Climate Risk Management

As climate-related events are becoming increasingly evident and surface temperature of the Earth is rising, accelerating climate action has become a priority. Environmental and climate-related risks encompass various risks (credit, market, operational, and legal) arising from the exposure of the Bank to activities that may contribute to or be impacted potentially by climate change, air and water pollution, scarcity of fresh water, land contamination, biodiversity loss and deforestation. Recognising the need to understand and address these emerging risks, the Bank has an ESG team under the Risk Management Group to provide insights and develop expertise to strengthen climate and ESG risk management capabilities. Our climate strategy involves climate risk considerations including physical and transition risks and enhancement to our ESG risk assessments as part of our sustainability practices.

The Bank has formulated a Climate Risk Management Framework (CRMF) for integration of climate risk into overall risk management framework and providing guidance on assessing the impact of climate change on the Bank's own operations due to physical risk events. Additionally, it guides in identifying and analysing the impact of both physical and transition risks on the lending portfolio.

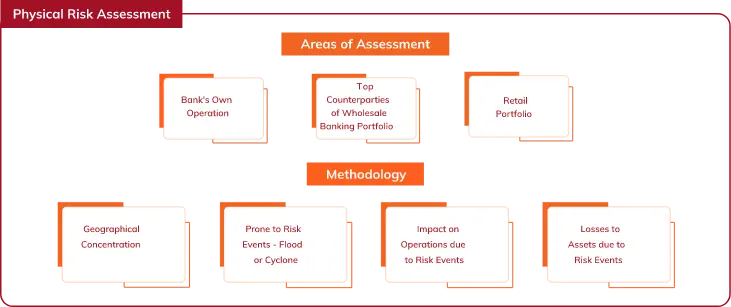

Physical Risk Assessment

The consequences of climate change include both incremental effects (a long-term change in the mean and variability of climate pattern) and acute effects (increase in frequency and severity of extreme weather event). The potential impact of physical climate risks on the Bank could be significant, as they can affect Bank’s own operations and the credit quality of borrowers due to extreme weather events and changes in environmental conditions.

With regard to its own operations, the Bank has a business continuity management plan whereby the Bank conducts periodic assessment of climate risk on infrastructure including data centres and selected operations hubs. Resilience assessment is also carried out by an external agency of key locations on account of extreme climate events like cyclonic floods and the probability of simultaneous occurrence of climate events in the identified critical locations. The last assessment was carried out in fiscal 2022, where the probability of occurrence of such events and its impact of any of the paired locations was assessed to be extremely low. The Bank’s disaster recovery policy provides details on actions to be considered in case of extreme events.

With regard to evaluation of physical risk for the lending portfolio, the Bank has initiated assessment for top counterparties of wholesale banking and retail lending portfolio using internal scenarios. The methodology involves analysing the geographical concentration of the borrower’s operations in regions prone to cyclones and floods, losses in operational days, and losses to assets in the last five years. Borrowers are further classified under the categories of high, medium and low.

The Bank is also keeping track of methodologies which are being developed for evaluating the impact of physical climate risks for certain areas and regions in India, depending on availability of relevant and reliable data.

