At ICICI Bank, we are committed to adhering to the high standards of governance in the way we conduct our business. We ensure compliance with the laws, rules and regulations that govern our business and have established a culture of accountability, transparency, and ethical conduct.

The Board of Directors is constituted in compliance with the Banking Regulation Act, 1949, the Companies Act, 2013 and the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 and in accordance with good corporate governance practices. The Board functions either as a full Board or through various committees constituted to oversee specific operational areas.

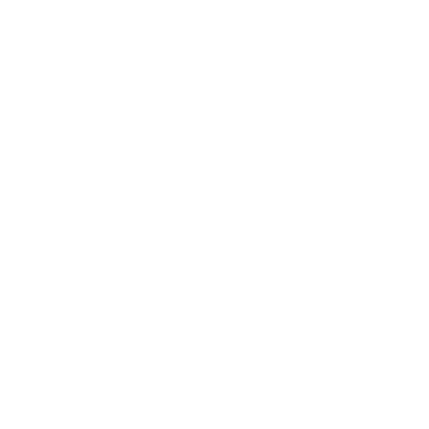

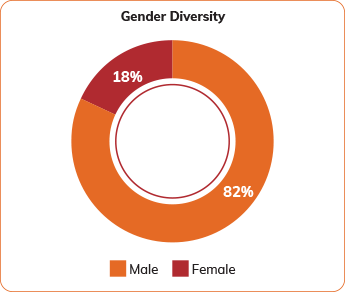

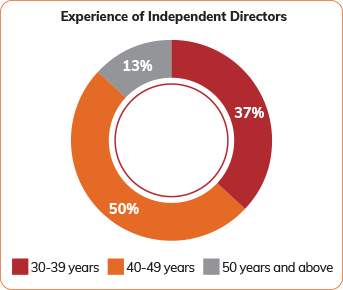

The Board of the Bank consisted of 11 Directors, out of which eight were Independent Directors, and three were Executive Directors at June 30, 2022. There were 10 meetings of the Board during fiscal 2022.

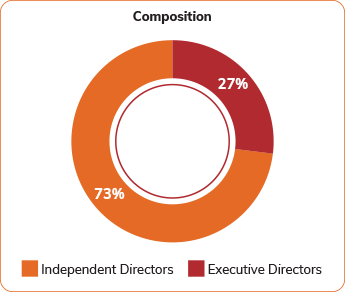

The Board of ICICI Bank consists of distinguished individuals from multiple backgrounds. At June 30, 2022, there are two female directors and nine male directors.

Girish Chandra Chaturvedi

B. Sriram

Hari L. Mundra

Neelam Dhawan

Radhakrishnan Nair

S. Madhavan

Uday Chitale

Vibha Paul Rishi

An independent Board is the key to ensuring robust governance culture in an organisation. All Independent Directors have given declarations that they meet the criteria of independence as laid down under Section 149 of the Companies Act, 2013 as amended (the Act) and Regulation 16 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (SEBI Listing Regulations) which have been relied on by the Bank and were placed at the Board Meeting held on April 23, 2022. In the opinion of the Board, the Independent Directors fulfil the conditions specified in the Act and the SEBI Listing Regulations and are independent of the Management. There are no inter se relationships between any of the Directors.

