Enhancing Environmental Focus at ICICI Bank

ICICI Bank is committed to conducting its business sustainably and responsibly with the aim of reducing adverse impact of its operations on the environment. Our strategy for environmental and ecological conservation is led by the 4R (Reduce, Reuse, Recycle and Responsible disposal) principles of environmental stewardship. We invest in impactful initiatives to promote the use of environment-friendly practices at our facilities. Our ESG Policy (details available on the website at www.icicibank.com) underscores our commitment to reduce the environmental impact of our premises and operations through sustainable business conduct. ICICI Service Centre at Bandra-Kurla Complex (BKC) in Mumbai, Maharashtra is ‘Net Zero Waste’, ISO 14001:2015 and ISO 45001:2018 certified.

Key Focus Areas

Energy Conservation

Water Conservation

Waste Management

Digitisation of Operations

Health and Safety

Energy Conservation

ICICI Bank takes proactive measures to promote energy conservation at its offices, branches and other buildings. Installation of optimal capacity as well as energy-efficient equipment are key initiatives in this direction. We also focus on effective operation of equipment to maintain optimal levels of energy consumption. Monitoring and reviewing energy consumption metrics periodically helps us to take necessary corrective actions to eliminate the wastage of energy at all our locations. Further, our strategy of replacing air conditioners (ACs) which are at the end of their life-cycle, with more efficient ones, as per availability in the market, helps to maintain uptime as well as consume energy optimally.

Focus on Green Buildings

As part of its energy conservation focus, ICICI Bank invests in the construction and maintenance of sustainable and green workplaces. It is our endeavour to align our buildings to Indian Green Building Council (IGBC) standards and strictly comply with them on a continuous basis. Our efforts led to 29 new sites with more than half a million square feet of area, becoming IGBC-certified in fiscal 2024. Four buildings — two data centres and two newly commissioned offices in Mumbai — received the ‘Platinum’ rating, which is the best possible rating as per IGBC standards. 24 buildings have been rated as ‘Gold’ and one received the ‘Silver’ rating from IGBC. The key metrics of IGBC certification assessment include energy efficiency, use of renewable energy, water conservation, waste management, indoor air quality and sustainable sourcing of material, among others. In fiscal 2024, ICICI Bank engaged external agencies to conduct a three-day awareness session for employees on green building concepts. Further, more than 60 employees appeared for and passed the IGBC AP (Accredited Professional) examination conducted by IGBC, taking the total number of such employees to over 150. ICICI Bank focusses actively on the use of lighting and other equipment, which are energy-efficient, at all its locations. We also deploy suitable equipment, which are required for capacity optimisation. These include effective recording, monitoring, audit and benchmarking of energy usage through IT-enabled devices. We continue to invest in Inverter and Variable Refrigerant Flow (VRF) air conditioning units, Modular Uninterruptible Power Source (UPS) and Energy Star labelled IT machines. This is aiding us in conserving raw materials, enhancing asset utilisation, and reducing wastage over the complete lifecycle of the equipment. These targeted initiatives have helped ICICI Bank to significantly bring down the connected load per square feet – the total energy consumed by all electrical devices connected to an electric supply system. Over the last seven to eight years, we have been able to reduce the connected load per square feet by almost 40%.

ISO 14001:2015 lays down the requirements for an environmental management system.

ISO 45001:2018 outlines an organisation’s commitment to the health and safety of its employees.

IGBC-certified

183

Sites

4.95 million sq. ft.

Area covered by the sites

32%

of the Bank’s total area is certified

Promoting Renewable Energy Usage

We continuously endeavour to increase usage of power from renewable sources at our offices to reduce harmful emissions to protect the environment. In fiscal 2024, we increased the proportion of renewable energy within the total energy consumption from the grid and onsite solar generation to 35% from 9% in fiscal 2023. With this, the Bank’s total green energy usage increased to 75.73 million kilowatt-hours (kWh).

