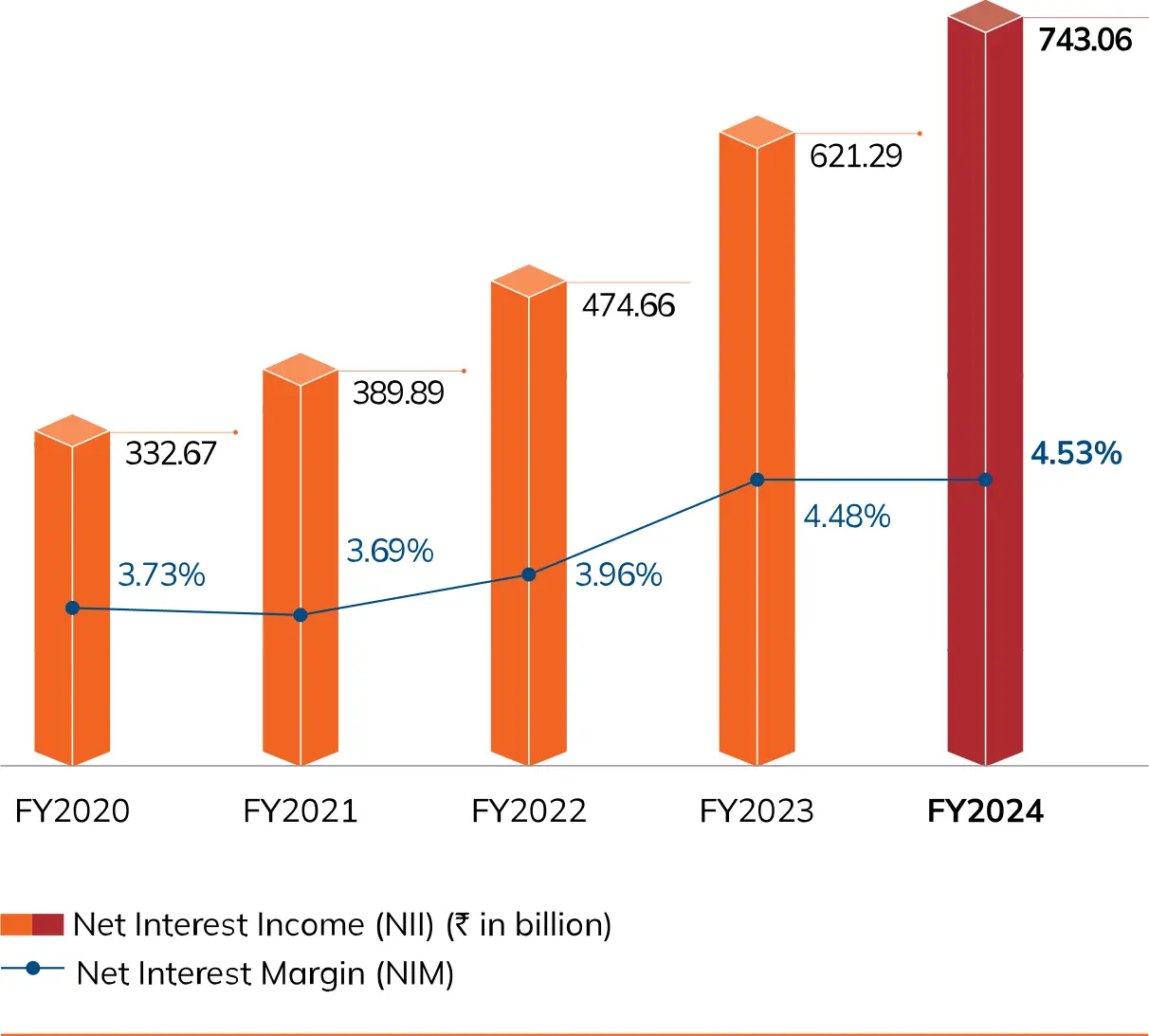

Net Interest Margin*

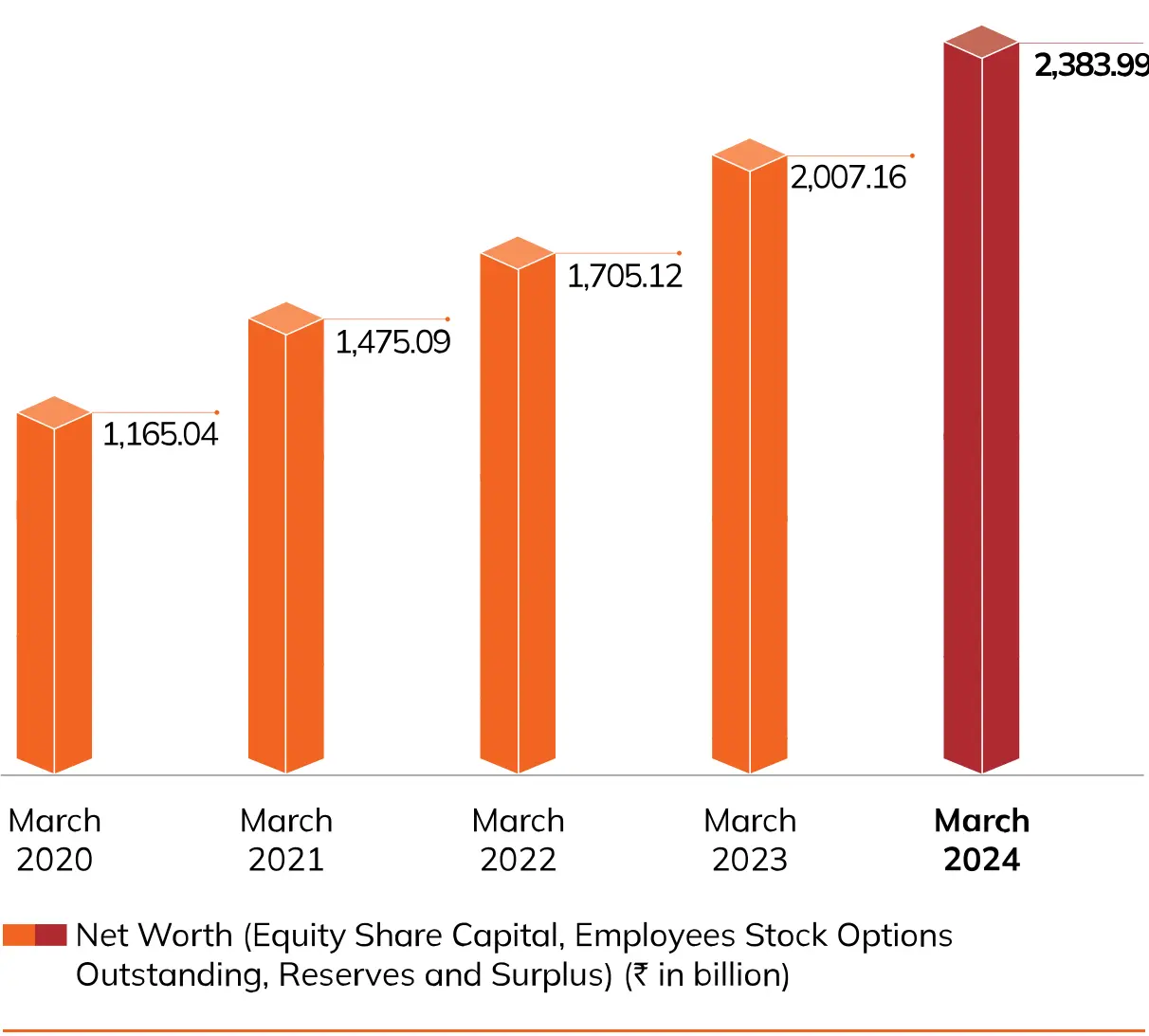

Standalone Total Assets

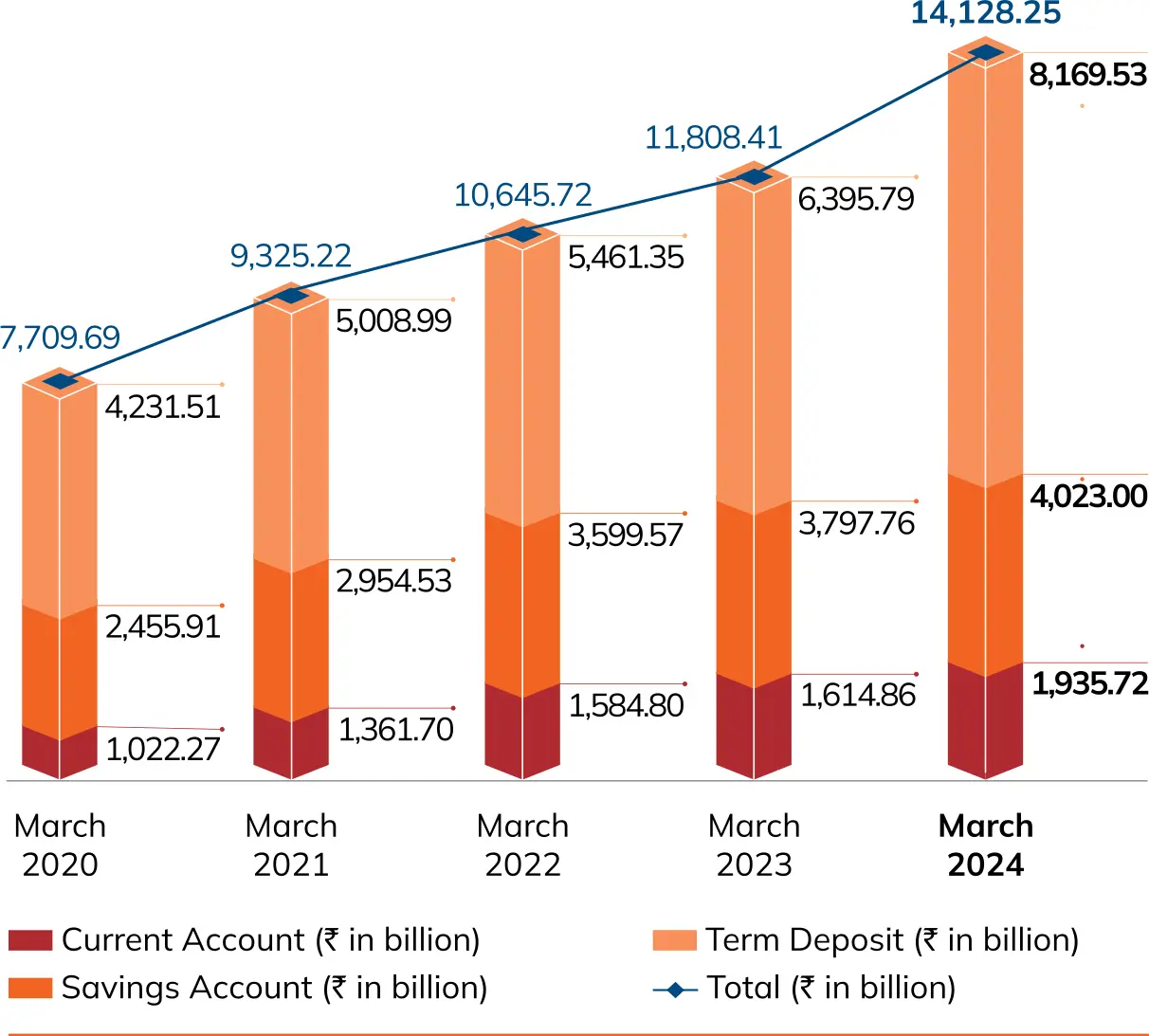

Total Deposits

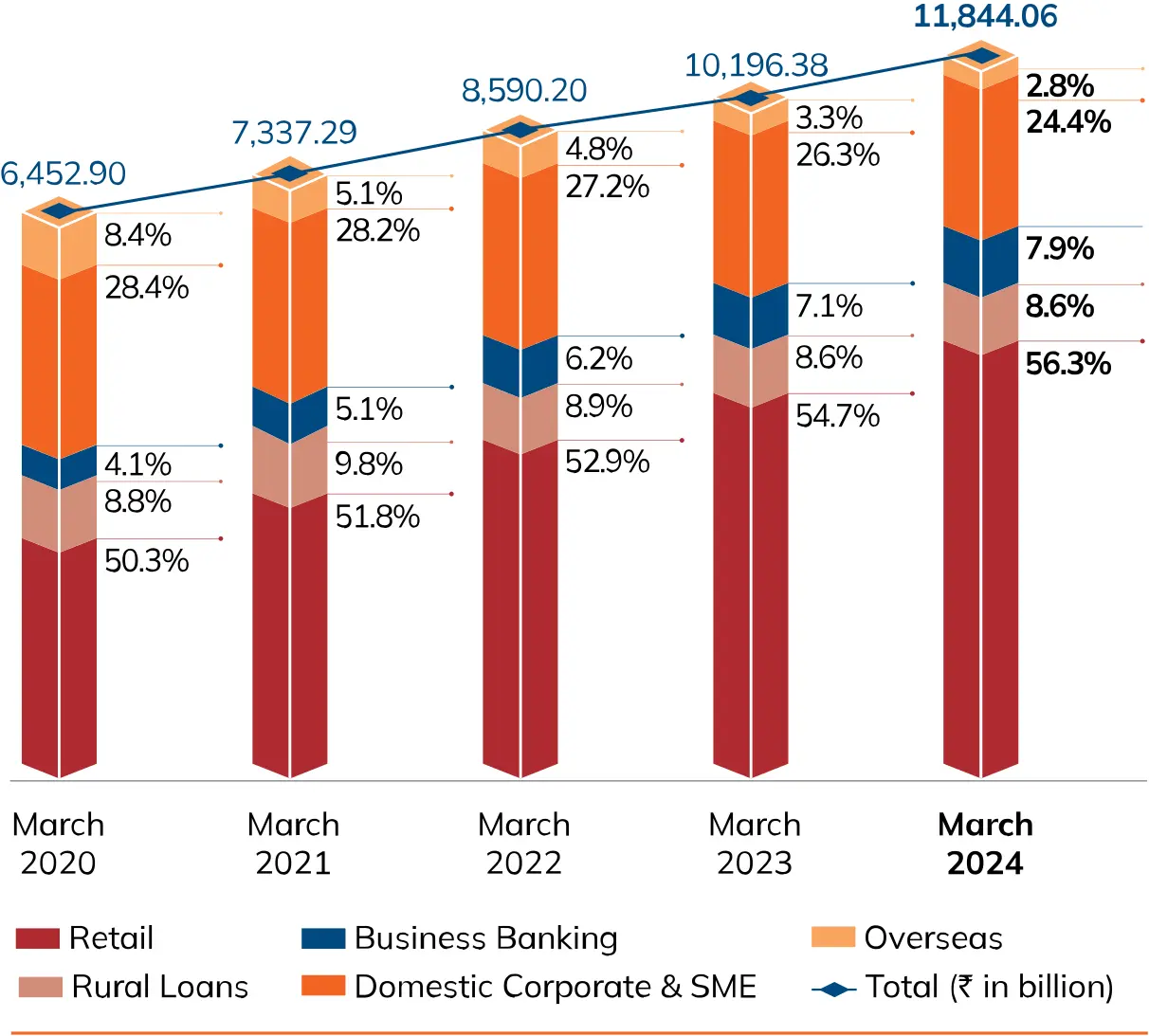

Total Advances

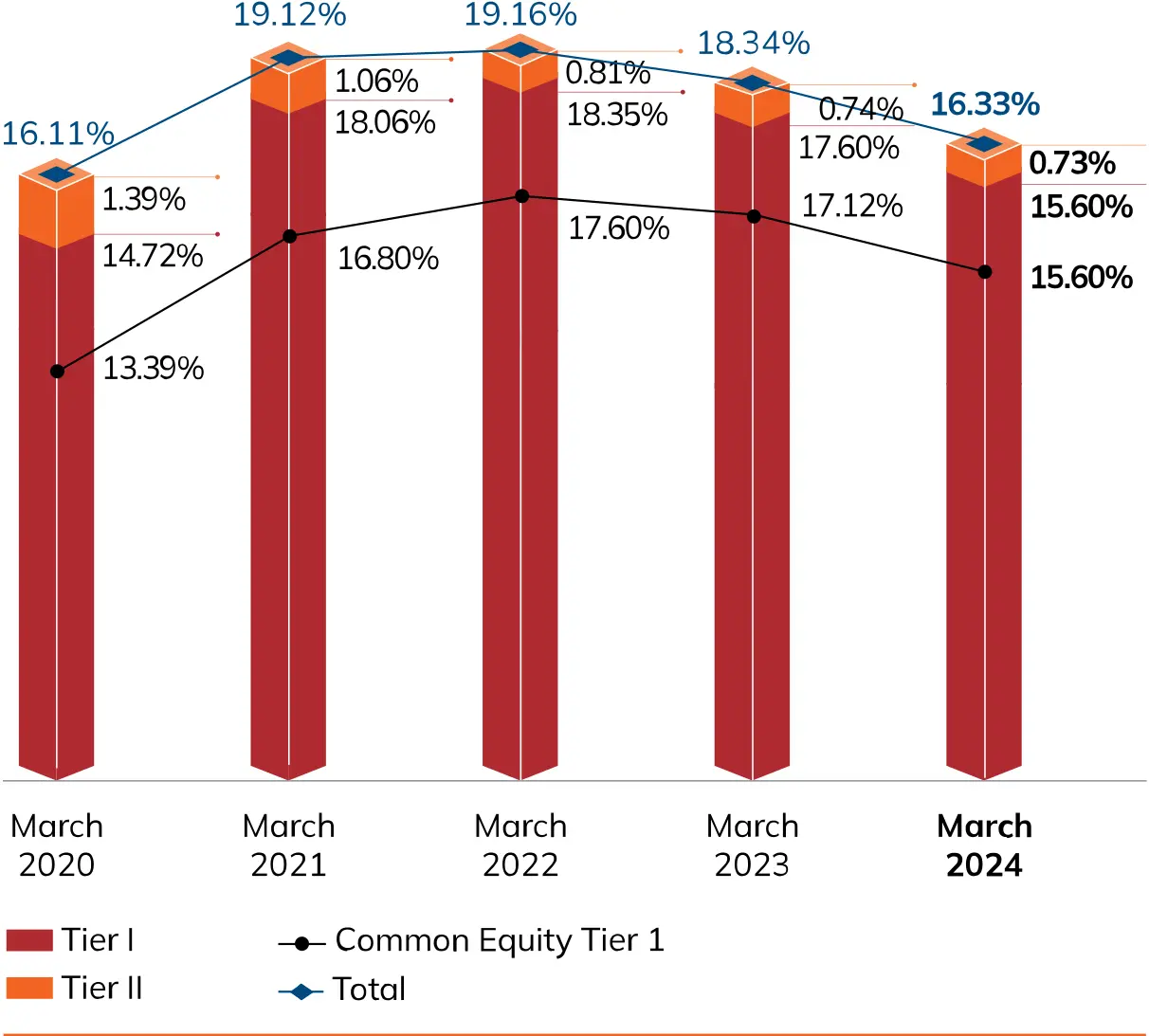

Capital Adequacy Ratio

*During fiscal 2024; others at March 31, 2024

iMobile Pay, ICICI Bank’s mobile banking application, has more than 30 million users. The total value of transactions done through this app stood at close to ₹11,000 billion in fiscal 2024.