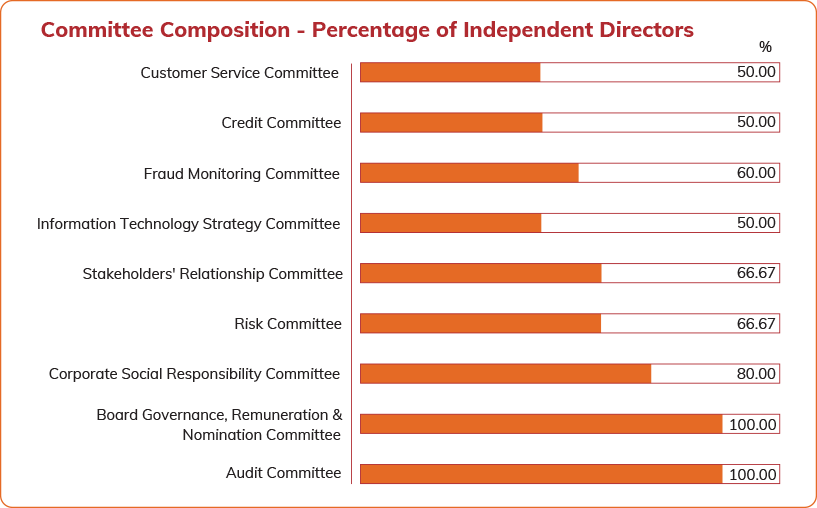

The corporate governance framework at ICICI Bank is based on an effective independent Board, the separation of the Board’s supervisory role from the executive management and the constitution of Board Committees to oversee critical areas. At March 31, 2022, Independent Directors constituted a majority on most of the Committees and most of the Committees were chaired by Independent Directors.

ICICI Bank has a Board Governance, Remuneration & Nomination Committee (BGRNC) which is responsible for overseeing the remuneration aspects at the Bank. Our compensation practices ensure meritocracy within the framework of prudent risk management and are formulated under the guidance of the Board and the BGRNC.

BGRNC specifies Key Performance Indicators (KPIs) for Whole Time Directors (WTDs) and equivalent positions and the organisational performance norms for variable pay, which is based on the financial and strategic plan approved by the Board. The KPIs include both quantitative and qualitative aspects defined with sub parameters. The BGRNC assesses organisational performance and based on its assessment, it makes recommendations to the Board regarding compensation for WTDs, senior management and equivalent positions and variable pay for employees, including senior management and key management personnel.

The Bank with the approval of its BGRNC has put in place an evaluation framework for evaluation of the Board, Directors, Chairperson and Committees. The evaluations for the Directors, the Board, Chairman of the Board and the Committees is carried out through circulation of four different questionnaires, for the Directors, for the Board, for the Chairperson of the Board and the Committees respectively. The performance of the Board is assessed on select parameters related to roles, responsibilities and obligations of the Board, relevance of Board discussions, attention to strategic issues, performance on key areas, providing feedback to executive management and assessing the quality, quantity and timeliness of flow of information between the Company management and the Board that is necessary for the Board to effectively and reasonably perform their duties. The evaluation criteria for the Directors is based on their participation, contribution and offering guidance to and understanding of the areas which were relevant to them in their capacity as members of the Board. The evaluation criteria for the Chairperson of the Board besides the general criteria adopted for assessment of all Directors, focuses on leadership abilities, effective management of meetings and preservation of interest of stakeholders.

The Compensation Policy is applicable to all employees of the Bank including those located at overseas branches. In addition to the Bank’s Compensation Policy guidelines, the overseas branches also adhere to relevant local regulations. The Compensation Policy is further aligned with prudent risk taking. The Bank offers a judicious mix of fixed and variable pay, with a higher proportion of variable pay at senior levels and no guaranteed bonuses. The compensation criteria are based on both financial and non-financial indicators of performance including aspects like risk management and customer service.

During the year ended March 31, 2022, the Bank employed the services of a reputed consulting firm for market benchmarking in the area of compensation, including executive compensation.

Our corporate governance structure is designed not only to fulfil regulatory and legal requirements, but to also create a culture of business ethics, supervision, and sustained value creation for all stakeholders. The Bank has developed a wide spectrum of policies, codes, and procedures to facilitate that and established Board Committees for their implementation, well supported by people, process and technology.

The Board has formed various committees and delegated certain powers to such committees to monitor the functioning of the Bank and provide necessary direction to senior management in view of external / internal developments including changes in regulatory environment. The Committees conduct their business in accordance with their terms of reference.

The brief terms of reference of the above Committees and the details of their meetings held during fiscal 2022 are disclosed in the Corporate Governance Section in the Annual Report.

Copyright© 2022 . All rights Reserved.