Welcome to ICICI Bank Home Solutions

Features

-

Instant provisional sanction*

*T&C, Subject to correct upload of documents

-

Long tenure

-

Online loan application

Balance Transfer Calculator

Calculate your monthly savings

Outstanding Principal

Amount(₹)

₹5 Lakh₹3Cr.

Current Interest

Rate

5%20%

Current Outstanding

Tenure (Months)

12360

Revised Principal

Amount(₹)

₹5 Lakh₹3Cr.

Illustrative Interest

Rates (In %)

5%20%

Required Tenure (Months )

12360

Outstanding Principal

Amount(₹)

₹5 Lakh ₹3Cr.

Current Interest

Rate

5% 20%

Current Outstanding Tenure (Months)

12 360

Revised Principal Amount(₹)

₹5 Lakh₹3Cr.

Illustrative Interest

Rates (In %)

5%20%

Required Tenure (Months )

12360

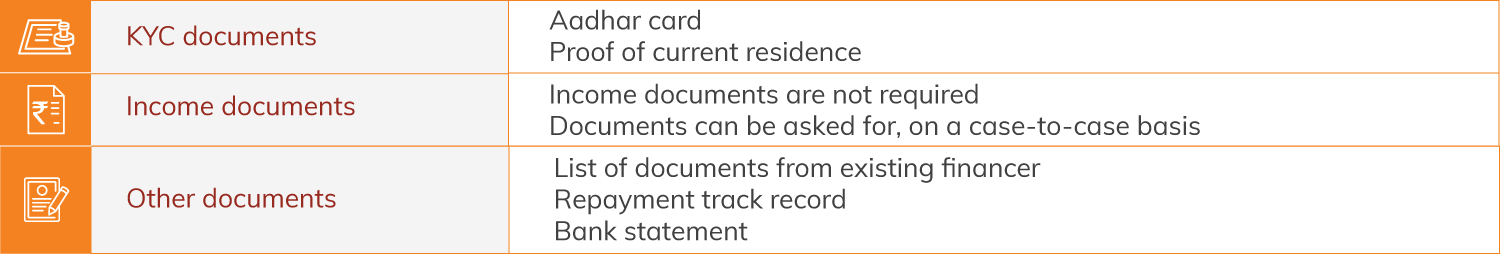

DOCUMENTS

DOCUMENTS

Recommended Products

FAQs

A borrower can transfer a Home Loan multiple times. However,

you can only do a Home Loan balance transfer after the lock-in period ends.

The lock-in period usually ranges from 6-12 months.

You can apply for Home Loan Balance Transfer after paying EMI’s for 12-18 months on your

loan.

The minimum balance transfer amount is above Rs 15 Lakh.

The minimum CIBIL score requirement is 700 for a Salaried, and 750 for Self Employed

applicant.

* On a case to case basis lower seasoning and CIBIL score can also be considered.

* On a case to case basis lower seasoning and CIBIL score can also be considered.

The penalty for Home Loan Balance Transfer ranges between 2-5% as per the Reserve Bank

of India (RBI) mandate.