The Bank's human resources and cultural anchors are critical to driving the success of its business.

The Bank’s human capital strategy is underpinned by key cultural anchors of Fair Compensation, Learning and Growth, and Care.

The Bank’s endeavour is to create a responsive workforce, encouraged by empowering the teams to take cues from the local environment and identify opportunities for risk-calibrated growth. The Bank has taken steps to organise and structure teams in a way which facilitates the Bank’s approach to Customer 360°. The Bank has invested in aligning the organisation around micromarkets and customer ecosystems by increasing the density of leadership in key markets. The integration of the Bank’s businesses happens closer to the customer. This enables better understanding of customer needs at a micromarket level in addition to enhancing the Bank’s agility in responding to business requirements and opportunities. The corporate office operates as a service centre and the purpose of the central team is to serve the employees to facilitate customer engagement and seamless delivery of products and services. The Bank encourages its employees to experiment and innovate to deliver services and create solutions for customers within the guardrails of risk and compliance.

The Bank follows a prudent compensation practice under the guidance of the Board of Directors and the Board Governance Remuneration & Nomination Committee (the BGRNC or the Committee). The Compensation philosophy of the Bank is aligned to reward team performance. The Bank’s approach to compensation is intended to drive meritocracy within the framework of prudent risk management. The total compensation is a prudent mix of fixed pay and variable pay, which takes into account a mix of external market pay and internal equity. The fixed pay offered by the Bank, largely reflects pay for the role. The variable compensation is in the form of share-linked instruments or cash or a mix of cash and share-linked instruments. The cash component of variable pay (performance bonus) is aligned to the philosophy of 'One Bank One Team' as it is based on overall performance of the Bank and reflects reward for team performance. The grant of share-linked instruments to eligible employees, reflects individual potential and criticality of position/employee. The compensation of staff engaged in all assurance functions like Risk, Compliance & Internal Audit depends on the achievement of key results of the respective functions and is independent of the business areas they oversee.

The Bank’s focus on Customer 360° banking requires employees to have multi-product knowledge and skills. The Bank has invested in training its employees and enhancing their ability to comprehensively serve customers. This has enabled teams to be agile in responding to requirements of customers, and work collaboratively to create innovative and personalised products & solutions for customers.

The Bank has a capability building architecture spanning across functional training, leadership development, digital and industry academia programmes to equip employees with the required skillsets.

The Bank has collaborated with academia partners to provide a steady supply of quality, job-ready workforce. One of the key aspects of the industry academia programmes is the skills it builds in the banking, compliance, financial and digital services domains. This aligns new hires to the culture of the Bank and imparts functional knowledge in banking and related subjects. Employees at frontline levels can also enrol in ICICI Bank’s Probationary Officer programme and get inducted as Probationary Officers after completing the programme at ICICI Manipal Academy.

The Bank has a Young Leaders Programme (YLP), where employees have the opportunity for higher education (Post Graduate Programme). Those who successfully complete this programme are deployed back into the Bank in managerial roles.

The Bank is an employer of choice at premier management and engineering campuses across the country.

As a part of 'Bank to BankTech' journey, the Bank continues to skill employees under the Digital Academy in line with the vision of a scalable, futureready and data-driven organisation. Employees from across groups undergo skilling in domains such as API & Micro Services, Cloud Computing, Data Engineering, Software Engineering, Artificial Intelligence and Project Management.

To mitigate cybersecurity domain risks, the Bank conducted a dedicated Cybersecurity Programme in partnership with reputed institutes covering areas such as infrastructure security, network security, digital forensics, incident management and network analysis.

To enable employees with diverse skills in data sciences, design thinking and artificial intelligence, various programmes and academies have been created across the Bank. During fiscal 2023, the Bank delivered a total of over 12 million learning hours for its employees; the average learning person-days was around 12.2 days.

In order to periodically review and align learning content and design, the Bank has constituted academic councils, comprising representatives from business, human resources and the Bank’s skilling partners. These councils meet on a quarterly basis to review the alignment of the existing content in view of evolving business needs.

As custodians of trust, employees are expected to take decisions which are fair to customers and fair to the Bank.

To enable our employees to manage workplace dilemmas, we have conducted workshops to orient frontline leadership on dealing with dilemmas they may face during the course of their roles. The workshop reinforces the need to apply the Bank’s framework while dealing with such situations within the guardrails of risk and compliance.

The Bank believes in investing in its employees to take up challenging assignments and responsibilities early in the career. The Bank’s ‘customer-oriented’ approach known as Customer 360°, encourages employees to take up new roles and not restrict themselves to specific areas. As a part of their career and skill development, the Bank offers opportunities to employees to explore diverse roles and functions. This provides employees the chance to explore and develop learning and expertise in different domains.