Transition Risk Assessment

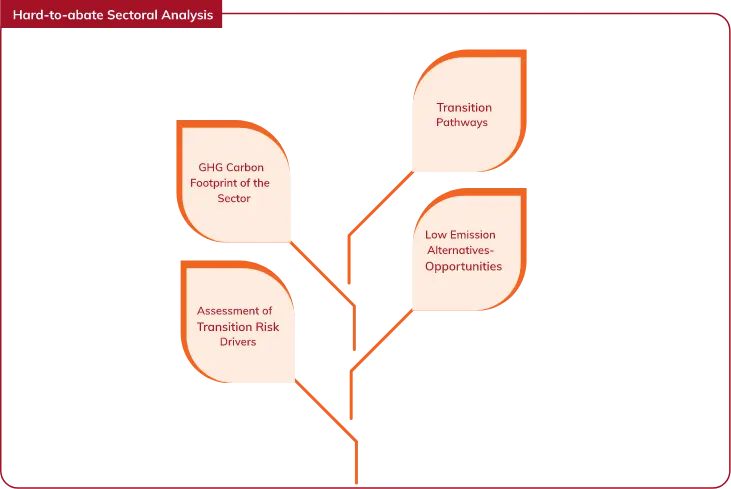

The identification of transition risks and impact assessment at the Bank is performed at broad sectoral level for the top corporates especially within hard-to-abate sectors due to their substantial reliance on carbon-intensive processes and resources. The assessment of transition risk considers principles of ‘relevance’ and ‘proportionality’ at sectoral level. Relevance considers sector-wise greenhouse gas emissions, transition risk factors and the sectoral credit risk, while proportionality is a combination of the exposure size and the tenor rating of the sectors.

Sectoral Analysis to Understand Transition Risks and Opportunities

The Bank is monitoring transition risk drivers in hard-to-abate sectors with deep-dive analysis based on parameters selected with guidance from the Taskforce on Climate-Related Financial Disclosures (TCFD) framework. The focus is on understanding the transition risk drivers such as policy and legal risk, technology risk, consumer demand and market risks as well as associated transition costs. The Bank also tracks potential policy risks arising from national-level developments, such as the proposed carbon taxation mechanisms across geographies and evolving reporting requirements. On the technology side, analysis involves low-emission-based technology alternatives that may pose risks to existing assets and their potential evolution for commercialisation.

The Bank has performed sectoral analysis for ‘hard to abate’ sectors such as steel, cement, aluminium and power, and aims to expand the assessment to other ‘hard to abate’ sectors and opportunity sectors such as green hydrogen.

The Bank also actively engages with regulators, corporate borrowers, and rating agencies to analyse the key developments and potential associated impact at sectoral level. Regular updates are provided to the appropriate Board Committee.

Social and Environmental Management Framework

The Bank is committed to financing projects that are environmentally sustainable, socially beneficial, and financially viable. The Bank’s endeavour is to make a positive impact by assessing challenges pertaining to environmental and social parameters inherent in its project financing portfolio.

The Bank’s Social and Environmental Management Framework (SEMF) requires analysis of specific environmental and social risks as part of the overall credit appraisal process for assessing new project financing proposals. Key elements of the assessment include screening through an exclusion list drawn broadly from the lists published by the International Finance Corporation (IFC) and list of highly polluting sectors published by the Ministry of Environment, Forests and Climate Change (MoEFCC) in India, adopting measures such as seeking a declaration from borrowers on critical parameters and stipulating independent due diligence, based on criteria defined in the SEMF.

Integration of ESG Assessment in Credit Evaluation

ESG and climate-related parameters are being further integrated into the credit evaluation process, acknowledging the inherent risks associated with climate and ESG issues.

As part of the credit evaluation process for large corporate lending proposals, ESG score, if available from external agencies, are considered. Additionally, the Bank has developed sector-specific risk assessment tools to gauge the ESG maturity and associated risks of borrowers with exposures exceeding a certain threshold. This risk assessment tool has been developed with a focus on hard-to-abate sectors that are challenging to transition to low carbon pathways and sectors with substantial exposure within the Bank's portfolio.

During fiscal 2024, ESG risk assessment tool was extended to two more sectors, namely, cement and aluminium, taking the total number of sectors to 16 at March 31, 2024. Some of the sectors for which ESG risk assessment tool is being utilised include, construction, real estate, iron and steel, power generation, petrochemicals, oil and gas, automobiles, wholesale and retail trade.

Borrowers are evaluated based on their responses to two separate checklists designed to assess ESG maturity and ESG risk of their business models. The overall ESG rating is determined by considering both the maturity and risk ratings, with a deflator applied to sectors with high climate impact or to borrowers with low ESG maturity scores.

