- 18

- 60

- ₹ 500

- ₹ 500000

- 40%

- 100%

- 60

- 75

- 5%

- 15%

- 5%

- 15%

42

₹78,088

₹3,90,44,162

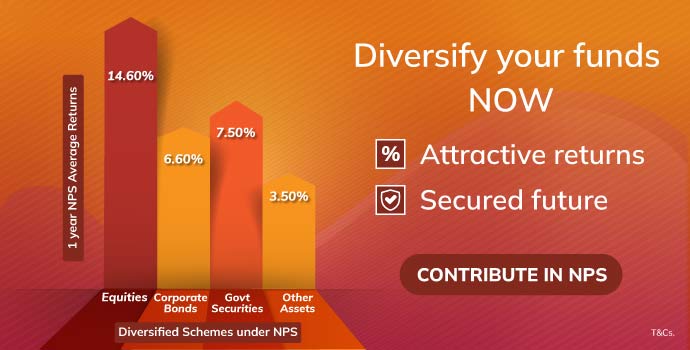

Why Invest in National Pension System (NPS)?

How does National Pension System (NPS) work?

Begin your National Pension System (NPS) investment as early as age 18 to benefit from great,

steady returns by the time you reach 60.

Who Should Invest in the National Pension System (NPS)?

The National Pension System Scheme is ideal for those looking to plan their retirement early with a low-risk approach. By regularly contributing to the NPS scheme, you ensure a steady income and financial security in retirement.

If you're salaried and want to maximise tax benefits under Section 80C, the NPS Pension is a valuable addition to your investment strategy. With its focus on long-term growth and stable returns, the NPS offers peace of mind for your financial future. For more details, explore the NPS pension scheme details and start your national pension system account online.

Types of NPS Accounts & Contributions

The National Pension System (NPS) offers two types of accounts: Tier 1 (mandatory) and Tier 2 (voluntary). A Tier II account requires a Tier I account and differs in tax benefits and withdrawal rules.

- Tier 1 Account: Government employees contribute 10% of their base pay plus DA, while others invest a minimum of Rs. 500 initially and Rs. 6,000 annually.

- Tier 2 Account: Does not offer tax breaks or matching contributions but allows flexible withdrawals anytime. Opening a Tier II account requires an initial payment of Rs. 1,000 and subsequent top-ups of Rs. 250, maintaining a yearly balance over Rs. 2,000.

National Pension System Benefits and Its Features

The National Pension System (NPS) offers a range of benefits and features that make it a top choice for retirement planning:

- Regulated: Managed under the PFRDA (Pension Fund Regulatory and Development Authority), the NPS is governed by transparent guidelines and regular monitoring by the NPS Trust.

- Voluntary Participation: Available or Open to all Indian residents, citizens between 18 to 70, the NPS scheme provides flexibility in investment amounts and timing according to their financial goals and risk tolerance.

- Flexibility: Choose or change your Point of Presence (POP), investment pattern, and fund manager to optimise returns.

- Cost-effective: Offering one of the lowest fees among other investment options, the NPS ensures economical long-term savings.

- Portability: Your National Pension System account and PRAN remain unchanged, even with job changes or relocations.

- Superannuation Fund Transfer: Allows tax-free transfer of superannuation funds to your NPS pension system account, subject to approvals.

- Tax Advantages: Triple tax benefits make the NPS a smart choice for reducing taxable income. NPS Scheme helps salaried employees individuals and self-employed individuals reduce their taxable income significantly;

- Section 80CCD (1): Claim up to 10% of basic salary + dearness allowance for employees; and up to 20% of gross annual income for self-employed people, both subject to a maximum limit of Rs. 1,50,000 under section 80C.

- Section 80CCD (1B): Enjoy additional tax deductions worth up to Rs. 50,000 beyond the limits set by section 80C.

How to Open

National Pension System (NPS)?

- 01. Login to ICICI Bank iMobile pp> Invest and Insure> Instant NPS

- 02. Fill all the required details (Investment, Personal, Nominee details & Upload your photo and signature)

- 03. Confirm all your details and then submit.

- 01. Login to ICICI Bank Net Banking> Investments and Insurance> National Pension System

- 02. Fill all the required details (Investment, Personal, Nominee details & Upload your photo and signature)

- 03. Confirm all your details and then submit.

How to make Investment in National Pension System (NPS)?

- Login to ICICI Bank Net Banking> Investments and Insurance> National Pension System

- Click on Make Contribution & fill all the mandatory details.

- Preview the details filled and click on ‘Submit’ to register the biller and fund the NPS Account.

Please Note: First contribution towards National Pension System (NPS) needs to be made online within 45 days of PRAN generation or the Account will be frozen.

National Pension System (NPS) FAQs

What are the key features of NPS?

1. Regulated - NPS is regulated by PFRDA, which is established through an Act of Parliament (PFRDA Act 2013)

2. Pension for all - can be voluntarily subscribed by any Indian citizen (resident/non-resident/overseas citizen)

3. Low cost – NPS is one of the low cost pension schemes in the world

4. Flexible - Subscribers have various options to choose from - Point of Presence (PoP), Central Recordkeeping Agency (CRA), Pension Fund and Asset Allocation, etc. The choices exercised can be changed subsequently

5. Portable – NPS Account can be transferred across employment, location(s)/geography(ies)

6. Tax efficient – Tax incentives are available to the subscribers under the Income Tax Act 1961.

7. Optimum returns – Market linked returns based on the investment choice made by the subscriber

8. Transparent – Subscribers can access their NPS Accounts online 24X7 and public disclosures are mandated.

What is the eligibility criteria for NPS?

To qualify for the National Pension Scheme, the following criteria must be met:

- Indian Citizens: Both resident and non-resident Indians, as well as Overseas Citizens of India (OCI), are eligible to open an NPS account.

- Age: Applicants must be between 18 and 70 years old.

- KYC Compliance: Must adhere to Know Your Customer (KYC) norms.

- Exclusions: Hindu Undivided Families (HUFs) and Persons of Indian Origin (PIO) are not eligible for the NPS scheme.

- Individual Account: The NPS is an individual pension account and cannot be opened on behalf of someone else. The applicant must be legally competent to execute a contract as per the Indian Contract Act.

What is the All Citizen model?

You are eligible to open your NPS account if you are a citizen of India whether resident, non-resident or an Overseas Citizen of India , if you fulfil the following conditions: You should be between 18 and 70 years of age as on the date of submission of your application to the PoP / PoP-SP, or online through e-NPS

National Pension System (NPS) Videos