- Monthly benefits for superannuation/ retirement, disability, survivor, widow(er), children.

- A member who is permanently and totally disabled during the employment shall be entitled to a minimum pension

- Amount of pension based on average salary during the preceding 12 months from the date of exit and total years of employment

- In case of the death of subscriber monthly pension would continue to dependents

- Widower's pension:- Monthly widow pension shall be payable up to the date of death of the widow or remarriage whichever is earlier

- Children's pension:- If there are any surviving children of the deceased member, Monthly children pension shall be payable until the child attains the age of 25 years

- Monthly benefits for superannuation/ retirement, disability, survivor, widow(er), children.

- A member who is permanently and totally disabled during the employment shall be entitled to a minimum pension

- Amount of pension based on average salary during the preceding 12 months from the date of exit and total years of employment

- In case of the death of subscriber monthly pension would continue to dependents

- Widower's pension:- Monthly widow pension shall be payable up to the date of death of the widow or remarriage whichever is earlier

- Children's pension:- If there are any surviving children of the deceased member, Monthly children pension shall be payable until the child attains the age of 25 years

- New Savings Account Form along with KYC documents to open a new account

- Identity proof, Address proof, 1 photographs (passport size) and for

New Customer:

- Pensioner may approach to any branch to open pension account.

- Branches should follow the same documentation as general account opening process.

- In terms of documents eligibility, any letter/ document (preferably from his company) stating that the said customer is approaching retirement or has retired from the company.

- In case, family pension account Branches should adhere the above mentioned process for family members.

- In case, any minor family members, then Branches should adhere minor account opening process.

Existing customer:

- In case the pensioner is already holding an account with us and intends to receive pension through our Bank, he/she may provide bank account details to the Pension Authority on or before convert his/her existing account into pension account.

- Whenever customer approach to the branch for converting his/her existing account into a pension account, branch needs to collect the status change request along with any letter/ document (preferably from the pension authority) stating that the said customer is approaching retirement or has retired from the company.

Age – 18 - 60 Years

OCCUPATION - ANYONE WORKING IN THE ORGANISED SECTOR

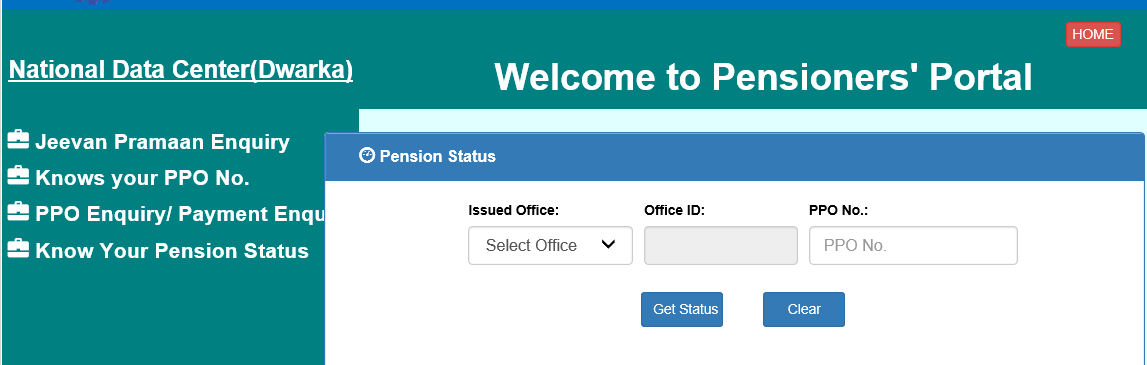

EPFO FAQs