We have opted for sourcing green power directly from electricity distribution companies (DISCOMs) by paying green tariff. Green tariff is a special price offered by a DISCOM to enable large commercial and industrial customers to purchase bundled renewable electricity. In fiscal 2024, we sourced 72.53 million kWh by paying for green tariff.

ICICI Bank’s other important initiatives to lower its carbon footprint include implementation of green practices, investment in advanced technology and regular audit of energy use at its premises.

Employee awareness posters about environment-friendly practices at ICICI Service Centre in BKC, Mumbai

Renewable Energy Consumption in Fiscal 2024 (In million kWh)

3.20

On-site solar generation

72.53

Renewable energy through green tariff

75.73

Total renewable energy consumption

Energy Consumption (in gigajoules)

Reducing Scope 1 and Scope 2 Emissions

ICICI Bank has been following the practice of getting an independent assurance of its Scope 1 and Scope 2 emissions. The year-on-year emissions intensity for total Scope 1 and Scope 2 emissions (in tCO2e per FTE employee) declined from 1.16 tCO2e in fiscal 2023 to 0.90 tCO2e in fiscal 2024. Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organisation. Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.

For fiscal 2024, the Bank’s Scope 1 and Scope 2 emission parameters underwent a reasonable assurance process by an independent external agency, namely, Grant Thornton Bharat LLP. The parameters for reasonable assurance are governed by SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with SEBI circular SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122 dated July 12, 2023. The requirement for independent reasonable assurance is applicable to the top 150 listed entities in India from fiscal 2024. The scope of assurance included the Bank’s operations at its data centres, offices, and business centres in India. As part of the Assurance Statement, which is available on ICICI Bank’s website (www.icicibank.com), Grant Thornton confirmed that it has fulfilled the ethical responsibilities in accordance with the requirements of the International Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants (the ‘IESBA Code’). Further, the firm has applied International Standards on Quality Management (‘ISQM’) 1 - Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements. The reasonable assurance engagement was conducted in accordance with the International Standard on Assurance Engagements (‘ISAE’) 3000 (Revised) – Assurance Engagements other than Audits or Reviews of Historical Financial Information (‘ISAE 3000 (Revised)’) issued by the International Auditing and Assurance Standards Board (‘IAASB’).

During fiscal 2023, DNV Business Assurance India Private Limited had undertaken a limited assurance for the Bank’s Scope 1 and Scope 2 emissions in accordance with its own management standards and compliance policies for quality control established as per ISO IEC 17021:2015 - Conformity Assessment Requirements. It confirmed that ICICI Bank prepared its GHG emissions data based on the principles of ISO 14064-1, World Resource Institute (WRI) GHG Protocol, Emission factors from the Intergovernmental Panel on Climate Change’s (IPCC) Fourth Assessment Report, GWP values published by EPA, Central Electricity Authority, Govt. of India.

The Bank will continue to report Scope 1 and Scope 2 emissions and emissions intensity.

GHG Emission metrics:

Scope 1 emissions include CO2 emissions from the combustion of fuel in diesel-generating sets and company-owned vehicles, emissions due to loss of refrigerants and emissions due to CO2 based fire extinguishers. The emissions from diesel-generating sets was estimated based on expenses on procurement of diesel and applying the lowest diesel price in the country to estimate the quantity of diesel consumed. The emissions from fire extinguishers and owned vehicles was based on actual consumption.

Scope 2 emissions are due to electricity purchased from the grid. The estimation was based on actual consumption of electricity, and using the grid emission factor published by the Central Electricity Authority, India.

Scope 3 emissions for capital goods have been estimated in accordance with the GHG Protocol. For the purpose, EXIOBASE 2019 emission factors have been considered. Scope 3 emissions for business-related travel by employees through modes like aircraft, train, buses, and cars have been estimated. Emissions from hotel stay during such travel is not included. For the purpose, DEFRA (Department for Environment, Food and Rural Affairs) 2023 emission factors have been considered. Scope 3 emissions for employee commuting have been estimated based on a survey conducted. The Average-data method has been used for extrapolating to all employees. For this purpose, latest India GHG Programme emission factors have been considered.

tCO2e - Tonnes of carbon dioxide equivalent is a standard unit for counting GHG emissions.

