Risk is an integral part of the banking business and the Bank aims at achieving an appropriate trade-off between risk and returns

As a financial intermediary, the Bank is exposed to various risks, primarily credit risk, market risk, liquidity risk, operational risk, information technology risk, cyber risk, compliance risk, legal risk and reputation risk.

The Board of Directors of the Bank has oversight of all risks assumed by the Bank with specific Committees of the Board constituted to facilitate focussed risk management. There is adequate representation of independent directors on each of these Committees. The Board has framed specific mandates for each of these Committees. The proceedings and the decisions taken by these Committees are reported to the Board. The policies approved by the Board of Directors or Committees of the Board from time to time constitute the governing framework within which business activities are undertaken. The Bank has put in place an Enterprise Risk Management and Risk Appetite Framework that articulates the risk appetite and drills down the same into a limit framework for various risk categories. The trends in the portfolio and risks are reported to the Board Committees periodically.

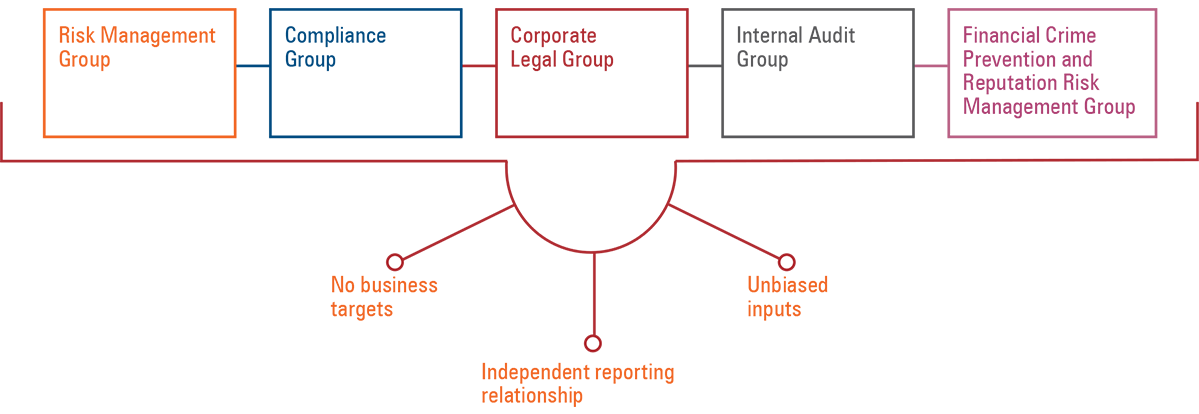

INDEPENDENT GROUPS FOR MONITORING RISKS IN THE BANK

Several independent groups and sub-groups have been constituted to facilitate evaluation, monitoring and reporting of risks. These groups function independently of the business groups.

The Risk Management Group is further organised into the Credit Risk Management Group, Market Risk Management Group, Operational Risk Management Group and Information Security Group.

The Risk Management Group reports to the Risk Committee of the Board of Directors. The Compliance Group and the Internal Audit Group report to the Audit Committee of the Board of Directors. The Risk Management, Compliance and Internal Audit Groups have administrative reporting to the Executive Director, Corporate Centre.

To know more about the key risks impacting the Bank’s business, click here