The Bank is committed to adapting to emerging trends that will shape the nation's transition to a low-carbon economy, with appropriate assessment of risks and opportunities in delivering on the objectives.

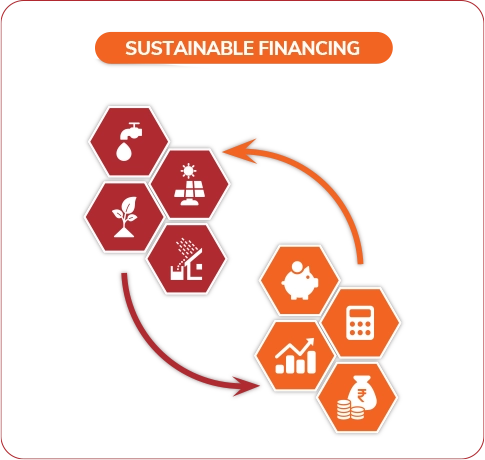

The Bank's efforts in promoting environmental sustainability is in three strategic areas including sustainable financing, in its own operations and corporate social responsibility.

During fiscal 2023, the Bank made further efforts to embed sustainable financing in its business strategy. Consideration of Environmental, Social and Governance (ESG) aspect in the Bank’s lending decisions and risk management framework are important factors and various approaches have been implemented. The Social and Environmental Management Framework (SEMF) requires analysis of specific environmental and social risks as part of the overall credit appraisal process for assessing new project financing proposals. Key elements of the assessment include screening through an exclusion list drawn broadly from guidance by the International Finance Corporation (IFC) and the list of highly polluting sectors published by the Ministry of Environment, Forests & Climate Change (MOEFCC) in India, seeking a declaration from borrowers and independent due diligence as per the criteria defined in the SEMF.

As part of the credit evaluation process for all large corporate lending proposals, borrower ESG scores from external agencies, if available, are considered. Further, the Bank has developed sector-specific checklists to facilitate assessment of ESG and climate-related physical and transition risks that a borrower in sectors like power, transportation, cement, steel and others could be exposed to. This helps the Bank in profiling borrowers as ‘High’, ‘Medium’ and ‘Low’, based on their ESG-related risks and maturity in terms of policies and processes deployed to address these risks.

During fiscal 2023, the Bank developed a framework for Sustainable Financing, aimed at providing guidance on green/ social (sustainable) / sustainability-linked lending. It outlines the methodology and associated procedures to be uniformly applied to classify financial products and services offered by the Bank as sustainable finance. The framework specifies the eligibility criteria, the applicable due diligence requirements and the verification process for sustainable finance. The framework also aims to establish a consistent and comprehensive methodology for the classification and reporting of the Bank’s credit facilities as sustainable.

At March 31, 2023, the Bank's outstanding portfolio to sectors like renewable energy, electric vehicles, green certified real estate, waste management, water and sanitation, positive impact sectors like small-scale khadi, handicrafts and lending to weaker section under priority sector norms was about ₹ 556.00 billion. Of this, the green financing portfolio accounted for about 21.4%.

Climate change and its impact on the economy and financial systems is a tangible risk and requires close monitoring. The Bank’s approach to analysing climate risks include developing methods to integrate climate risk in the risk management framework and begin testing the resilience of the lending portfolio to climate risks which can be categorised into transition and physical risks.

The Bank has formulated an approach to address risks emanating from climate change, as part of its Climate Risk Management Framework. The scope of the framework comprises assessment of impact of climate change on the Bank’s own operations, climate risk management of the Bank’s loan book and integration of material climate risks into the existing risk management framework. The framework will be periodically reviewed for aligning with regulatory guidance on climate risks. As climate risk management is at a nascent stage in the Indian banking industry and regulations in this regard are being formulated, the Bank will ensure that gradually the approaches evolve and get refined for integration of climate risk management within the risk management framework.

Further, the rapidly evolving regulations, policies, technology and law on climate change and climate action could significantly impact lending practices as well as enhance associated risks for the Bank. Navigating through this dynamic environment is crucial for the Bank's sustainable growth. The Bank will proactively integrate these risks into the Bank's credit evaluation process. Further, risks could arise with changing investor and customer expectations. The Bank is cognisant of transition from fossil fuel-based energy to renewable sources, and will capitalise on business opportunities in this transition based on selection of counterparty and appropriate risk-return in accordance with the Enterprise Risk Management framework.

The Bank has emphasised the need to sharpening the focus on measuring its carbon footprint. During fiscal 2023, evaluating Scope 3 emissions in own operations was taken up and the Bank is considering various pilot projects to assess key data and information requirements for calculating carbon and GHG (Greenhouse Gas) emissions in accordance with established protocols.