One Full Time Equivalent (FTE) employee - One full time employee working on a full time schedule over the year.

Water Conservation

Conservation of water is a crucial part of sustainability for ICICI Bank. We have adopted several measures for effective water management in our operations. These include recycling and reusing water and harvesting of rain water.

The water recycling facilities at ICICI Service Centre at BKC in Mumbai and Gachibowli in Hyderabad are contributing significantly to our water conservation efforts. The facilities at these sites have a total capacity of 80 Kilolitre per day (KLD) and 1,100 KLD, respectively. We use the recycled water for landscaping as well as in cooling tower of the chillers.

We continue to replace old plumbing fixtures with new water-efficient ones. Our new offices and branches are pre-installed with water-efficient fixtures which are compliant with the Indian Green Building Council (IGBC) guidelines.

The Bank monitored usage of water through meters installed at 32 locations across the country, housing about 32% of the total employee strength. The average per capita water consumption at these locations was 32 litres per day, lower than the National Building Code (NBC) benchmark of 45 litres.

We continue using the Atmospheric Water Generator (AWG) at our regional office in Gachibowli, Hyderabad. This was installed in March 2023 as a significant step forward in our journey towards water management. The AWG has a capacity of producing 500 litres of clean potable water per day from atmospheric moisture, without emitting carbon. The water produced by AWG also helped in eliminating the need to purchase packaged water.

The Bank’s regional office in Gachibowli, Hyderabad meets its demand by producing 500 litres of clean potable water everyday from atmospheric moisture.

Waste Management

ICICI Bank’s commitment to sustainability extends to efficient management of all significant waste generated at its facilities. We have in place a robust process for handling waste, including composting organic waste in large premises. We also established a process to manage e-waste responsibly by handing over the waste to authorised agencies for recycling in compliance with various national and local regulations on waste management.

Case Study

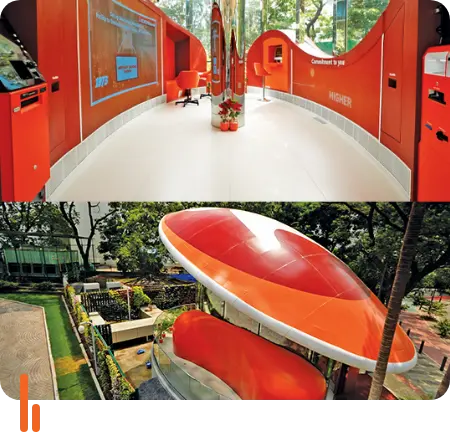

Service Centre at BKC Receives IGBC ‘Net Zero Waste’ Certification

ICICI Bank introduced several measures to enable waste reduction and recycling at its Service Centre at BKC in Mumbai, Maharashtra. These include appropriate measures for waste segregation at the site for suitable treatment according to the type of waste. The Bank also advocated the use of environment-friendly consumables at the premises with the aim of promoting sustainable practices.

These initiatives led to the Service Centre getting a rating of ‘Net Zero Waste’ in the category of ‘Net Zero Waste to Landfill (Operations)’ by IGBC in fiscal 2024. The rating implies that ‘zero’ waste went to the landfill from the site, validating ICICI Bank’s efforts towards effective waste management. This was possible due to the Bank’s multi-pronged approach pivoted around nature-centric design, reducing debris during construction, responsibly handling waste from operations, reusing the waste as much as possible and recycling the remaining waste.

ICICI Service Centre at BKC in Mumbai, Maharashtra

Waste Segregation

We have streamlined the process for waste segregation at the Service Centre. A wet waste composter has been installed to treat wet waste generated at the facility. There is an end-to-end resource chain contract in place for efficient recycling and re-using of the dry waste by ICICI Bank.

Waste Reduction

The key initiatives implemented at the Service Centre to reduce waste included significant curbs in the usage of paper cups, tissue paper and packaged water bottles. Further, bamboo-based tissue paper has been introduced in the cafeterias. To avoid food wastage, cafeteria contractors have been asked to take back the extra food brought to the premises, leading to optimisation of the quantity of food being served on site every day. We have also initiated the use of environment-friendly HK (green certified) consumables at the facility.

