About the Report

Sustainability is integral to ICICI Bank’s philosophy and is embedded in each of its business functions. The Bank continues to take focussed initiatives to drive its sustainability journey.

Focus Areas of ESG Policy

Responsible Financing

Environmental Sensitivity in the Bank’s Operations

Our Customers

Our Employees

Society

Corporate Governance

Cybersecurity and Data Privacy Governance Framework

Stakeholder Engagement and Accountability

Message from the Chairman

We have set ourselves the goal of becoming carbon neutral in Scope 1 and Scope 2 emissions by fiscal 2032.

Girish Chandra Chaturvedi Chairman

Know More

Message from the Executive Director

In fiscal 2024, we continued our efforts towards reducing the Bank’s emissions from our own operations through mechanisms to adopt more green power.

Sandeep Batra Executive Director

Know MoreHighlights

Carbon Neutral by Fiscal 2032

ICICI Bank has formulated a long-term vision for enhancing sustainability and becoming carbon neutral in Scope 1 and Scope 2 emissions

- Reduced its total Scope 1 and Scope 2 emissions by 15.7% during fiscal 2024 over previous fiscal.

‘Net Zero Waste’ Certification

Received for Service Centre at BKC, Mumbai

Trees Planted (in million)

1.1

Fiscal 2024

3.7

Since fiscal 2022

27.5 million

A4 sized papers

=

2,044*

Trees saved

*As per estimates, 17 trees can be saved from one tonne of A-4 sized paper. During the fiscal, the Bank has saved over 120 tonnes of paper.

25.8 billion

Litres annual water harvesting capacity created

At

6,800

Schools

&

1,180

Water bodies

183

Offices with 4.95 million sq. ft. area is IGBC-certified

=

86**

Football grounds

**A standard football field is of 57,600 sq. ft.

CSR activity in Rural Schools

1,950 kW

Solar capacity created in 770 schools in fiscal 2024

9,970 kW

Solar capacity created in 3,180 schools since fiscal 2022

Renewable Energy Consumption in the Bank’s Own Operations (in million kWh)

All numbers are at March 31, 2024

Lives Positively Impacted (in million)

12.8

In 250 districts across India

=

2.1

By healthcare initiatives

+

3.7

Through livelihood programmes

+

7

By societal development interventions

Societal Welfare

99

Pedestrian bridges built in Himalayan region since fiscal 2022

Empowering Women through SHGs (in million)

1.1

In fiscal 2024

10

Since inception

Broad-based Board of Directors (13)

9

Independent Directors

4

Executive Directors

(at March 31, 2024)

Robust Role and Independence of the Board

Independent Directors

- Chair most committees

- Constitute the majority on most committees

- The Board’s supervisory role is separated from the executive management

- 10 committees formed to oversee critical functions of the Bank

- Performance of the Board is assessed on multiple parameters by independent external agency

Strengthened Climate Risk Management

- Introduced sectoral analysis of hard-to-abate sectors

- Expanded the ESG risk assessment tool to more sectors

- Integrated ESG assessment in credit evaluation of lending proposals above a certain threshold for large corporates

Outstanding Sustainable Financing portfolio grew to ₹685.28 billion

at March 31, 2024

Green financing portfolio was ₹193.66 billion at March 31, 2024

- ~ 50% of this was for financing renewable energy

Cybersecurity and Data Protection Governance

Multiple levels of management oversight with ultimate responsibility lying with the Board of Directors

Dedicated Cybersecurity Incident Response Team (CSIRT) to respond to security incidents

The Bank’s Personal Data Protection Standard ensures personal data is kept secured

Key Principles of Customer Rights Policy

Right to Fair Treatment

Right to Transparency

Fair and Honest Dealing

Right to Suitability

Right to Privacy

Right to Grievance Redressal and Compensation

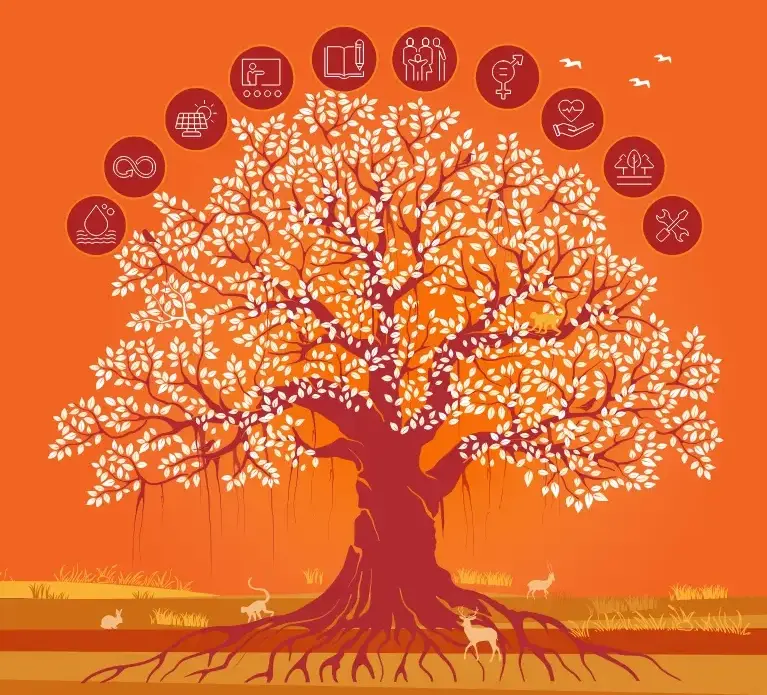

ICICI Bank’s Contribution to UN SDGs

The United Nation’s Sustainable Development Goals (UNSDGs) is an action-oriented framework encompassing economic, social and environmental aspects that aims to transform the lives and livelihood of people. India has endorsed the UNSDGs, implemented suitable policy frameworks and is adopting several initiatives to meet its commitments. Significant strides have been made on issues like poverty eradication, sustainable growth, health, nutrition, gender equality, quality education, among others. Accelerated action in areas like environment and climate change are undertaken to meet the commitments under the Nationally Determined Contributions (NDCs). At ICICI Bank, we are consistently drawing on these ambitions set out to transform India and sharing the vision of prosperity for its people and the planet.

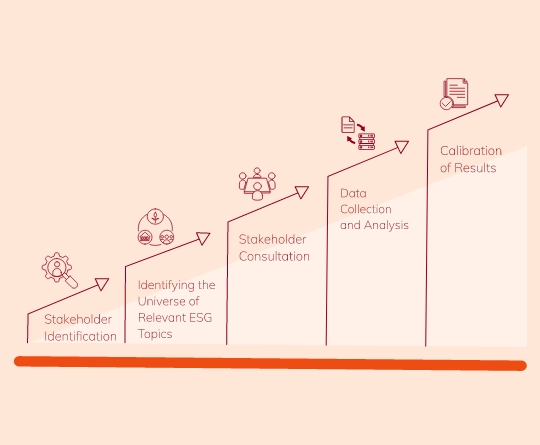

Stakeholder Engagement and Materiality Assessment

The Bank is committed to inclusion, economic development and sustainable growth of all its stakeholders

Know More