HUMAN CAPITAL

- Fair to Customer

- Fair to Bank

- Care for Employees

PARTNERING BUSINESS STRATEGY

One of the shifts in our operating model in recent times has been the adoption of ‘One Bank, One ROE’, leading to ‘One Bank, One Team' as a guiding factor. With our focus on maximising risk-calibrated core operating profit, based on the opportunities available in the market, this pillar provides a guiding path towards capturing market share and growing profitably within the guardrails of risk and compliance. With a focus on creating enablers for participating in opportunities and leveraging ecosystems, we moved away from centrally-driven authority structures to enabling the frontline business heads to consider suitable structures, resourcing, product models and market-specific service innovations. To ensure success in the market and capture the 360° banking needs of customers, every employee is encouraged to spot opportunities and generate business for the Bank.

A key shift in our functioning has been to remove the grade-based hierarchy for the Bank's senior management. This has created process efficiencies and a work culture that enables quicker response in the market place and bringing resolutions faster to the teams. Another step towards building a successful work culture has been the focus on collaboration and bringing together the expertise of cross-functional teams to provide solutions that meet the complete banking requirements of our customers. With the purpose of enhancing product synergies, diminishing department boundaries, and embedding the essence of ‘One Bank, One ROE’, we have identified customer ecosystems across businesses and segments, and a team structure that focusses on key account management, thus enabling employees to cater to the 360° needs of the customers.

Further, a strong technology team is imperative for the success of our digital initiatives and seamless delivery of services. The technology team was strengthened during the year through reorganisation and introduction of roles in line with the demands of #2025 Enterprise Architecture Framework.

OUR RESPONSE TO COVID-19

Banking being declared an essential service, the Covid–19 pandemic presented us with a situation where we had to ensure continuity in our services to customers while ensuring the safety and well-being of all our employees working in approximately 5,500 branches and offices at locations across the country. Ensuring Covid-19 related protocols of social distancing and sanitisation were followed across every location was critical. Providing a safe and healthy work environment, along with extending care and support to employees was of paramount importance. We put mechanisms in place to ensure that emotional, medical and physical support was provided to our employees on a real-time basis.

As part of safety measures, thorough contact tracing is done in case an employee tests positive. All employees who have been in physical proximity to the Covid-positive employee are strictly advised to isolate themselves and self-quarantine for a period of at least 14 days. A digital contact tracing system has been developed to track and monitor the employees who came in contact with any Covid-positive employee. The system uses the data collected from the employees through Universe on the Move application, on the given day.

For employees and family members who are advised home quarantine, we have tied up with a healthcare provider to offer specialised medical care to monitor and provide virtual consultation services, thus facilitating timely medical help as well as taking care of the mental health of the affected employees and their families. Similarly, for employees and their family members needing closer monitoring by way of institutional quarantine, the Bank tied up with the healthcare provider for an institutional quarantine programme, which is available in eight major cities. These isolation centres are best-in-class facilities for employees in need of institutional quarantine. The employees are under the supervision of on–duty doctors on a daily basis and have assistance of nurses in the facility to cater to health requirements and monitoring.

Advisory and constant communication with employees by means of defining 'Norms of New Normal' was established and circulated to ensure that the advisory reaches every employee and gets reinforced in their behaviour. Office protocols were put in place quickly to ensure safety of employees. Masks, sanitisation, fumigation and social distancing were made mandatory across premises. Signage and posters were displayed in various places in the large offices. Maximum capacity for each of the offices and big branches were determined and zoning norms were established and implemented across office locations so that employees do not mingle with anyone outside their zones. In order to ensure a smooth commute, employees were provided with system verified and generated authorisation letters and vehicle passes, made available to them on the Bank’s internal app, UOTM - Universe on the Move. Further, the Bank reimburses the cost of vaccination of employees and their dependents.

ICICI Bank UOTM app integrates several functions including engagement, learning and business applications.

HIRE FOR ATTITUDE AND TRAIN FOR SKILL

We believe in building talent by identifying individuals with potential and attitude for growth, and providing them with opportunities to acquire necessary knowledge and skills. This focus is across levels, from those beginning their journey with ICICI Bank to different levels up to the senior management.