Electronic waste (e-waste) has been successfully reduced with the introduction of re-filling of printer cartridges to extend their lifespan.

The use of biodegradable and eco-friendly A4 paper for printing made from wheat straw further contributed to minimising environmentally damaging waste at the premises.

The Service Centre generated total waste of 145,350 kg between March 2023 and February 2024. Of this, only 550 kg waste was rejected and sent to landfills while 144,800 kg, amounting to 99.62% of total waste, was recycled and reused at the premises. The recycled/reused waste included 66,160 kg wet waste, 9,390 kg horticulture waste and 69,250 kg dry waste.

550 kg

Rejected waste sent to landfills

144,800 kg

Waste recycled and reused

145,350 kg

Total quantity of waste generated

(March 2023 - February 2024)

Going Green by Digitising Operations

ICICI Bank has been on a journey to minimise the use of paper by digitising its operations. The Bank invests in providing digital solutions to customers and encourages their adoption by all its stakeholders, thereby reducing usage of paper. We also promote digitisation of internal work and in our operations. These efforts are aimed at saving trees as well as reducing the CO2 emissions.

Since fiscal 2023, the Bank has been encouraging execution of legal documents with its service providers through an automated system. This end-to-end digital initiative includes payment of stamp duty and enables Aadhaar based e-signing thereby eliminating use of paper. It also makes the documents easy to store and access them at the click of a button.

The Bank has also digitised the transaction banking journey for clients, enabling them to send their transaction request letters over email with their digital signature certificate affixed on the documents. This has resulted in ease of doing business from one’s office without the need to visit a branch.

During fiscal 2024, we saved about 27.5 million A4-sized paper which is over 120 tonnes, through ongoing and new digital initiatives. This is equivalent to saving 2,044 trees resulting in abatement of emissions of 217.5 tCO2e.

ICICI Bank’s new digital banking space ‘Digiverse’ powered by green energy at BKC in Mumbai, Maharashtra

We have gradually digitised most of our processes thereby limiting paper consumption. However, there are some types of forms and transaction statements where we need to use paper. For this requirement, we are migrating to use of recycled paper, albeit at additional cost to the Bank. In fiscal 2024, we shifted to using Forest Stewardship Council (FSC) recycled paper for our pre-print forms being used at business centres and by customers. Around 37% of pre-print forms used during the year were recycled and FSC-certified. Additionally, 72% of the A4 paper used at the Bank was BIS ECO marked.

In another paper-saving initiative, we stopped the use of paper cups and tissue paper at our facilities, including at the pantry and cafeteria. We encourage employees to use ceramic mugs for their beverages. The initiatives led to a reduction of usage of paper cups and tissue papers during fiscal 2024. It also helped in the avoidance of dry waste.

27.5 million

A-4 sized paper saved in fiscal 2024

As per estimates, 17 trees can be saved from one tonne of A-4 sized paper.

As per Indian Pulp & Paper Technical Association (IPPTA), the average emission intensity for the Indian Pulp and Paper industry is 1.58 mtCO2e/MT paper.

Health and Safety Certification

In March 2024, ICICI Bank was certified with ISO 45001:2018, Occupational Health and Safety Management Systems at 18 large offices with cumulative occupancy of more than 30,000 employees, over one-fifth of total workforce. These include service centres, phone banking centre, data centres and regional offices.

This is an international standard for health and safety at work, developed by national and international standards committees independent of government. The certification, which is valid for three years, makes it significant for the Bank to systematically assess hazards and implement risk control measures. This will pave the way for minimising illnesses, accidents, and injuries at workplaces. These initiatives demonstrate the Bank’s commitment towards employee safety and well-being.

As a part of employee engagement in Health & Safety areas, we have covered 100% of our Business Centres for emergency evacuation drill. All new employees undergo training on Health & Safety aspects during the induction training programmes.

Previous Topic