Retail and Rural Banking

The retail business continued to be a key driver of growth

in fiscal 2021, as we pursued a strategy of building a

diversified and granular loan portfolio. The focus in

the retail business was on understanding and fulfilling

customer needs underpinned by personalised banking,

simple banking, fair banking and strong risk management.

The Bank’s retail loan portfolio (including the rural and

business banking portfolios) grew by 19.9% year-on-year

to ₹4,892.20 billion at March 31, 2021, compared to a

growth of 17.7% in the overall domestic loan book to

₹6,961.39 billion. Retail loans accounted for 66.7% of total

loans, and including non fund-based outstanding, the

share was 55% in the total portfolio.

The Bank’s funding profile remained robust with

strong growth in the deposit base. Total savings

account deposits increased by 20.3% year-on-year to

₹2,954.53 billion at March 31, 2021. Total term deposits

grew by 18.4% year-on-year to ₹5,008.99 billion at

March 31, 2021. The growth in the deposit franchise was

supported by ongoing efforts to strengthen the Bank’s digital platforms and process simplification to provide

a seamless banking experience to our customers.

Retail Banking

During fiscal 2021, with challenges posed by the Covid-19

pandemic, we responded quickly to enable customers to

meet their financial requirements safely. About 97% of the

Bank’s branches were functional with reduced working

hours during the months of lockdown in April-May

2020. We deployed mobile ATM vans for the benefit of

the public residing in and around containment zones. A

video-based Know-Your-Customer process (Video KYC)

was launched, which empowered retail customers to

complete their onboarding process for savings accounts,

personal loans and Amazon Pay credit cards through

a contactless video interaction. We also launched

WhatsApp banking to enable retail customers to

undertake a range of banking requirements from their

homes during the pandemic. Further, a cardless cash

withdrawal facility was enabled at our ATMs.