To meet the demands for a skilled workforce, the Bank has adopted a strategy to backward integrate at the ecosystem level to create a pool of industry-ready workforce. Our industry-academia partnership has democratised the platform for hiring and pushed the boundaries that defined employee profiles as urban and English-speaking to encourage alignment with a workforce based on social skills and attitude of individuals. The industry-academia initiatives have thus cast their net wide to attract a diverse pool of applicants from various fields, and ensuring diversity in terms of gender, culture and social backgrounds. Through our industry-academia partnerships, we have successfully created a continuous pool of ready bankers, not just for the Bank but for the industry at large.

Shaastraath - a digital thought leadership event facilitated by ICICI Bank was attended by more than 50,000 students from over 300 top business schools.

One of the key aspects of these programmes is the familiarity it builds with the banking and financial services sector, and with ICICI Bank. The thrust is to orient students to the culture of ICICI Bank and to impart functional knowledge in banking and related subjects. Participants are put through rigorous training with emphasis on application of knowledge and overall personality development. The tutoring is supplemented through structured internships and on-the-job training at various Bank branches, where students are assigned roles and live projects to give a real-time experience of banking.

Considerable investments have been made in setting up the training infrastructure and designing programmes that have a bias for vocational pedagogy rather than the cognitive approach prevalent in educational institutions. The focus and rigour of the design of these academies has ensured that every student is acclimatised to ICICI Bank’s culture and way of banking. This has helped ensure continuity of service across roles, and also the continued trust of our customers over the years of engagement and service. Today, the alumni of these academies have etched successes for themselves and have also made the institution proud of their achievements, and complimented our efforts of creating winners.

Shaastraarth – a congregation of thought leaders aimed at bringing corporates to the campus and serving as a partnership platform for industry and academia where practitioners put forward their varied views, rich knowledge and experience – was held over two days on October 7 and 14, 2020. More than 50,000 students from 300+ top business schools were the audience. The event had multiple panels with eminent leaders from various industries coming together from different geographies and time zones. In the eight panel discussions held over two days, leaders put forth their perspectives on themes pertinent to the workforce of tomorrow. The two-day event was livestreamed on the ICICI Bank YouTube channel, with 150,000 views and 800,000 impressions over all sessions. Our LinkedIn page hosted an elaborate campaign covering the whole event where we witnessed 650,000 impressions overall.

One of the ways to be future-ready is to invest in skills and capabilities which are essential to be relevant in the market over the long term. Our employees are our asset, and we invest in capability-building of our employees on an ongoing basis.

Culture, Ecosystem & ICICI STACK Sessions under Capability Building Programmes

Culture, Ecosystem and STACK sessions were incorporated in all capability building academies. The culture sessions enabled reiteration and reinforcement of the ICICI Bank culture among the employees. The ecosystem approach and ICICI STACK were incorporated to enable employees to take the Bank to the customer and focus on the market opportunity. Engagements with the leadership team were scheduled to provide participants with perspectives on the Bank's cultural anchors.

Technology Based Learning

Skilling on ICICI STACK

The skilling sessions on ICICI STACK covered employees across business groups, delivering 1.4 million learning hours. The sessions are also incorporated in all the functional academies to acquaint employees on the ICICI Bank way of selling and to handhold employees on the Bank’s digital product suite.

Courses on Data Science, Behavioural Finance & Model Thinking

A curated learning journey was designed for the leadership team with Coursera in the areas of data science, behavioural economics and model thinking. Certificate programmes by renowned universities like Johns Hopkins and Duke University were offered under this initiative.

Tech School

A series of curated video modules are offered on emerging technologies by leading technology organisations. The video modules are made available on the Bank’s Learning Matrix (LMS) to help participants understand various technologies like Blockchain, AI & ML, Public Cloud, Data Lakes, DevOps, Kubernetes, API Ecosystem, Microservices, IaaS, PaaS, Cloud Security, Edge Computing, Continuous Delivery and Cloud Computing.

