SOCIAL AND RELATIONSHIP CAPITAL

Kanku Bai, a beneficiary of the ICICI RSETI Dairy Farming course in Jaipur, Rajasthan.

We are committed to act in the best interests of our stakeholders and with a sense of purpose.

Our involvement in socio-economic development has always been integral to our strategic objectives. We have participated in these activities either as part of our business or through our corporate social responsibility initiatives. In fiscal 2021, the Bank spent ₹2.00 billion towards corporate social responsibility projects. The aim is to identify critical areas of development that require investments and action, and which can help to realise India’s potential for growth and prosperity.

SOCIAL INITIATIVES OF ICICI BANK

With a purpose-driven approach, we play a role in creating meaningful social impact. The unprecedented challenges due to Covid-19 pandemic led to a difficult period where lockdown measures created significant difficulties particularly for low income groups, and led to migration of a large segment of the population to the rural areas. Extraordinary efforts were demanded from frontline staff like doctors, police, municipalities and others. The ICICI Group committed a sum of ₹1.00 billion towards meeting this challenge, as part of which the Bank contributed ₹500.0 million to the PM CARES Fund. Under our corporate social responsibility, the Bank and ICICI Foundation actively responded in the efforts on the ground, by supplying critical materials like sanitisers, masks and personal protective equipment. Ventilators and other critical equipment were supplied to hospitals. The efforts covered over 550 districts across the country and all 36 states and union territories.

ICICI Foundation for Inclusive Growth

ICICI Foundation was established in 2008 for strengthening the efforts of ICICI Group towards meeting its corporate social responsibility. ICICI Foundation's efforts are managed by an in-house team with direct project implementation capabilities. The focus on enabling sustainable livelihood through skill training gained momentum with the setting up of the ICICI Academy for Skills in October 2013.

During fiscal 2021, the efforts of ICICI Foundation were on multiple fronts from supporting the Covid-19 relief efforts on the ground, developing new models of delivering training online, enabling livelihood for migrants and undertaking projects meeting social and environmental goals.

Rural Livelihood Programme

Sustainable and distributed growth is a key driver of the Rural Livelihood programme, and ICICI Foundation has structured its efforts around four key areas:

- Addressing shortages in the village ecosystem which includes efforts to improve the yield and quality of local products;

- Addressing surplus in the local economy and developing value chains to improve market linkages for better realisation;

- Adopting an inclusive approach by providing low investment entrepreneurial opportunities to landless and other excluded communities; and

- Conserving and protecting the environment by addressing local environmental challenges and promoting sustainable practices

ICICI Foundation continued to implement its strategy by identifying clusters of villages with such gaps for driving interventions. The model is based on Value Chain & Entrepreneurship Development. In identified clusters, different groups of trainees work in various segments of the value chain of an identified commodity, or as entrepreneurs in a for-profit arrangement or as its employees. The idea is to create supply chains and synergies that can enhance value and make the intervention sustainable. This has helped improve the income opportunity of trainees and effectively benefit communities rather than just individuals. This model has made significant impact on communities and the environment.

Despite the challenges of Covid-19, ICICI Foundation’s efforts benefitted over 30,000 people across 346 villages during fiscal 2021. Of these, 64% were women. On a cumulative basis, the efforts in the rural areas have impacted lives of close to 307,000 people in 2,534 villages, with women's participation at 61%.

ICICI Academy for Skills

At March 31, 2021, ICICI Foundation was operating 28 skill training centres under the ICICI Academy for Skills in 21 states/union territory. These Academies are providing industry-relevant, job-oriented training on a pro-bono basis in 10 technical and three non-technical skills. With a comprehensive approach which ensures employment opportunities for all successful trainees, these academies are equipped with state-of-the-art practical labs to support and enhance learning. Skill training also includes modules on financial literacy, life skills and soft skills.

In fiscal 2021, due to Covid-19, new models of delivering training were implemented at the skill academies that combine digital learning as well as hands-on experience at the labs. These new models including the hub and spoke model are agnostic to the location of the academy. This has enabled ICICI Foundation to take the skilling initiative to new locations and offer technical programmes at academies that hitherto provided training only on office skills. To ensure practical training under these new models, ICICI Foundation has tied up with various service centres. Nine courses offered by skill academies have been converted to digital medium and the National Skill Development Corporation (NSDC) has accredited these courses.

Trainees during a practical session of the 'Home Health Aide' course at ICICI Academy for Skills, Chennai.

In fiscal 2021, ICICI Academy for Skills trained over 14,238 youth across 21 states and union territories and helped them find suitable jobs. On a cumulative basis, the efforts in the skill academies impacted the lives of close to 159,652 people from 28 centres, with women's participation at 43%.