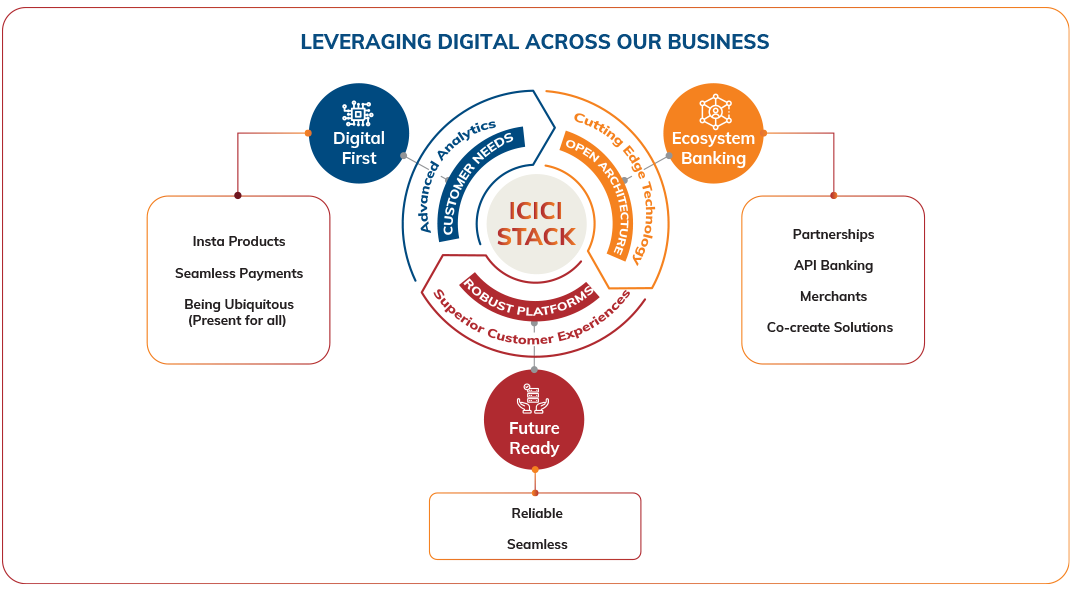

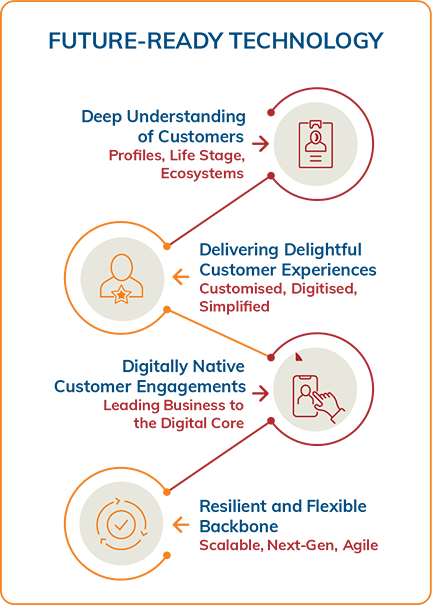

The Bank has always been at the forefront of digital

transformation across the financial services industry in

India. The all-new ICICI Bank website launched during

the year is equipped with new capabilities including

semantic and personalised search, and voice and hyper-personalised communication. We are focussing on key

partnerships across ecosystems of liabilities, co-branded

credit cards and e-commerce, to provide differentiated

offerings to our customers and create opportunities

for growth.

ICICI Bank’s mobile ATM deployed at Chennai.

A first-of-its-kind facility, iMobile Pay extended the ambit

of the Bank’s mobile banking app to customers of any

bank, providing instant access to the entire range of payment options and the Bank’s services. An innovative

feature is the facility to pay to contacts, which enables

users to automatically see the Unique Payment Interface

(UPI) IDs of their phone book contacts. The mobile app is

interoperable with all other UPI-based payment apps. In a

span of five months since its launch, there were more than

2.5 million activations from non-ICICI Bank customers.

iMobile Pay: ICICI Bank's mobile banking app, provides instant access to the entire range of payment options and the Bank’s services to customers of any other bank.

iMobile Pay: ICICI Bank's mobile banking app, provides instant access to the entire range of payment options and the Bank’s services to customers of any other bank.

Enhancing the digital journey of customers with the Bank

involved creating innovative solutions, both for customers

and for relationship managers. We revamped our home

loan website offering an interactive customer experience

and providing relevant content like a calculator for

checking loan eligibility, an e-book explaining the journey

to apply for a home loan and a blog on the mortgage

industry to enable customers to make informed decisions.

With instant processes like Express Home Loans, the

entire loan sanction process is facilitated in just five simple

steps and in a few minutes for eligible customers.

For superior and seamless connect, a Virtual Relationship

Management channel was introduced which caters to

customers' transaction and product needs through a

human interface on the phone. We have focussed on

decongested and seamless delivery and enhanced

customer convenience.

The Bank offers a host of APIs and SDKs (software

developer kits) which facilitate third-party apps offering

payment solutions for their retail customers. The Bank

has launched an API Banking portal which consists of

250 APIs and enables partner companies to co-create

innovative solutions in a frictionless manner and in a

fraction of the time usually taken for such integration.

Various digital solutions have been developed by the

Bank for lending and payments, including democratising

of APIs for a seamless experience.

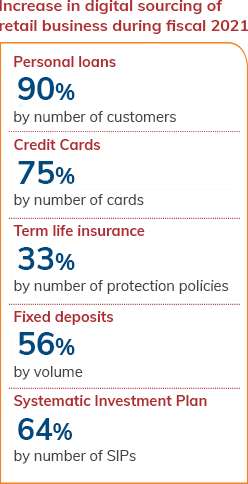

Digital initiatives have played a key role in driving

growth and efficiency in the retail business. These

initiatives have improved the efficiency of branches.

The Bank is now able to serve more customers at

its existing branches and has enabled employees

to perform more value-added activities. The Bank

periodically reviews branches based on customer

footfalls and economic activities to ensure optimal

distribution of the branch network. We added 922

cash acceptance machines and 148 insta-banking

kiosks during fiscal 2021.

