Our lending to environment-friendly sectors is based

on appropriate assessment of risks and returns.

We have actively financed projects for capacity creation

in environment-friendly sectors. This includes renewable

energy sectors like solar, wind and hydro power and other

sustainable sectors like waste processing and mass rapid

transport. Our outstanding portfolio to the renewable

energy sectors was about ₹31.50 billion at March 31, 2021.

Further, the Bank availed lines of credit from select

multilateral agencies towards financing green/sustainable assets. The assets financed under these

lines include financing for wind, solar, biomass plants

and energy efficiency projects. At March 31, 2021, the

outstanding lending by us for such specific purposes was

USD 70.8 million.

An internal team within the Bank is dedicated to providing

financial assistance to initiatives that promote biodiversity,

environmental sustainability and initiatives in education,

health, sanitation and livelihoods. The team’s mandate

is to administer funding lines received from bilateral/

multilateral agencies/Government of India, specifically

for such projects. Their efforts include identifying

relevant projects, ensuring financial assistance through

collaboration or directly and knowledge sharing.

Total financial assistance provided by the group in

fiscal 2021 was about ₹265.0 million. Some of the projects

implemented in fiscal 2021 were:

- Assistance was provided for skilling in a tribal

belt in Amaravati district in Andhra Pradesh.

Adopting sustainable agriculture, sustainable livelihood

and village level institutional empowerment are some

of the focus areas which is expected to benefit the

people in 20 villages.

- A watershed development project in Yavatmal district

of Maharashtra has been given assistance that

would lead to 200 hectares of land being brought

under protective irrigation and treatment for

soil/water erosion.

- In the area of promoting education, assistance has

been provided for part of the cost for setting up a

school in Bhandara district of Maharashtra, which is

expected to provide educational facilities to students

belonging to low-income groups at a nominal fee.

Another project involved sponsoring the conversion of

two schools into innovation hubs for education.

- Establishment of a geriatric care centre for older

adults at Bhubaneswar that would provide outpatient,

diagnostic and surgical services, a rehabilitation centre

for the elderly, home care and tele medicine/internal

medicine facilities. The centre will also focus on

training eye care cadres in elderly care and research

on various age-related eye conditions.

- Government departments, institutions and

organisations were supported in their efforts to fight

the Covid-19 pandemic. This involved supplying

essential protection material, strengthening hospital

infrastructure and extending support to health workers.

ENVIRONMENT SENSTIVITY IN

THE BANK'S OPERATIONS

The Bank’s commitment to energy efficiency and adopting

environment-friendly practices in its operations remains a

prime objective. Our consistent efforts over several years,

and ongoing enhancements at our premises on various

fronts, has led to efficiency gains. These efforts range from

adopting green features at our premises, energy efficiency

practices, water conservation measures and paper

savings. Fiscal 2021 was a disruptive year as the Bank’s

large offices were partially closed and there was limited

opportunity to undertake any new energy conservation

initiatives, though certain ongoing projects continued.

Roof top solar panels at ICICI Bank Towers in Ambattur, Chennai.

Green Building Features

Roof top solar panels at ICICI Bank Towers in Ambattur, Chennai.

Since fiscal 2018, the Bank has been ensuring Indian Green

Building Council (IGBC) green building features in all its

new offices and branches at the time of set up. The total

number of offices awarded the highest rating was

11 at March 31, 2021, covering a total area of 2.28 million

square feet. The Bank has employees who are certified

IGBC Accredited Professionals.

97.5 KWp

of new solar power capacity added at the Bank’s

premises, taking the total onsite renewable energy

capacity to 2.9 MWp.

30 %

of the energy requirement at the Bank's three

large offices were met through renewable energy

in fiscal 2021.

A lithium ion battery storage system at an

ICICI Bank branch in Delhi.

Efforts Towards Reducing Emissions

Reducing greenhouse gas emissions and securing

the future of our planet requires an all-encompassing

approach. We have actively pursued opportunities to

adopt new technologies and energy-efficient practices

in our operations to reduce our operational emissions.

This is an ongoing effort at the Bank. Our efforts have

included undertaking audit of our large offices and

branches for identifying areas of focus for improving

energy savings, investing in new technologies and

experimenting with new ideas that are proven to be

favourable for the environment. One such recent effort

has been towards replacing diesel generating sets

with lithium ion battery storage system at branches

to enhance reliability and improve energy efficiency.

Another effort undertaken during fiscal 2021 was

replacing carbon dioxide based fire extinguishers with

Clean Agent fire extinguishers at the Bank’s branches

that are less damaging to the environment.

Our efforts to reduce emissions also include promoting

use of renewable energy sources wherever feasible at our

premises. During fiscal 2021, 97.5 KWp (Kilo Watt peak)

of new solar power capacity was added at the Bank’s

premises, taking the total onsite renewable energy capacity

to 2.9 MWp (Mega Watt peak) at March 31, 2021. The total

generation from these systems was 3 million kWh during

the year, which was 66% higher on a year-on-year basis.

Under the open access mechanism for power sourcing,

the Bank has signed power purchase agreements (PPA)

for solar and wind energy purchase for three of our

large offices. The total contracted capacity is 9 MWp.