Rural Self Employment Training Institutes (RSETIs)

ICICI Foundation manages two RSETIs at Udaipur and Jodhpur with 16 satellite centres in Rajasthan. These centres provide skills based on the local market requirements. This has significantly improved livelihood opportunities for the trainees. The ICICI RSETIs have been recognised as the top performing RSETIs in India for seven consecutive years by the Ministry of Rural Development and the National Centre for Excellence of RSETIs.

The ICICI RSETIs were amongst the first to begin digital training during fiscal 2021. A unique initiative during the year was providing online training in mobile phone repairs and service. This online training covered 543 candidates from 271 villages across the two districts. The practical training was conducted for these trainees at the nearest block location. In fiscal 2021, the RSETIs also launched a new initiative of 'Suposhan Vatika' specially focussed on serving the poor, landless and malnourished families of tribal communities.

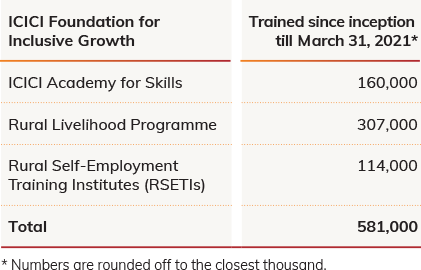

The cumulative number of people trained through these three initiatives crossed 580,000 individuals at March 31, 2021. ICICI Foundation also provides a platform for trainees from rural areas to exhibit their products in the marketplace.

Social and Environmental Projects

The majority of ICICI Foundation’s efforts in rural areas are largely themed around improving agricultural productivity, promoting sustainable practices and strengthening the supply chain. Through these efforts, it was realised that water is an important factor for sustainable development in the rural areas. Accordingly, ICICI Foundation started undertaking a host of interventions for improving water conservation, creating awareness of sustainable use of water, crop substitution from water-guzzling crops, promoting different varieties/practices that do not require flood irrigation and similar other efforts.

Another learning from working at the grassroot level in the rural areas was the need for significant investment in education and healthcare infrastructure. This need has only been reinforced through the pandemic. While ICICI Foundation has always believed that ensuring sustainable livelihood creates a demand, followed by which market forces bridge the supply gap, it has been realised that there is a gestation period during which public investments are required to enable market forces to take over. Keeping this in mind, ICICI Foundation has been participating in education and healthcare sectors to supplement the investments being made by the central and state governments. It is also exploring extensive convergence with government schemes to identify opportunities that can provide significant benefits to the local community.

Beneficiary of the Integrated Farming programme conducted by ICICI Foundation in Silsuan village, Kendujhar district in Odisha.

Human dependence on natural resources for livelihood has created significant human-wildlife conflict in various forest/periphery areas across the country. In many cases, it is the local tribal population that is trapped in such conflict situations. ICICI Foundation is taking a livelihood approach to address this conflict and is identifying and developing alternate livelihood for these sections of the society. Supplementing the livelihood initiatives are projects on afforestation and conservation including creating awareness amongst all sections of the society.

We believe that ICICI Foundation’s approach of undertaking targeted efforts along with the continued enhancements on livelihood projects for urban and rural segments will lead to more inclusive growth in a distributed and sustainable way.

RURAL DEVELOPMENT

There are specific segments of the rural economy that require a more supportive and sensitive response to their financial requirements. There are initiatives by us to specifically address the needs of such segments. The Self Help Group (SHG) programme is an initiative that has contributed to entrepreneurship among women in the rural areas. We provide a comprehensive suite of banking products, including zero-balance savings account and term loans, to meet the business requirements of the women of these SHGs. Services are offered at their doorstep, thus saving their time and money from visits to the branch. The Bank is also organising financial literacy camps and has set up dedicated service desks at select branches to guide SHGs on banking procedures. There has been a gradual rise in entrepreneurial ventures by women in the areas where the Bank has been providing services to SHGs. Due to the outbreak of the Covid-19 pandemic, access to credit had become difficult for SHGs. However, we continued our operations without any disruption in credit flow to the segment. In addition to direct efforts in reaching out to SHGs, the Bank has tied up with about 560 non-government organisations called Self-Help Promoting Institutions (SHPIs).

SHG beneficiaries with sanitisers manufactured by them at Bambavade village in Kolhapur district, Maharashtra.

We have provided loans to over eight million women beneficiaries through over 600,000 SHGs till March 31, 2021. Of these, 3.6 million women were ‘first time borrowers’, who had not taken a loan from any formal financial institution. In addition to direct customers, the Bank reaches out to about 1.3 million customers through microfinance institutions.