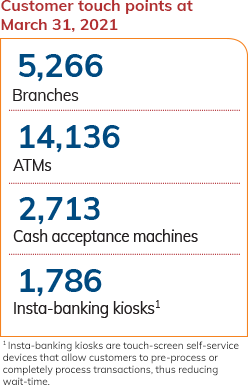

Rural and Inclusive Banking

Our rural banking operations aim to meet the financial

requirements of customers in rural and semi-urban

locations. Our products in this segment include working

capital loans for growing crops, financing post-harvest

activities, loans against gold jewellery along with

personal loans, financing against warehouse receipts,

farm equipment loans, affordable housing finance

and auto and two-wheeler loans. We also provide

consumption loans for low-income customers. We

offer financial solutions to micro-finance institutions,

self-help groups, co-operatives constituted by farmers,

corporations and medium enterprises engaged in

agriculture-linked businesses.

Our operational structure and offerings put us in a unique

position to leverage opportunities in different ecosystems

within the rural markets. At the heart of this approach are

six main ecosystems identified in the rural market which

include Agriculture, Dealers, Self-Employed, Corporates,

Institutions and Micro-Entrepreneurs.

The farmer ecosystem includes participants like farmers,

seed producers, agri-input dealers, warehouses,

agri-equipment dealers, commodity traders and

agri processors. The Bank has designed different

products for each player to meet their specific financial

requirements so that the entire agri-value chain is well-financed. Products offered include working capital loans

through the Kisan Credit Card and gold loans, and term

loans for farm equipment, dairy livestock purchase and

farm development. The rural ecosystem of corporates

includes manufacturing and processing units, employees,

dealers and suppliers. The dealer ecosystem comprises

dealers/distributors of farm equipment, white goods,

and pharmaceutical manufacturers. Similarly, the self-employed ecosystem comprises of rural entrepreneurs

who are engaged in trading and manufacturing activities

based out of commercial and industrial areas in the

rural market dealing with both agri and non-agri related

products. The institutional segment comprises various

institutes like schools, colleges, hospitals and government

offices. We closely engage with them to develop products

and processes, including technology solutions. The micro-lending space includes women from the lower-income

strata of the population, non-government organisations

and other institutions working at the grass-root level in

the rural economy. The Bank has products and services

specifically to cater to this segment.

We have scaled-up funding of electronic Negotiable

Warehousing Receipts (eNWR), which provides an

opportunity for borrowers to access credit quickly and

with ease. Farmers can use eNWR to get loans against

underlying commodities. This protects the farmers from

volatility and gives opportunities to avail better prices for

their produce. Further, the Warehousing Development

and Regulatory Authority (WDRA) has a well-defined

mechanism to empanel warehouses for issuing eNWR,

which mitigates potential risks in the business.

Offering complete financial solutions to customers

and their ecosystem has been a strategic focus in the

Bank’s businesses. In the rural space, an example of this

approach is the financial solution provided to farmers

and other participants of the dairy ecosystem. This

includes providing a suite of financial solutions including

term loans and working capital loans to dairy unions,

payment solutions and promoting investments in

animal husbandry. These solutions are supplemented

by providing skill training through ICICI Foundation. We

have reached over 29,500 farmers to invest into animal

husbandry valued over ₹5.10 billion and have tied-up with

about 2,200 Village Level Cooperative Societies (VLCS)

with about 0.2 million members.

Apart from meeting the financial requirements for business

purposes, we also offer products to meet the personal

requirements of participants in the rural ecosystem.

A community banking approach has been adopted with

emphasis on personal relationships with customers. The

operational structure ensures that we can meet holistic

financial needs of customers in the villages at their

doorstep. The Bank’s reach in rural areas comprises a

network of branches, ATMs and field staff, and business

correspondents providing last-mile access in remote

areas. Of the Bank’s network of 5,266 branches, 51% are

in rural and semi-urban areas with 649 branches in villages

that were previously unbanked. There were over 4,000

customer service points enabled through the business

correspondent network at March 31, 2021.

The Bank has a mobile application that enables its

employees to capture and submit loan applications

from the applicant’s doorstep and also gives indicative

eligibility and deviations on product lending norms.

