Delivering Banking Through Multi-Channels

Our operational structure ensures that we can meet the holistic financial needs of rural customers at their doorstep. We deliver financial and banking solutions to India’s rural population, through an extensive network of branches and ATMs across the country. Additionally, the Bank has Business Correspondents (BCs), who provide last-mile access to remote regions.

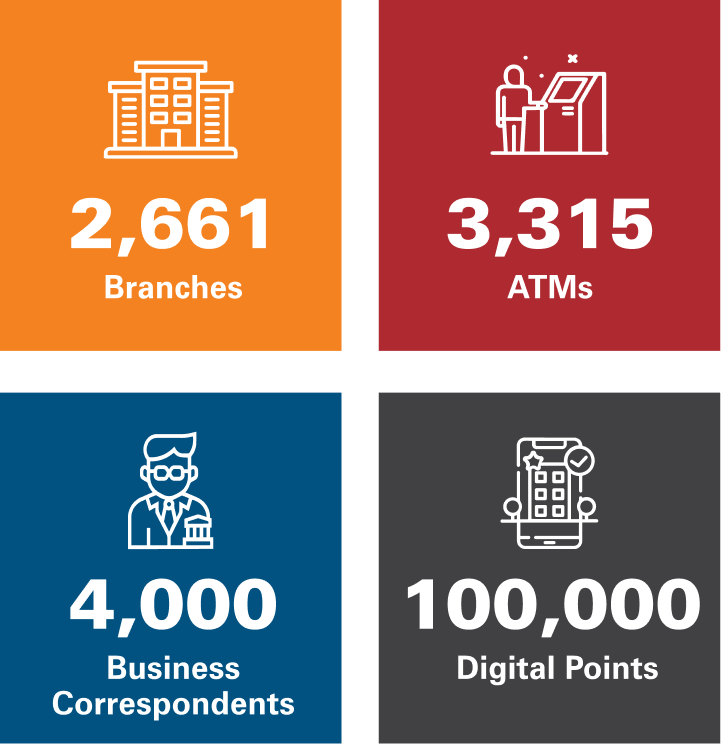

Our footprint21 to enable inclusive banking in semi-urban and rural areas

Our physical presence has been supplemented by our digital channels and solutions that help us widen our reach to the remote parts of rural India, thereby making banking solutions more accessible and convenient to rural customers. Prominent among our digital solutions are:

21. At March 31, 2021

We offer ‘Mera iMobile’, a comprehensive, first-of-its-kind, multilingual mobile application created especially for the requirements of rural and semi-urban customers. Launched in 2017, even non-customers of ICICI Bank can use this innovative app. Available in 13 regional languages, ‘Mera iMobile’ app offers 135 services -- a majority of them work without internet access. This helps the customers to avail banking services digitally in a few simple click.

We have introduced a mobile application that enables

our employees to capture and submit loan applications on a real-time basis

from the rural applicant’s doorstep. It also helps to indicate eligibility

for loan applications, complete e-KYC (Know Your Customer) and provide

preapproved loan offers. These services have significantly enhanced the

banking experience. It improves convenience for customers as they can save

on time and travel expenses since they are no longer required to visit a

nearby branch or service centre.

In addition, we have partnered with

fintech startups that support Aadhaar enabled transactions. During the year,

180 million transactions aggregating about ₹389 billion were facilitated

through these partnerships. These solutions too are making financial

services more accessible and affordable.

Using Satellite Data to Assess the Credit Worthiness of Farmers

ICICI Bank’s continuous efforts to provide state-of-the-art and futuristic digital solutions to its rural customers led it to use satellite data to assess the creditworthiness of farmers in a contactless manner. This helped both customers and employees, especially during the pandemic, to get access to reliable information without having to visit the land.

Explore More