Data Science will be one of the key differentiating skills in future, and in order to inculcate a culture of data in the Bank, we have partnered with open online course providers to offer data science courses by top universities to the leadership team. We are partnering with top organisations that are data leaders in the world to curate a series of videos and webinars on emerging technologies and data science. We are conducting training specifically for the employees working on data on a regular basis.

We believe that learning cannot be restricted to one’s own sector or area of work. We draw leadership insights from people from different walks of life, which provides a learning opportunity in one’s own domain too. One such initiative is our 12x12 Ignite Series, where leaders from different fields are invited to share their expertise, experiences and lessons in leadership. Similarly, we also launched 12x12 Dialogue series, where internal experts of the Bank share their views and know-how with a larger employee base.

The 12X12 Ignite Series facilitated leaders from various fields to share leadership insights with employees across ICICI Bank.

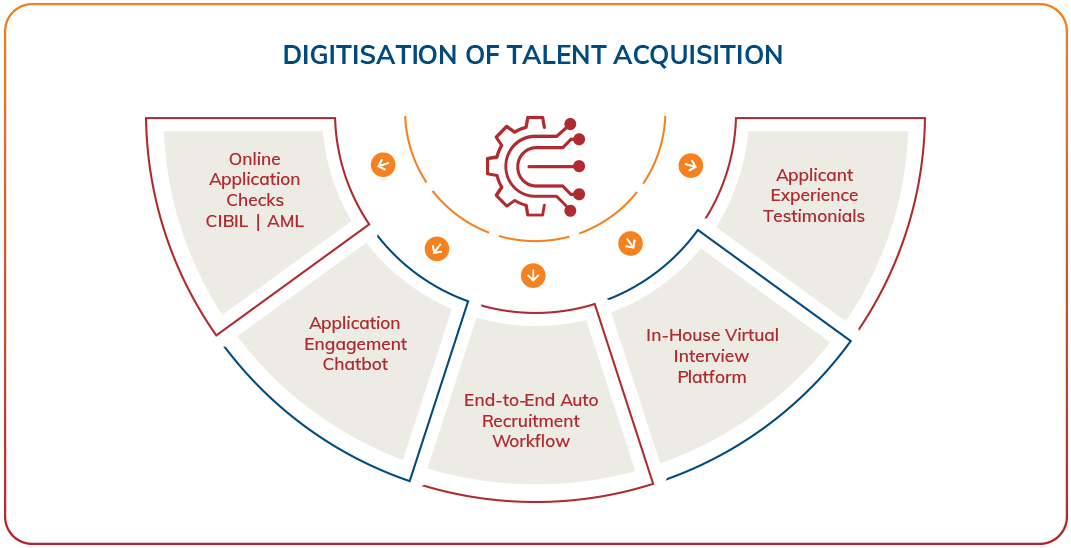

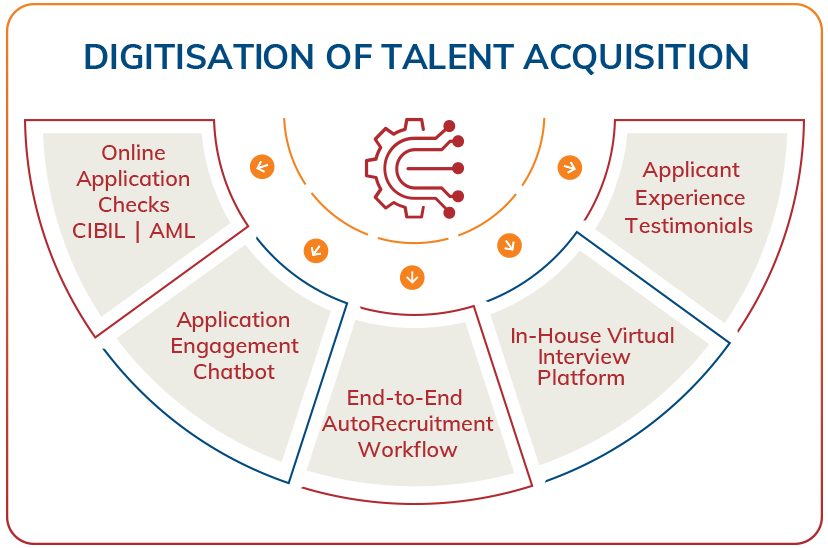

For new employees, the full recruitment journey is available on a new age bot, a unique offering based on Natural Language Processing (NLP) with which applicants can engage to clarify their queries. It is available on four platforms: WhatsApp, Google Assistant, Amazon Alexa and Web/Mobile browser. Our state-of-the-art platform, iStudio, enables virtual interviews and overcomes the challenges of distance and time. ICICI Bank has adopted an Artificial Intelligence (AI)-based testing and selection platform to evaluate cognitive abilities, language abilities, sentiments, personality insights and emotions. This in-house cognitive testing platform is configured to administer adaptive testing with advanced features such as image recognition, text analytics, language checks, emotion and tone analytics, and security check systems.

Our walk-in module over WhatsApp is a first of its kind NLP and ML based technology solution available which assists in managing bulk recruitments. It is built for scale, speed and convenience for all stakeholders. This has enabled complete migration of recruitment system to a paperless model.

Our long-term success is dependent on building future leaders. Developing core skills and capabilities of our leaders is required to align with the Bank’s future business strategy.

We have a robust succession planning process which measures the depth of the leadership bench. The Bank has a strong bench for all key positions and continuously measures the depth of succession for all critical leadership roles.

ENGAGING WITH RESPONSIBILITY