This effectively shortens the turnaround time and the

cost to service new loan applications. A light version

mobile app, 'Mera iMobile' has been developed for rural

customers in 11 regional languages, with 135 services,

in which multiple functionalities work without internet

access. ‘Mera iMobile’ app is used by more than half a

million customers.

We have tied up with fintech start-ups that support

Aadhaar-enabled transactions. During the year,

180 million transactions aggregating about ₹389 billion

were facilitated. These solutions are making financial

services more accessible and affordable.

The rural banking portfolio grew by 26.9% year-on-year

during fiscal 2021 to ₹721.58 billion, driven mainly by

growth in loans against jewellery and loans to rural self-employed customers.

Small & Medium Enterprises and Business Banking

The Small and Medium Enterprises (SME) portfolio

comprises exposures to companies with a turnover

of up to ₹2.50 billion. Our business banking portfolio

comprises small business customers with an average

loan ticket size of ₹10-15 million. The SME portfolio

grew by 32.5% year-on-year to ₹302.84 billion and the business banking portfolio grew by 40.5% year-on-year

to ₹373.27 billion at March 31, 2021.

Our focus in these businesses is on parameterised and

programme-based lending, which is granular and well-collateralised. We offer our SME and business banking

customers a wide spectrum of solutions addressing their

evolving business needs such as customised offerings,

faster turnaround time, transaction convenience, timely

access to capital and cross-border trade and foreign

exchange products. Providing digital solutions is at the

core of the engagement, with the range of solutions

spanning customer onboarding, payments and

collections, lending and cross-border transactions.

Following the Covid-19 pandemic, we have provided

financial assistance to clients based on various

government schemes, which includes providing

moratoria on loan repayment and Emergency Credit

lines to eligible SME customers. We have disbursed

an aggregate amount of about ₹140 billion to SME and

other customers under the government's Emergency

Credit Line Guarantee Scheme till March 31, 2021.

We were able to leverage on our growing digital

capabilities during this period by providing contactless

solutions like digital current account opening, online

electronic franking and digital signature-based document

execution (Eazysign).

A new digital platform, InstaBIZ, was launched specifically

for the small and medium enterprises (SME) and the

self-employed segment, which offers over 200 products

and services on mobile and internet banking platforms.

Customers can seamlessly execute their trade finance and

foreign exchange transactions through the Trade Online

and FX Online platforms and carry out trade transactions

online in a paperless environment. Customers can avail

bank guarantees on the go, which provides a superior

transaction and service experience.

The Bank continued to enhance the data analytics-driven

onboarding, credit assessment and monitoring of our

retail and SME customers and creation of propositions

for their supply-chain financing needs. Supply chain

financing is an integral part of the SME business and

a focus area towards deepening our coverage of the

corporate ecosystem. Our CorpConnect platform enables

corporates to integrate their Enterprise Resource Planning

(ERP) system using Application Programme Interfaces

or host-to-host protocols. Our plug-n-play based digital

supply chain financing platform, DigitalLite, enables the

onboarding of customers seamlessly and quickly.

These

two platforms enable corporates to seamlessly manage

the supply chain financing, payments, collection and

reconciliation requirements of their dealers and vendors

in a convenient and paperless process.

InstaBIZ: India's most comprehensive digital banking

app for businesses offers over 200 banking products

and services.

These platforms

also automatically assess the eligibility of the corporate’s

dealers and vendors for credit through business rule

engine and intelligent algorithm with automated bureau

checks. With these capabilities, digital approval letter

generation automation and e-sign features, we are able

to set up credit limits and offer credit sanction to the

corporate’s dealers and vendors within a few hours, even

if they are not customers of the Bank. Over half of our

supply chain linked business corporate clients have been

onboarded on our digital platforms.

