At ICICI Bank, we are committed to maintain high standards of governance in the conduct of our business and continuously strive to create lasting value for our stakeholders. We focus on maintaining comprehensive compliance with the laws, rules and regulations that govern our business and promote a culture of accountability, transparency and ethical conduct.

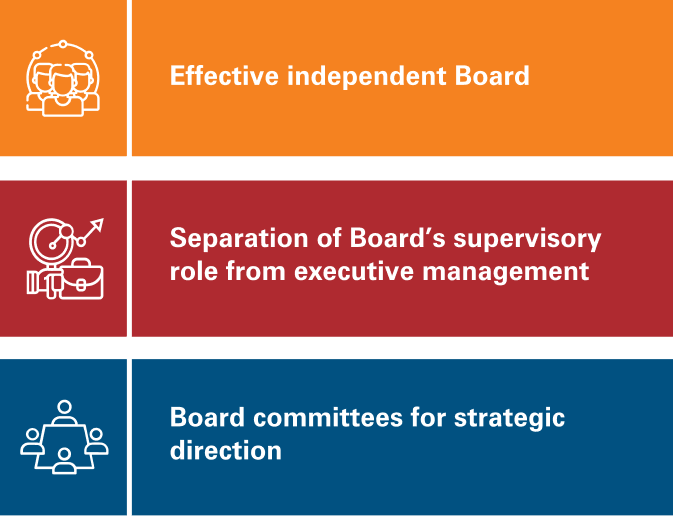

The Bank has a broad-based Board of Directors, constituted in compliance with the Banking Regulation Act, 1949, the Companies Act, 2013 and the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 and in accordance with good corporate governance practices. The Board functions either as a full Board or through various committees constituted to oversee specific operational areas.

The Board of the Bank as on March 31, 2021 consisted of 13 Directors, out of which eight were Independent Directors, one was a Government Nominee Director and four were Executive Directors. There were 12 meetings of the Board during the fiscal. There were no inter-se relationships between any of the Directors.

ICICI Bank’s corporate governance philosophy encompasses regulatory and legal requirements, which aim at achieving a high level of business ethics, effective supervision and enhancement of value for all stakeholders. In line with it, the Bank has created a large spectrum of policies, codes and procedures. These are implemented through its Board Committees, well supported by people, process and technology.

The Board is committed to ensuring that ICICI Bank is a future-ready and resilient organisation with a focus on long term value-creation. Our business is underpinned by strong governance and risk management practices, and an ethos of being a trustworthy financial institution. During the year, the Board and its Committees conducted regular reviews to assess the Bank’s response to the challenges posed by the pandemic and evaluating its impact on our business and loan portfolio. The balance sheet was strengthened by making significant provisions for the potential losses arising from the pandemic, and raising additional capital to boost the balance sheet from a risk as well as growth opportunity perspective. From a longer term perspective, a wide range of issues and risks were reviewed to ensure organisational resilience and the responsiveness of the Bank to the evolving environment, particularly with relation to technology. The Board is focussed on critical aspects like cyber security and data privacy, and the scalability and resilience of the Bank’s technology architecture.

We recognise that we have a responsibility towards addressing environmental and social risks that arise from potential adverse change in the environment. The framework aims to address the impact of these changes on economic activities and human well-being.

ICICI Bank holds regular interactions with stakeholders including investors, employees, customers, regulators and engages with communities and banking associations to seek their views and inform them of the developments at the Bank.

In fiscal 2021, we engaged with stakeholders on key topics including our response to the Covid-19 pandemic. We also interacted with investors digitally.

The Bank’s risk management framework is based on a clear understanding of various risks, disciplined risk assessment and measurement procedures and continuous monitoring. Our active risk management drives our approach of risk-calibrated growth in core operating profit.

The Board of Directors has oversight on all the risks assumed by the Bank. Specific Committees have been constituted to facilitate focused oversight of various risks. There is adequate representation of independent directors on each of these Committees for which the Board has framed specific mandates. The proceedings and the decision taken by these Committees are reported to the Board. The policies approved by the Board of Directors or Committees of the Board from time to time constitute the governing framework within which business activities are undertaken.

The Board Governance, Remuneration and Nomination Committee (BGRNC) is the body which oversees the remuneration aspects at the Bank. The Bank has under the guidance of the Board and the BGRNC, followed compensation practices intended to drive meritocracy within the framework of prudent risk management.

The Chief Risk Officer (CRO) reports to the Risk Committee constituted by the Board which reviews risk management policies of the Bank. The CRO for administrative purposes reports to an Executive Director in the Bank.