The Bank expects all our employees to act in accordance with the highest professional and ethical standards upholding the principles of integrity and compliance at all times. In this regard, expectations around compliance are communicated to our employees through multiple channels. All new employees are also required to complete mandatory training modules pertaining to Code of Conduct, Information Security, Anti Money Laundering and other compliance-related areas that are critical and sensitive.

We are an equal opportunity employer and seek to ensure that the workplace is free of any kind of harassment or inappropriate behaviour. Comprehensive policies and procedures have been laid down to create an environment where there is respect and dignity in every engagement. Sexual harassment cases are handled as per the guidelines set under the Prevention of Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013. This is imbibed in the Bank’s culture by creating awareness through mandatory e-learning on the subject at the time of induction and regular communication to employees regarding the mechanism for raising complaints and the need for right conduct by all employees. The Bank has a mechanism for dealing with complaints of harassment or discrimination. The policy ensures that all such complaints are handled promptly and effectively with utmost sensitivity and confidentiality, and are resolved within defined timelines.

For other workplace issues, we have a robust mechanism to resolve them. Call@I-Care provides employees with a platform to raise any issues or concerns that they may have.

ICICI Bank has always encouraged diversity in its workforce and this is deeply rooted in its culture and DNA. The Bank's philosophy of meritocracy and equal opportunity in its people decisions led to a large number of leadership positions being held by women over the last two decades.

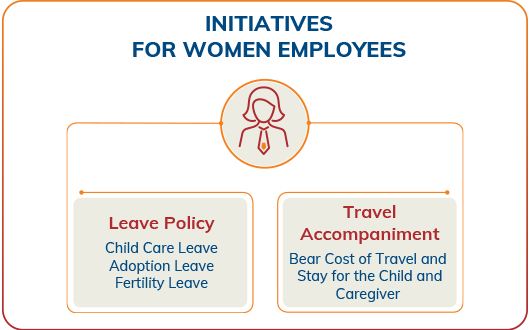

Conscious of the life stage needs and safety of women employees, a range of benefits and policies has been curated. We have a liberal leave policy for women employees, which was established much ahead of its time. We provide fertility leave to employees seeking to undergo treatment. We also provide child care leave and adoption leave. The Bank is also associated with various day care facilities across the country. Managerial responsibilities at times require women employees to travel outside city limits, either for business reviews/engagements or for training. For women managers who are mothers with young children, travelling outside city limits disturbs their support ecosystem. We have taken an initiative to address this need for women managers with children up to 3 years of age. In order to support these employees, we have defined a policy to bear the cost of travel and accommodation for the child and a caregiver (family member or child caretaker). This will help the women managers to focus on their work without the emotional stress of staying away from their children.