We follow strong risk management practices in

managing our SME and business banking portfolio, with

a view to enhancing the portfolio quality by reducing

concentration risks and a focus towards granular and

collateralised lending-based growth. Our robust portfolio

monitoring framework is able to proactively analyse and

detect stressed cases which enables us to take early

action and ensure healthy portfolio quality. The Bank

has further strengthened its underwriting process by

integrating various digital tools like bank statement

analyser, automatic fetching of bureau reports and

enhanced business rule engine to generate probability

of default scores for score-based analysis into one single

ecosystem called Infinity. A combination of qualitative and

quantitative assessment tools are utilised to arrive at the

final decision.

Wholesale Banking

The Wholesale Banking Group has a wide and deep

client franchise, which includes top business houses,

large private sector companies, financial institutions

and banks, public sector undertakings and central and

state government entities. In the last few years, we

have developed a strong franchise across multi-national

companies (MNCs) and new age services companies,

and also established a strong franchise in the financial

sponsors space with special focus on private equity

funds and their investee companies.

We have a comprehensive coverage model. Our Bank’s

established presence as a financial service provider and

extensive branch network across the country providing

last mile coverage has helped us to strengthen our client

franchise. By leveraging the Bank’s overseas branches,

we have been able to focus on MNCs, financial sponsors

and India linked companies. Our approach has been to

deepen our partnership and support our clients through

their life cycle. Our leading-edge product portfolio is

comprehensive and technologically advanced and

includes lending products for working capital and capital

expenditure requirements and other products that the

client may need across trade, treasury, bonds, commercial

papers, channel financing, supply chain solutions, and

various other activities.

With a focus on the Bank’s overall strategy of maximising

the risk-calibrated core operating profit, the Wholesale

Banking Group has reimagined its strategy of engaging

with corporate clients. While Portfolio Quality and Earning

Quality remain the key principles driving our strategy value creation for our clients is the main focus. Instead

of being only capital providers, we aim to become

business partners to our clients. To achieve this, we

realigned our structure in the past from product-centric

to a client-centric model. With the client at the centre, all

the groups across the Bank are well-aligned to offer the

entire Bank’s offerings to our clients and their ecosystems.

We continued our strategy of 360° banking across the

corporate ecosystem by offering a comprehensive suite of

banking products to the corporate and its entire network

of employees, dealers, vendors and all other stakeholders.

This has not only made client servicing more effective, but

also helped us to penetrate deeper in high-value retail

accounts of promoters, directors and employees through

a suite of retail products like salary, private and wealth

banking, home loans, personal loans, vehicle loans, etc.

This approach also reduced client acquisition cost. The

Group focussed on capturing the money in motion for

the entire Corporate Ecosystem to strengthen the Bank’s

liability franchise further.

Driven by data analytics to derive insights, combined

with an approach to build future-ready banking solutions

and integrating client journeys through digitisation, we

have evolved our digital offerings for corporate clients.

One such innovative offering is the ICICI STACK for

corporate clients that provides digital banking solutions

for corporates on a single platform and also provides

sector-specific solutions.

In a volatile business environment, with return of capital

being the overarching objective, we leveraged analytics

extensively to monitor transactions and portfolio quality.

While new credit is extended in a granular manner to well-established and higher-rated business groups, analytics

is used for portfolio monitoring and identification of

early warning signals in the existing book. This has led

to enhancement of the overall quality of the existing

corporate portfolio. We also focussed on reducing

concentration risks to make the portfolio more granular.

Technology continues to be the cornerstone of our

strategy as well as execution. The online application for

credit assessment of mid-corporate clients was scaled up

during the year. Apart from quick onboarding, this enabled

objective and comprehensive risk assessment of clients,

based on multiple parameters like bureau information, and

qualitative and quantitative factors. Another innovative

solution offered was CP Online, a first-of-its-kind cloud

based platform, which seamlessly integrates various stakeholders for the issuance of commercial paper (CP).

By automating the document preparation and digitising

the process flow, CP Online reduces the client’s workload

by more than 80% and turnaround time from four days to

less than a day. The strong product proposition helped the

Bank to double its market share of CP flows within a year.

We have evolved our digital offerings for corporate

clients by building future-ready banking solutions and

integrating client journeys through digitisation.