The volume of financial transactions on InstaBIZ, the Bank’s one-stop solution for all banking needs of business banking customers, grew by 22% in fiscal 2024.

iLens, ICICI Bank’s lending solution, is an industry-first end-to-end digital lending platform covering the entire loan life cycle. It is a single interface that allows employees, third party agencies and sourcing channels to collaborate to facilitate faster turnaround of loan applications, greater transparency of loan status and an enriched customer experience. In addition to mortgages, the platform is now extended to personal and education loan offerings.

Of all the eligible trade transactions processed through the Bank, over 70% were done digitally.

Managing Director & CEO

Executive Director

Executive Director

Executive Director

Strengthening our operational resilience and enhancing delivery systems to achieve sustainable growth.

The Bank lays strong emphasis on risk and compliance and creating awareness among employees on the core values and desired behaviour.

The Bank continues to deepen its engagement with customers and further simplify delivery processes and digital platforms, with a sharp focus on enhancing efficiency and resilience.

The Bank is committed to achieve responsible and sustainable growth, underpinned by our core values of Return of Capital, Agile Risk Management and Compliance with Conscience.

The Bank recognises the importance of adopting a rigorous approach to understanding and responding to risks and opportunities that enables long-term value creation for all stakeholders.

The Bank’s success is anchored by its people and a culture of ‘One Bank, One Team’ driving its business.

An ongoing engagement with our stakeholders is important for the Bank to understand matters relevant to them and create sustainable value for all.

Incorporating sustainability into the Bank’s operations and business is an ongoing process that supports our objective of minimising environmental impact and contributing towards a sustainable future.