ICICI Bank has played a pioneering role in the digital transformation of the financial services industry in India. We continuously invest in innovative products and state-of-the-art platforms that leverage emerging technologies to make banking easier, safer, more personalised, more accessible and more intuitive for our customers and also enable us to become more agile and more efficient.

The customer is at the centre of all our initiatives and we believe in being ‘Fair to Customer, Fair to Bank’.

At ICICI Bank, we believe that digitally-enabled banking solutions not only empower our customers to fulfil their ambitions but also create value for our stakeholders.

Vision

To be the trusted financial services provider of choice for our customers, thereby creating sustainable value for our stakeholders

Mission

To grow our risk-calibrated core operating profit by:

- Delivering products and services that create value for customers

- Bringing together all our capabilities to seamlessly meet customer needs

- Conducting our business within well-defined risk tolerance levels

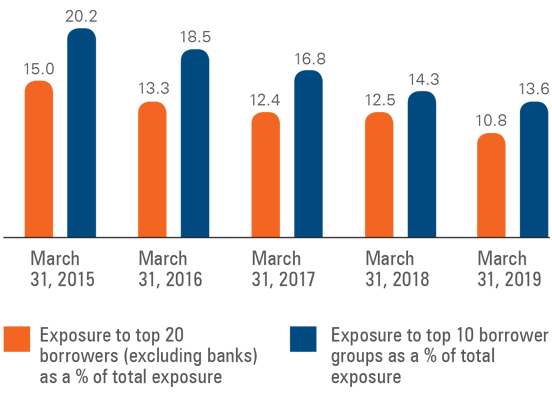

The Bank has focussed on growing risk calibrated operating profit by leveraging its strong franchise, and building a more granular and higher rated portfolio.

Girish Chandra Chaturvedi

Chairman

Sandeep Bakhshi

Managing Director & CEO

Anup Bagchi

Executive Director

Sandeep Batra

Executive Director

(Designate)*

Vishakha Mulye

Executive Director

(Based on the principles of International Integrated Reporting Framework)

ICICI Bank has focussed on being a future-ready organisation and has consistently evolved its capabilities to ensure agility and value creation in its businesses. This focus is integral to the Bank’s strategy and underscores the several pioneering initiatives taken by the Bank

Risk is an integral part of the banking business and the Bank aims at achieving an appropriate trade-off between risk and returns

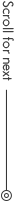

INDEPENDENT GROUPS FOR MONITORING RISKS IN THE BANK

Several independent groups and sub-groups have been constituted to facilitate evaluation, monitoring and reporting of risks. These groups function independently of the business groups.

Our commitment towards social empowerment and a financial ecosystem accessible to all

Impact on natural resources either through our operations or business focus