Business Ethics and Policies

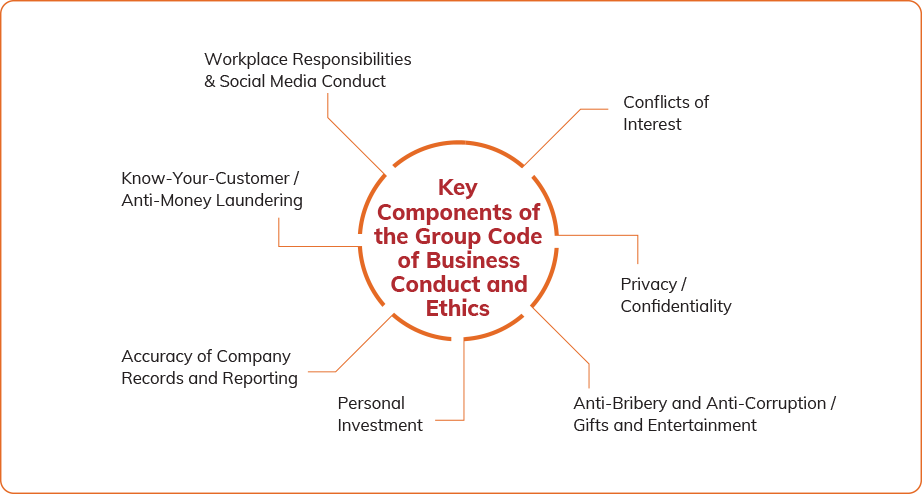

ICICI Bank is dedicated to acting professionally, ethically and with integrity in all its activities. Our Group Code of Ethics and Conduct (the ‘Code’) provides the values, principles and standards that should drive decisions and actions of the employees of the Bank. The Code is also the Bank’s commitment to its stakeholders of adhering to the highest ethical standards. In addition, we have a ‘Group Anti-Money Laundering Policy’ in line with global regulations and conventions frameworks dedicated to Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT). The policy covers guidelines on Know Your Customer (KYC), customer due diligence, screening, customer risk categorisation, transaction monitoring, reporting, audit, and training.

The Code is applicable to all the members of the Board of Directors and employees, including senior management. This Code is reviewed on an annual basis and the latest Code is available on the website of the Bank.

As an organisation, we have zero tolerance towards bribery and corruption and have a well-defined AntiBribery and Anti-Corruption Policy in place that mandates the obligations of our employees in these matters. It is our constant endeavour to test the effectiveness of our financial controls and ensure compliance with all regulatory requirements. The Bank’s third-party vendors are also required to adhere to the Bank’s Anti-Bribery and Anti-Corruption Policy, including providing an annual self-declaration confirming their compliance. Periodic risk assessment of the policy is conducted, at least once in three years.

Our Whistle-Blower Policy comprehensively provides an opportunity to employees and directors of the Bank to raise any issue concerning breaches of law, accounting policies or any act resulting in financial or reputation loss and misuse of office or suspected or actual fraud. The policy lays down the mechanism to report such concerns to the Audit Committee through specified channels and states that all employees of the Bank can approach the Audit Committee for reporting on this matter.

The key policies undergo regular reviews and are modified to ensure relevance, adherence to regulations and adoption of best practices. The compliance framework mentioned in ICICI Group’s Compliance Policy ensures that all products, customer offerings and activities of the Bank comply with rules and regulations and reflect our guiding principle of "Fair to Customer, Fair to Bank".

To instil the culture of integrity and ethical business practices, new employees are mandated to undergo training related to Code of Conduct, Information Security, Anti-Money Laundering, Prevention of Sexual Harassment Policy (POSH) and other compliance-related areas that are critical and sensitive. We also have mechanisms on redressal for complaints and engagement with agents and third-party vendors in place. We also adhere to the Code of Conduct on Prohibition of Insider Trading as prescribed by the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015.

Our commitment to meritocracy, non-discrimination and employee complaint redressal mechanism is not applicable to the Bank alone but its subsidiaries also. We do not engage in any form of child labour practices and activities that involve violation of human rights. It is also ensured that there is no discrimination in selection of suppliers and vendors, and seeks compliance of vendors with national laws, including not employing child labour.

We also take initiatives to engage with the vulnerable stakeholders of the society. We are taking steps to enable easier access to the Bank’s branches and ATMs for the physically challenged and are also providing facility for the visually challenged to transact at ATMs. Further, we currently offer doorstep banking service to senior citizens, differently abled or infirm persons (having medically certified chronic illness or disability) including visually impaired.

The Bank is a member of various trade bodies and associations such as the Indian Banks’ Association among others. The senior management of the Bank participates as members of committees constituted by government, regulators and industry bodies.