Transaction Banking

In fiscal 2021, the disruptions due to measures to

control the spread of Covid-19 impacted the day-to-day

functioning of our corporate and SME clients, whether

it was paying their suppliers and employees, collecting

money from their customers or handling their daily

import and export transactions. Our proactive response

coupled with technology investments made in our

digital capabilities over the years, both in customer

facing solutions and in internal workflow management,

became compelling for our customers and enabled

our employees to provide uninterrupted services to

customers. In this context, one key positive outcome has

been a multi-year acceleration in the digital adoption by

our corporate customers leading to enhanced customer

satisfaction, amongst other business outcomes. The

number of customers on our Trade Online platform more

than doubled during fiscal 2021.

In continuing with our thought leadership in the digital

space and customer-centric approach, we have also

brought to market certain ecosystem based solutions.

We curated a number of industry and segment specific

solutions. An example of industry specific solutions that

we launched in fiscal 2021 was an end-to-end digital

capability for the capital market industry, which in turn

helped us capture a greater share of the liability opportunity

from this ecosystem. An example of a segment specific

solution that we launched during the year was a platform

to enhance the ease of doing business for MNCs in

India through our Infinite India portal. The portal offers

value-added services in collaboration with partners to

ease the MNCs’ journey of setting up or scaling up their

business in India. Similar initiatives have been taken to

capture the entire ecosystem opportunity across multiple

industries and segments.

We have also launched 15 industry STACKs as a part

of ICICI STACK for Corporates to provide the depth

and breadth of digital solutions required by the diverse

customer segments we serve.

With a focus on capturing the entire 360° banking

opportunity, the Bank continues to create best-in-class

digital solutions to meet the varied requirements of

our customers. These solutions range from industry

shaping initiatives such as the first 'e-bank guarantee

with e-stamping' issuance in collaboration with the state

of Uttar Pradesh, thus creating a pathway for complete

paperless bank guarantee issuance and advising, and

amendments to operational efficiency-enhancing solutions

for our customers such as a simplified digital payment

solution for 'Multi-state GST'. Customisation at a scale is a

key factor in our approach.

These solutions are being delivered to our customers

through physical and digital channels. In addition to

leveraging the existing physical branch network, we have

expanded our capabilities to provide transaction banking

services to our customers from about 114 locations as

of March 31, 2020 to 183 locations as of March 31, 2021.

This has also involved co-location of skilled transaction

banking teams to branches. Many of these expanded

branch capabilities are in the factory/township premises

of certain large conglomerates in the country.

In addition to our scalable corporate internet banking

platform which has over 100 features that are being

continuously upgraded, we also embarked on providing

embedded solutions at scale to our customers. These

embedded banking solutions, which are offered through

APIs or host-to-host connectivity, provide access to day-to-day banking services to corporates within their own

ERP environments. In fiscal 2021, the Bank delivered

over 21% higher number of integrations compared to a

year ago. In addition to enhancing customer satisfaction,

these embedded solutions ensure stable business for

the Bank.

A critical aspect of capturing the ecosystem opportunity

is vendor and dealer financing. A key priority for our

corporate customers is to ensure continued and

competitive financing for their supply chain to ensure

uninterrupted business. In this regard, the Bank

offers a complete product suite including all forms

of vendor and dealer financing solutions. Necessary

investments have been made in technology capabilities

to ensure scalability of business is achieved within

the credit guardrails. The digital capabilities are also

supplemented by distributed teams located out of our

branches capturing this important business for our

customer and the Bank.

In these digital capabilities developed by the Bank, data

analytics plays a very critical role. Investments in capability

and capacity building in data analytics have resulted in

delivering a number of use cases in wholesale banking,

which is aimed at three main objectives of improved

customer service, enhanced revenue opportunities and

superior risk management. A number of tangible use

cases have been delivered with measurable outcomes

across the stated objectives.

International Business

ICICI Bank’s international presence consists of branches in

the United States, Singapore, Hong Kong, Bahrain, Dubai

International Finance Centre, South Africa, China, Offshore

Banking Unit (OBU) and IFSC Banking Unit (IBU), and

representative offices in Bangladesh, Dubai, Abu Dhabi,

Indonesia and Malaysia. We also have wholly-owned

subsidiaries in the United Kingdom (UK) and Canada.