Maturity assessment parameters encompass several factors such as existing environmental and social policies, emission reduction targets, and certifications related to safety, quality, and environmental management systems. Risk evaluation parameters are designed to appraise factors such as the extent of damage or impact caused by physical climate risks, investments in decarbonisation technologies, frequency of workplace injuries, as well as any penalties imposed by regulatory entities. The criteria for ESG parameters have been established by drawing upon existing frameworks such as the Business Responsibility and Sustainability Reporting (BRSR) requirement stipulated by Securities Exchange Board of India (SEBI) for the top 1,000 listed companies in India, sectoral standards as outlined in the International Financial Reporting Standards (IFRS), disclosures from Carbon Disclosure Project (CDP), and standards set forth by the Global Reporting Initiative (GRI). This approach facilitates a more thorough assessment by focussing on material ESG parameters specific to each sector and also enhances availability of essential information for the Bank.

The Bank has also been participating at various industry and regulatory forums for providing collaborative inputs on climate policy-making for the Indian banking industry.

Scenario Analysis

The Bank conducts climate scenario analysis to quantify the impact of climate-related financial risks and assess the potential impact on capital and provisioning. The analysis includes assessment of the potential impact of physical risks on the top counterparties of wholesale banking portfolio and retail lending as well as the probable impact of transition risk on the top counterparties within the wholesale banking portfolio. The output of the exercise has been incorporated in the Bank's financial planning as a part of Internal Capital Adequacy Assessment Process (ICAAP).

Climate Risk Management at Overseas Branches

The Bank is cognisant of regulations as applicable to its international banking units and overseas branches where it operates and has established systems with local branch management to address climate and ESG-related matters. The corporate office in India has oversight on the local branch management to ensure adherence to applicable regulations and also leverages developments in the climate and ESG domain across such locations.

In Hong Kong, the Hong Kong Monetary Authority (HKMA) has issued Supervisory Policy Manual (SPM) on climate risk management in December 2021 and circulars on integration of climate risk into banking supervisory processes, planning for net-zero transition, and questionnaire for SME borrowers to obtain information with respect to climate risk. The Bank’s local branch management formulated its Climate Risk Management Framework in November 2022 and has also developed questionnaire and risk assessment model for evaluating the borrower’s environment risk and potential impact in credit proposals. It makes climate-related disclosures to comply with local regulatory expectations.

In Singapore, the Monetary Authority of Singapore (MAS) has issued guidelines on Environmental Risk Management in December 2020 and in October 2023 published a consultation paper on guidelines on transition planning by banks for a Net Zero economy. The Bank’s local branch management formulated the Environmental Risk Management Framework in June 2022 and publishes limited climate-related disclosures to comply with local regulatory expectations.

In Bahrain, the Central Bank of Bahrain (CBB) issued ESG reporting requirements module in November 2023, which will be effective from December 31, 2024. Branches of foreign financial institutions are allowed to submit the ESG report of their head office. The CBB also issued a circular on signifying the importance of raising awareness about climate-related risks and include training as a part of annual training requirements of the employees. Accordingly, relevant officials at the Bank’s local branch team are included as part of training sessions on climate-related risks being taken up at the corporate office.

In the United Arab Emirates (UAE), the Sustainable Finance Working Group (SFWG), established in 2019, issued set of principles for the effective management of climate-related financial risks. The Dubai Financial Services Authority (DFSA) adopted the principles in November 2023. The Bank’s local branch management in these jurisdictions have been following the developments around coverage of financial Institutions under the principles’ scope and applicability in line with the branch operations and regulatory guidance.

In the United States of America (USA), the Office of the Comptroller of the Currency (OCC), Board of Governors of Federal Reserve System, Federal Deposit Insurance Corporation (FDIC) jointly issued principles for safe and sound management of climate-related financial risks in October 2023. The applicability of these principles is limited to financial Institutions with operations greater than USD 100 billion and the Bank’s local branch management is tracking further developments.

The International Finance Services Centres Authority (IFSCA) in GIFT city, Gujarat, India issued guidance on sustainable and sustainability linked lending in April 2022. In accordance with the requirements, the governing body of the local branch has adopted the Bank's Framework for Sustainable Finance with specific addendums. Additionally, it discloses details of its sustainable financing portfolio to the IFSCA on a semi-annual basis.

Previous Topic

Next Topic

Sustainable Financing