These offices have been using renewable energy

since fiscal 2016, and during fiscal 2021, 30% of the

energy requirement at these offices was met through

renewable energy.

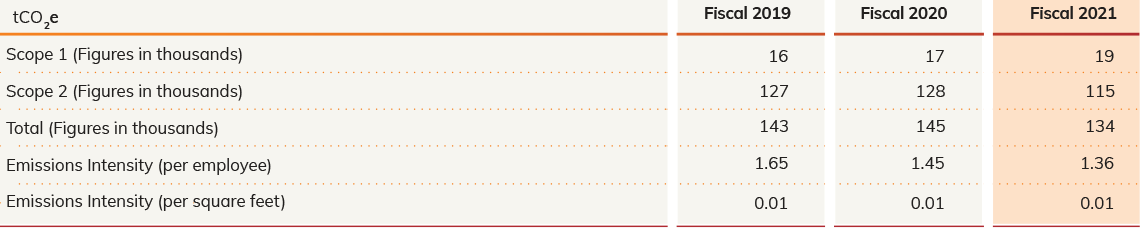

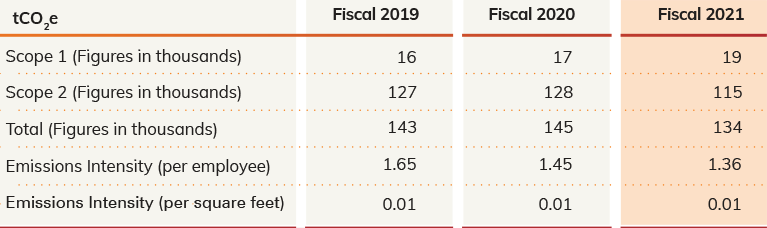

In fiscal 2021, the Bank engaged an external consultant

to evaluate our Scope 1* and Scope 2** emissions for

comprehensiveness and accuracy. The Bank’s Scope 1

and Scope 2 greenhouse gas emissions in the last three

years were as follows:

Water Savings

The Bank has been ensuring that water consumption per

day in its large offices is lower than the benchmark of

45 litres per person per day as per the Bureau of Indian

Standards for large offices. The Bank has undertaken

various initiatives to conserve water. The Bank recycles

and reuses waste water at three large offices including

the ICICI Service Centre (Corporate Office) at Bandra-Kurla

Complex, Mumbai. All new offices and branches opened

during the year were fitted with water-efficient plumbing

fixtures. Rainwater harvesting is being undertaken at three

large offices.

Paper Consumption

Fiscal 2021 was an exceptional year for paper

consumption, due to lockdown and containment

measures and large-scale adoption of work-from-home.

These factors and the growing use of digital channels led

to a decline in paper consumption.

Extending the digital advantages to customers and

in our processes are an ongoing effort. The Covid-19

pandemic accelerated the adoption of digital channels by

customers for undertaking banking activities. This was

augmented by a series of digital products launched by

us during the year to enable our customers to continue

accessing banking services without visiting a branch and

with minimal disruptions. We believe that encouraging

customers to adopt digital practices not only helps in

improving efficiency and reducing servicing time, but also

create a positive impact on the environment. ICICI STACK,

WhatsApp banking, Video KYC for onboarding of

customers and cardless cash withdrawal facility at ATMs

were some of the digital initiatives launched during the year

that enabled customers to transact in a safe and secure

environment. During the year, a range of insta-lending

products were offered to customers which are end-to-end digitally processed. There were significant efforts

towards decongesting processes and reducing physical

movement of documents. A significant portion of the

Bank’s operations today are paperless. Further, we procure

environment-friendly copier paper which is manufactured

from wheat straw, which is an agricultural residue.

The Bank is continuously reviewing its systems and

processes for optimising paper consumption.

Waste Management

The Bank focusses on waste reduction and its

management in every aspect of its operations.

The Bank undertakes recycling of organic waste using

composting techniques at the Bank’s large offices in

Mumbai at Bandra-Kurla Complex and Chandivli, and at

the Learning Centre in Khandala. E-waste is disposed

by handing over to certified recyclers. The Bank also

supports reuse of electronic devices. The Bank uses

remanufactured toners in printers which get recycled

at least 2-3 times. The Bank also recycles its IT assets

which are then donated.

Certifications

The Bank has adopted corporate objectives for

environment conservation activities in conformity with

the ISO-14001 standard 'International Organisation

for Standardisation' for environmental management

systems. This enables the Bank in developing policies

for addressing the objectives of environmental

sustainability and assessment of impact of the Bank’s

activities, products and services on the environment.

Health and safety systems at 13 large offices of

the Bank have been OHSAS 18001:2007* certified.

The environment management systems of the ICICI

Service Centre at Bandra-Kurla Complex in Mumbai are

both OHSAS 18001:2007 and ISO 14001:2004** certified.

The data centre was the country’s first data centre to be

awarded ‘Platinum’ by IGBC. The call centre at Thane in

Mumbai was declared a Leader in energy efficiency at

the National Level Energy Conservation & Management

Awards by the Confederation of Indian Industry (CII).

The Bank won 16 awards for energy efficiency/

environment management during fiscal 2021.