The Bank is working towards reducing its Scope 1 and Scope 2 emissions. A roadmap to reduce Scope 2 emissions and the overall emission intensity is being pursued. The Bank is in the process of evaluating Scope 3 emissions from own operations. The Bank is working towards identifying and putting in place the elements required to achieve carbon neutrality in own operations.

The Bank has developed a framework for Sustainable Financing, which provides guidance on eligibility criteria for sustainable/sustainability-linked lending, guidance on assessment of facilities, monitoring and reporting of such facilities. This is the first step towards bringing sharper focus in the Bank's sustainable lending practices.

The Bank is also committed to extending its expertise to customers that are transitioning to decarbonise their business activities.

The Bank has formulated an approach to address risks emanating from climate change, as part of a Climate Risk Management Framework which comprises assessment of impact of climate change on the Bank’s own operations, climate risk management of the Bank’s loan book and integration of material climate risks into the existing risk management framework.

The Bank has been participating in pilots conducted by the regulator to evaluate impact of climate-related financial risks on the Indian banking sector.

To facilitate the above initiatives in the Bank, developing proficiency in understanding ESG-related risks and opportunities, and evaluation of ESG/climate-related risks has been embedded into the training imparted to a core team within the risk management group and other critical functions.

The Bank's ESG Policy emphasises its commitment to conduct business sustainably and efficiently, thereby reducing the environmental impact from own premises and operations. The key areas of focus are digitisation, minimising GHG emissions, energy conservation, water conservation, waste management and sustainable procurement.

During fiscal 2023, efforts were further expanded to identify and address critical areas to decarbonise own operations. Some key efforts included:

*tCO2e - Tonnes of carbon dioxide equivalent.

The charging station for electric vehicles at ICICI Service Centre in Bandra-Kurla Complex, Mumbai.

To facilitate the above, in addition to creating awareness within the IMSG and training the relevant team members, engagement with vendors of IMSG was undertaken during fiscal 2023 to create awareness about the Bank's approach on adoption of sustainable practices and to communicate the Bank’s intent to evaluate them on environmental and social factors.

ICICI Bank office at Gachibowli, Hyderabad, rated 'Platinum' by IGBC in 'Green Existing Building' category (inset: IGBC Plaque).

*The Indian Green Building Council (IGBC), part of the Confederation of Indian Industry (CII), is the country’s premier body for green building certification. The ratings are awarded based on assessment of energy efficiency, use of renewable energy, water conservation, waste management, indoor air quality and sustainable sourcing of material. IGBC rating levels (in ascending order) are: Certified, Silver, Gold and Platinum.

As part of CSR initiatives being carried out through ICICI Foundation, ICICI Bank has extensively supported efforts for environmental protection and improving biodiversity. Projects have been executed in the areas of water conservation, forest conservation and afforestation and protecting biodiversity, which are contributing towards restoring ecological balance in the areas of intervention.

Additionally, projects have been undertaken to significantly abate carbon emissions. These include:

There are several other interventions as part of CSR activities, where the Bank has not evaluated the impact on reduction of GHG emissions.

The Bank continued with its practice to get an independent assurance of the Bank’s Scope 11 and Scope 22 emissions undertaken. For fiscal 2023, the limited assurance assignment was taken up by DNV Business Assurance India Private Limited for the Bank’s operations being carried out at its towers, data centres, business centres and offices. The limited assurance of Scope 1 and Scope 2 emissions for fiscal 2022 was conducted by TUV India Private Limited.

The Bank’s GHG emissions in its own operations in fiscal 2023 were:

While the Bank is yet to announce a target for carbon neutrality/net zero, the above efforts are a reflection of the deep-rooted commitment to managing the impact of our operations on the environment.

1

Scope 1 emissions include CO2 emissions from the combustion of fuel in diesel-generating sets and company-owned vehicles, emissions due to loss of refrigerants and emissions due to CO2 based fire extinguishers. The emissions from diesel-generating sets was estimated using the spend-based method. The emissions from fire extinguishers and owned vehicles was based on actual consumption.

2

Scope 2 emissions are due to electricity purchased from the grid. The estimation was based on actual consumption of electricity, and using the grid emission factor published by the Central Electricity Authority, India.

3

Scope 3 emissions have been estimated for business-related travel by employees through modes like aircraft, train, buses, and cars. Emissions from hotel stay during such travel is not included. As per internal estimates, air travel contributed the highest emissions followed by car travel. For the purpose, DEFRA (Department for Environment, Food and Rural Affairs) 2022 emission factors have been considered.

4

tCO2e - Tonnes of carbon dioxide equivalent.

5

One Full Time Equivalent (FTE) employee - One full time employee working on a full time schedule over the year.