ICICI Bank UK also has a branch in Germany. The Bank

opened a new representative office in Nepal and closed

its branch in Sri Lanka during the year.

Our international franchise continues to focus on four

strategic pillars, namely the NRI ecosystem comprising

deposits, remittances, investments and asset products;

the MNC ecosystem comprising both foreign MNCs

investing in India and Indian MNCs branching out for

their foreign currency and other India related requirements

and also Global In-house Centres (GIC), which are

back-offices of MNCs created to serve the world; Trade

ecosystem, comprising primarily India-linked trade

transactions which are self-liquidating in nature; and

funds ecosystem, to capture fund flows into India through

the Foreign Portfolio Investment (FPI) and Foreign

Direct Investment (FDI) route. Apart from this, the Bank

continued to progress in its objective of reducing the

non-India linked exposures in a planned manner. The

non-India linked corporate portfolio reduced by 56%

year-on-year or by USD 1.60 billion during fiscal 2021.

The Bank plays a pioneering role in promoting digital

initiatives across businesses in the international banking

arena. We have been continuously introducing and

innovating products to enhance customer experiences.

In the NRI segment, re-imagining the NRI ecosystem with

ICICI STACK, for a deeper understanding of customer

profiles and needs with 360° STACK solutions designed to meet the evolving banking needs of NRIs and their

families in India, has been a core focus. The on-boarding

of NRI customers has been made seamless by leveraging

emerging technologies like OCR based account opening

with facility to track applications. We also launched

the opening of three-in-one accounts digitally, an

industry-first initiative, for seamless opening of savings

account with linked demat account and broking account.

Remote servicing accessibility was enhanced with the

launch of WhatsApp banking and i-Pal chatbot. The new

and value-added digitised services for NRI customers

resulted in 85% of NRI customers being digitally active.

Facilitating frictionless cross-border remittance solutions

has been the core strategy in re-designing the solutions

for both inward and outward remittance needs of NRIs and

resident Indians. We implemented SWIFT gpi for inward

and outward remittances, enabling end-to-end digital

tracking of remittances. Our proprietary inward remittance

platform, Money2India, was enhanced with a completely

revamped user interface (UI) across both web and mobile

app solutions to deliver a superior user experience.

Single sign-on facility to access Money2India and Internet

banking was launched for NRI customers, facilitating

seamless unified login access to service remittance and

banking needs.

Segment-specific solutions were redesigned, including

the student ecosystem, for enabling seamless fee

payments to overseas universities through online

integrated solutions in tie-ups with institutional/fintech

aggregators, both in India and overseas.

The Money2India platform was enhanced with a

completely revamped user interface across both web

and mobile app solutions.

Government Banking

We are extensively engaged with government

departments/ bodies and support them with

technology-driven banking solutions. Government

banking has been a core focus area for the Bank and

we provide a range of banking services to Government

of India ministries, state government departments and

district and local bodies across the country. ICICI Bank

offers its government customers a wide spectrum of

solutions addressing the fast-evolving needs such as

customisable and integrated solutions, large transaction

processing capabilities and superior turnaround time.

The customised products and services offered are

aligned to act as enablers for enhancing e-governance

and financial management.

The Bank assists the Government in collection of central

taxes, state taxes and GST payments through authorised

branches and digital channels. Our technology-driven

banking platforms provide simple online tax payment

options to customers. Statutory payments like EPFO

and ESIC dues can also be done online through the

Bank’s platform.

We have partnered with a number of Central and

State government departments to ensure quick

disbursement of funds/benefits to beneficiaries and

implementing agencies through the Public Financial

Management System (PFMS) and non-PFMS platforms.

These customisable and integrated solutions have

supported the government’s endeavour for efficiency in

expenditure management.

ICICI STACK, the comprehensive digital banking suite

is offered to government bodies, institutions, district

administrations, local bodies and associated stakeholders,

including their staff and employees to bring transparency

and desired efficiencies in the implementation of the

Government's objectives.