Leadership Development Programmes and Leadership Engagement Sessions are conducted on a regular basis at the Bank.

The ‘Ignite' series is an ongoing initiative designed to keep the employees abreast with breakthroughs in the domains of leadership, digital transformation, data science and behavioural economics. The sessions provide an opportunity to teams to engage with domain experts and thought leaders in these areas.

ICICI Bank also partners with thought-leaders across a wide spectrum of fields ranging from academia, management to sports, to engage with and build leadership perspectives.

The Bank has institutionalised a succession planning and leadership development initiative to identify and groom leaders for next level roles. The Bank has a robust succession planning process which, through the Leadership Cover Index (LCI), closely tracks the depth of leadership bench at the senior management positions. The Bank has a strong bench for key positions and for critical leadership roles.

Employees are the most important capital for the success of the Bank’s strategy and growth of the organisation. The Bank believes in providing an enabling work environment that helps employees to achieve aspirational goals. The Bank is an inclusive and a caring workplace, driven by meritocracy and equal opportunities for all.

Employees at the Bank imbibe Officer Like Qualities (OLQ) at the workplace and in all internal and external engagements. These include respect for Brand ICICI, dignified behaviour in dealing with everyone, managers in position of authority can be demanding but not demeaning, being humble & service-oriented and having an attitude of learning. The Bank has a 24x7 emergency helpline, accessible to all employees of the Bank. This helpline facility has, over the years, provided crucial support to employees and their immediate family members during exigencies. To cater to emergencies, the Bank also has a dedicated Quick Response Team (QRT) to assist employees if they are in any distress. Each QRT is a GPS-enabled vehicle, equipped with a stretcher and other equipment.

To facilitate quick medical attention for employees in medical emergencies, the Bank has tie-ups with more than 100 hospitals in key cities across the country. The Bank also provides comprehensive insurance coverage for all employees, across all grades. Group insurance facility includes both the Personal Accidental Insurance Scheme as well as the Group Life Insurance Scheme. The Bank also facilitates a Parental Insurance Scheme at preferential rates for its employees.

ICICI Bank has also set in place a robust grievance handling mechanism to ensure that it is accessible to all employees. Known as I-Care, this centralised and dedicated team is equipped to handle employee queries and strives to provide a speedy resolution.

The Bank's philosophy of meritocracy and equal opportunity has led to a significant number of key positions being held by women employees over the last two decades. Conscious of life stage needs and safety of women employees, a range of benefits and policies have been curated. In addition to maternity leave, employees have access to child care leave and adoption leave. The Bank has a Travel Accompaniment Policy which allows women with young children to be accompanied by their child and a caregiver during official travel, with the cost borne by the Bank.

The Bank also has a policy designed to provide financial support to employees who have children with special needs. Under this policy, the Bank covers expenses incurred on improving the quality of life of employee’s children with special needs through specialised education (at home or through a special-needs school), specialised therapy, specialised equipment and periodic treatment, if required (at hospital or at home).

At the Bank, sexual harassment cases are handled as per the guidelines set under The Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013. The Bank has created awareness about the Act through mandatory e-learning at the time of induction. The Bank also regularly communicates with employees regarding the mechanism for raising complaints and the need for right conduct by all employees. The policy ensures that all such complaints are handled promptly and effectively with utmost sensitivity and confidentiality, and are resolved within defined timelines. For other workplace issues, the Bank has a structured mechanism to resolve them. The Call@I-Care provides employees with a platform to deal with their queries and concerns.

ICICI Bank believes in creating a culture of free and open conversations. Forums of engagement have been created where employees can engage with senior leadership of the Bank and seek clarification on policy and strategy.

The Bank's senior management regularly engages with employees physically and virtually to emphasise the Bank’s cultural anchors including ethical conduct, adherence to regulations and compliance. Business centre visits are also an important part of the communication agenda. Employees are also kept updated on the strategy and performance and progress of the Bank through quarterly engagement on financial performance by the Executive Director with the leadership team.

Through the initiative of 'Coffee and Conversation', supervisors and HR managers engage with their teams and new joiners on a regular basis. They cover different areas like ICICI Bank's culture, importance of respect and dignity in all engagements, and abiding by internal policy commitments on diversity and human rights.

Onboarding sessions are conducted by Business and HR managers to induct all new hires to the Bank's culture and systems.

ICICI Bank is committed to nurturing and promoting a culture of diversity, equity and inclusion. Our inclusive culture, free from any biases, enables employees to work effectively.

To maintain our culture of diversity and equity, the objectives of our DE&I initiatives are:

The Bank is also committed to promote and respect human rights. The Bank has put in place policies to provide an enabling and harassment-free work environment that respects and upholds individual dignity.

