Code of Conduct

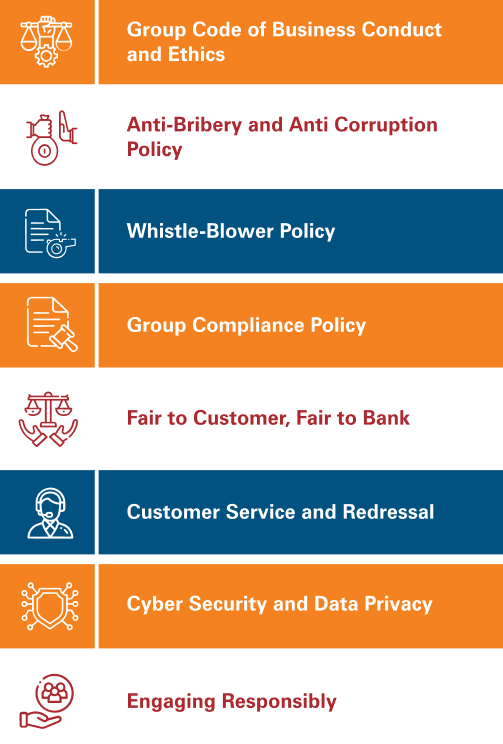

ICICI Bank is committed to act professionally, fairly and with integrity in all its dealings. Our Group

Code of Business Conduct and Ethics for Directors and employees of the ICICI Group aims to ensure

consistent standards of conduct and ethical business practices across the constituents of the ICICI Group.

This Code is reviewed on an annual basis and the latest Code is available on the website of the Bank.

We have a zero tolerance approach to bribery and corruption and have a well-defined Anti-Bribery and

Anti-Corruption Policy that articulates the obligations of our employees in these matters. We continuously

focus on the effectiveness of our financial controls and assess compliance with all regulatory

requirements.

As a disclosure, for the Whistle-Blower Policy of the Bank, no employee of the Bank has been denied access to the Audit Committee.

The Bank is committed to socially responsible conduct and ensures high

standards of integrity and ethics in its engagement with stakeholders, including customers,

shareholders, employees and society. We expect all our employees to act in accordance with the

highest professional and ethical standards upholding the principles of integrity and compliance at

all times. These principles of conduct are communicated to our employees through multiple

channels. All new employees are also required to complete mandatory training modules pertaining to

Code of Conduct, Information Security, Anti Money Laundering and other compliance-related areas

that are critical and sensitive.

The Bank also has well-articulated policies on code of

conduct, whistleblower complaints, redressal mechanism for complaints and engagement with agents

and third-party vendors. Further, we have adopted the Code of Conduct on Prohibition of Insider

Trading as prescribed by the Securities and Exchange Board of India (Prohibition of Insider

Trading) Regulations, 2015.

We constantly review our governance practices and frameworks, with a focus on staying updated and being responsive to the dynamic and evolving landscape, and acting in the best interest of our stakeholders.

The Bank is guided by Reserve Bank of India (RBI) guidelines on priority sector lending, lending to small and marginal farmers, lending to weaker sections among others and governmentled initiatives to improve access to financial services, and insurance and pension cover for disadvantaged, vulnerable and marginalised stakeholders.