We also provide lending to Joint Liability Groups (JLGs), which are semi-formal groups from the weaker sections of society. Compared to SHGs these groups are smaller. Lending to these groups is done through tie-ups with microfinance companies. The Bank also offers credit related services to microfinance companies that are providing financial services to the rural population.

Financial inclusion is another activity which we have actively pursued in the rural areas. At March 31, 2021, we had over 21.2 million Basic Savings Bank Deposit Accounts (BSBDA), of which around 4.7 million accounts were opened under the Pradhan Mantri Jan Dhan Yojana. We encourage and enable these account holders to transact digitally. We are also promoting government schemes like the Pradhan Mantri Jeevan Jyoti Bima Yojana for providing life insurance, Pradhan Mantri Suraksha Bima Yojana for providing accident insurance and Atal Pension Yojana for providing pension benefits. At March 31, 2021, a total of five million customers were enrolled under these three social security schemes, which was the highest among private sector banks.

ENGAGING WITH THE GOVERNMENT FOR DELIVERING VALUE

We believe that our continuous collaboration with government agencies and our integrated service solutions are contributing towards strengthening the government’s engagement with citizens and its stakeholders. Our support to the government ranges from creating technology solutions for strengthening e-governance, enabling end-to-end digital payments for critical projects, participating in pilot projects as a financial service provider and supporting initiatives for promoting social development. The Bank participated in several such opportunities during fiscal 2021.

The Public Financial Management System (PFMS) platform of the Office of Controller General of Accounts (CGA) of the Department of Expenditure under the Ministry of Finance today facilitates sound public financial management for the Government of India. The system enables efficient flow of funds from the central government to implementing agencies at state, district, block and village levels, beside Direct Benefit Transfers (DBT). The Bank has been associated with PFMS since its inception and is one of the largest processor of payments through this platform. For providing ease and convenience to stakeholders, we have provided multiple channels for uninterrupted service delivery through Web portal, call centre and mobile app.

Beneficiary in Bhatinda district, Punjab completing biometric authentication to receive funds under PMJDY.

During fiscal 2021, we processed more than 170 million PFMS transactions amounting to ₹650.83 billion across all 28 states. As per the Key Performance Indicators (KPI) of Department of Expenditure, Ministry of Finance, the Bank has been recognised as one of the top banks consistently. As part of our endeavour to diligently and efficiently service our customers and create value, we have launched the InstaBIZ app for Government customers to access their banking accounts and PFMS transactions digitally, both on mobile and tablet devices.

Customised Payment Solutions, a white label digital platform has been developed for government departments. This platform provides a range of payment activities and workflow management. It facilitates hierarchical mode of disbursements, expenditure-head wise payment and tracking up to the end beneficiaries depending on various models. Beside payments, the platform capabilities include project management, budget management, limit assignment and control, dashboard, reports/analytics and online reconciliation of transactions.

During fiscal 2021, we integrated our Customised Payment Solution with the PFMS system in a manner where Bank’s Customised Payment Solution becomes the front end and the PFMS system becomes the back end. This fulfills the general guidance of the central government to use PFMS for payment processing and also gives an integrated solution to the customer, thus providing complete end-to-end solutions for their payment needs.

The Smart Cities Mission was launched by the Government of India with a vision to drive economic growth and improve the quality of life of citizens. We have been closely associated with this initiative, offering a suite of digital solutions known as ‘ICICI Bank Smart City Solutions Suite’ catering to the day-to-day requirements of a Smart City. These include solutions for tax collection, bill payment of utilities, assistance in municipal bonds issuance, a comprehensive project and payment management solution for live project updates and just-in-time payments to vendors or contractors, funds monitoring on the PFMS platform, e-challan collections, smart toll collections on highways and smart parking spaces, besides other offerings like e-governance solutions, digital property tagging and many more smart solutions leveraging the Bank’s digital capabilities and expertise. We have been working with various Smart Cities in this regard.

ICICI Bank is one of the leading banks in developing Common City Payments Solution (CCPS), a citizen-centric solution to promote a cashless economy by facilitating digital transit and retail payments. During fiscal 2021, we partnered with the Greater Chennai Corporation and Chennai Smart City Limited for the launch of 'Namma Chennai Smart Card', a Ru-Pay powered co-branded, contactless pre-paid card which will facilitate tax, utility, retail and e-commerce payments. Our efforts in some of the Smart Cities Mission are helping scale up digital transactions and fostering competitiveness and benchmarking across smart cities.

We have additionally continued to build upon our association with the Government eMarket (GeM) by way of introducing facilities for Caution Money Deposit for ensuring only serious sellers continue being a partner to the GeM portal. Government departments/ institutions are now also benefitting from our 'Bank Guarantee Repository Solution' which has created an online repository of bank guarantees issued in their favour, which can also be authenticated through the BGRS portal.