The Bank's Human Rights Policy is aligned with the United Nations Guiding Principles on Business and Human Rights (UNGP) and International Labour Organisation’s Declaration on Fundamental Principles and Rights at Work.

To deliver superior service at scale, our ethos of care and our strength of technology came together to craft an intuitive and seamless experience for our employees.

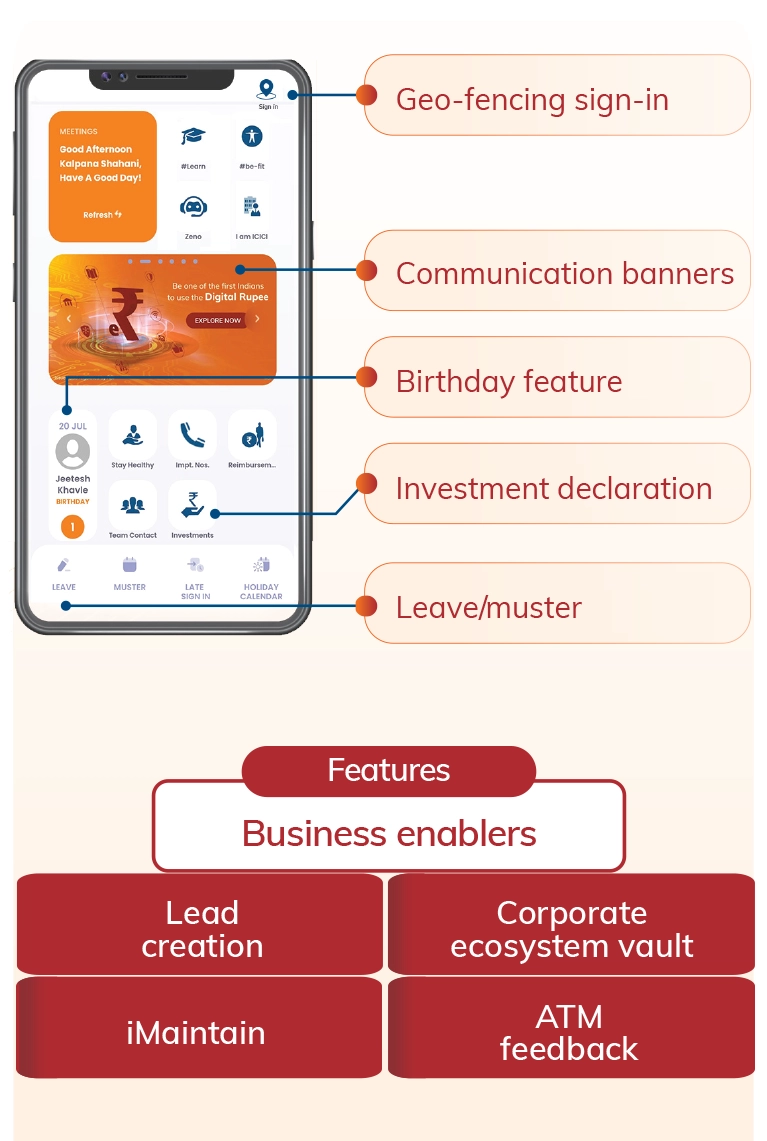

As an integrated workplace technology solution for HR and business transactions, the ‘Universe on the Move' (UOTM) mobile application makes life simple for employees every day – helping employees complete HR and business transactions on the go. Most employee services are available easily through the Universe on the Move app at the click of a button. What makes UOTM unique is that it also integrates business transactions – such as facility to provide business approvals or logging customer leads – in a seamless manner.

For any learning-focussed organisation, constant skilling, re-skilling, up-skilling and capability building are key factors to enable employees to serve evolving customer needs. The Learning Matrix is an AI-enabled digital learning platform with a rich online library and with features like leaderboard, social learning and access to curated open content. This AI-powered platform recommends personalised learning programmes and helps curate content based on in-platform feedback. The Learning Matrix offers an intuitive and engaging learning experience to employees on the go.

To attract the best talent, the Bank has created a digital careers platform to provide aspirants a seamless experience from the application stage to the onboarding stage. Candidates can easily apply for relevant jobs at the click of a button and be updated with real-time progress of their job application. At any juncture, candidates can reach out for support – through a comprehensive service platform integrating chat, calls and emails offering a seamless journey to aspiring ICICIans.

The ICICI Bank Alumni Portal is a digital platform which provides ex-employees with a smooth relieving experience and access to important documentation after their exit from the Bank.

As employee needs evolve, the Bank is committed to serve employees with passion and care.