Welcome to ICICI Bank Home Solutions

Features

Tenure up to 15 years

Balance Transfer available

Recommended Products

FAQs

Commercial Property Loan also known as a Non-Residential Property Loan, is a loan facility offered by ICICI Bank who want to construct, expand, renovate, or buy an office space, to achieve their business goals. Apply for an ICICI Bank Commercial Property Loan, online or offline

Any salaried and self-employed professional is eligible for Commercial Property Loan.

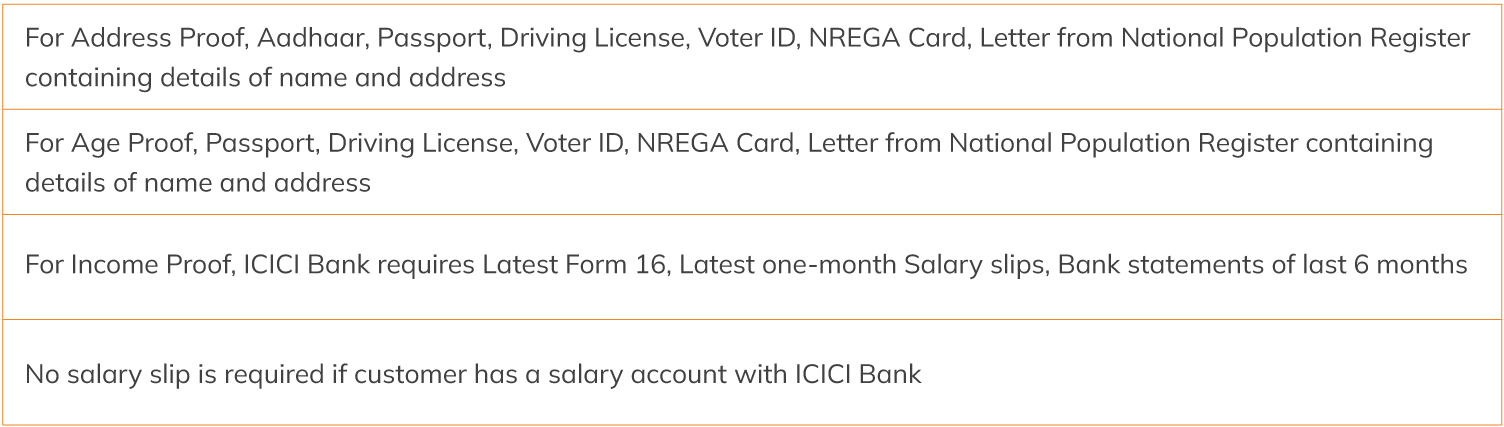

To be eligible for the loan, here are the essential documents that you should produce, along with a duly signed application form:

- Proof of Identity & Residence: You can produce either your Aadhaar Card, PAN Card, Passport, or Driving Licence

- Proof of Income: You need to submit the last 3 years ITR, with computation of Income, last 3 years’ Balance Sheet and Profit & Loss Account Statements attested by a CA and last 6 months’ Current Account Statements

- Property Documents: You need to submit a Copy of Allotment or the Buyer Agreement and Title Deeds