STAKEHOLDER ENGAGEMENT

An important factor in the Bank’s value creation for its stakeholders is to have meaningful partnerships and be responsive to their perspectives. During the Covid-19 pandemic, the Bank recognised the opportunity to stay connected and respond to the needs of our stakeholders. We strived to further prove our trustworthiness in these challenging times, and create a positive impact for our employees, customers, shareholders and society. We ensured our products and services were accessible and easier to use. Our contribution also involved ground-level efforts to help the government and people navigate the challenges created by Covid-19.

The Bank holds regular interactions with investors, employees, customers, regulators and engages with communities and banking associations to remain informed.

ICICI Bank’s key Stakeholders

Stakeholder

Customers

Mode of Engagement

- Interactions with employees

- Structured surveys for seeking feedback

- Meets organised at branches

- Communication through print, digital and social media

- Multiple channels available for raising queries and grievance

Areas of Importance

- Convenience

- Responsive, skilled and considerate staff

- Availability of relevant products and services

- Quick response to issues raised and grievance redressal

Bank’s Response

- Being 'Fair to Customer, Fair to Bank' is a core element of the Bank’s approach

- Ensure right-selling of products

- Dedicated customer service teams focussed on improving process efficiency, reducing customer effort and leveraging technology to enhance customer experience and improve response time

- Continuous upskilling and knowledge building of staff

- Policy of zero tolerance to unethical conduct by employees

Stakeholder

Shareholders/Investors

Mode of Engagement

- Annual General Meeting

- Emails and periodic meetings

- Conference calls

- Investor conferences

- Analyst Day

Areas of Importance

- Shareholder value creation

- Medium and long-term strategy

- Governance and ethical practices

- Compliance

- Transparency

- Disclosure of non-financial metrics pertaining to sustainability

Bank’s Response

- Increased interaction with investors during the year and also held digital interactive sessions

- Communicating on strategic objectives during the quarterly results call with investors and increased disclosures

- Non-financial disclosures included in the Annual Report

- Board-approved Environment, Social and Governance (ESG) Framework and release of the first ESG Report of the Bank

Stakeholder

Employees

Mode of Engagement

- Continuous engagement across employee segments and business

- Periodic communication meetings anchored by senior leaders

- iCare, an online portal for employees to raise queries

Areas of Importance

- Driving synergy as One Bank – One Team

- Enabling work culture with opportunities for growth and learning

- Culture of experimentation

- Meritocracy

- Employee alignment to common organisation goals

- Reduction in hierarchy

- Responsive grievance handling process

Bank’s Response

- Responsibilities given early in the career

- Focussed leadership and career mobility programmes

- Principle of 'One Bank, One ROE' across geographies, products and roles

- Surveys to assess alignment to cultural anchors

- Support to employees through other networks like Quick Response Team (QRT) in case of medical emergencies, i-Travel Safe for easy access to register an SOS distress signal

- Care for employees through leave policies catering to their different needs including life-stage needs

- Universe on the Move – a one stop digital platform for employees

Stakeholder

Regulators

Mode of Engagement

- Periodic meetings with regulatory bodies

- Participation in policy forums

- Other forms of communication like emails, letters, etc.

- Supervisory meetings

Areas of Importance

- Compliance culture

- Fair treatment of customers

- Role in developing the financial system

- Adherence to regulations/directives including for KYC procedures/anti-money laundering in a time-bound manner

- Operational and cyber resilience

- Participating with the regulator in providing necessary relief and impetus on account of the impact of the Covid-19 pandemic

Bank’s Response

- Compliance culture driven by organisational leadership

- A dedicated team for communicating with regulators and responding in a time-bound manner

- Well-defined processes and leveraging technology in responding to regulators

- Continuous engagement with the regulator and providing inputs on various aspects in dealing with the impact of the Covid-19 pandemic and the evolving business requirement

- Updating and seeking inputs from the regulator on emerging developments in technology and cybersecurity

Stakeholder

Society

Mode of Engagement

- ICICI Foundation for Inclusive Growth (ICICI Foundation)

- Rural development initiative

- Supporting government initiative

Areas of Importance

- Contributing to social development

- Financial literacy and improving access to financial services especially in rural areas

Bank’s Response

- Met the CSR requirement under the Companies Act, 2013

- Continuous focus on livelihoods, social and environmental issues through the ICICI Foundation

- Industry-academia partnerships for developing skills for the banking sector

- Contributing to disaster relief through on-ground efforts

Note: The listing of areas of importance may not necessarily follow the order of importance to the stakeholder category.