Stakeholder Engagement and Materiality Assessment

The Bank is committed to inclusion, economic development and sustainable growth of all its stakeholders. As part of this, we continuously strive to enhance our relationship with external and internal stakeholders to ensure responsible business conduct. Such engagement is also essential for the integration of our strategies and growth plans with the expectation of stakeholders and changing behaviour of customers. We believe that regular interaction with stakeholders keeps us apprised about their evolving expectations as well as the opportunities for value creation in a rapidly changing macro environment. At the same time, it helps us in identifying the risks of our operations and their impact.

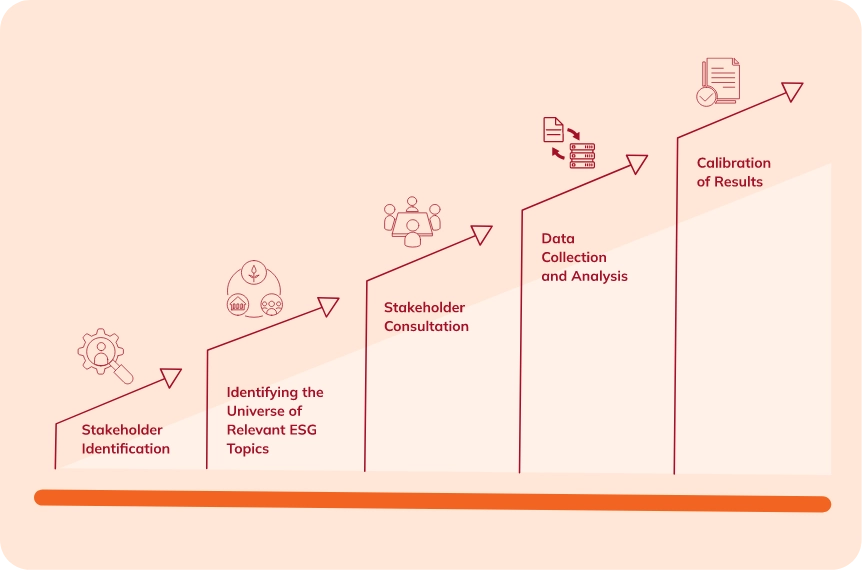

Recognising the importance of understanding stakeholder expectations, the Bank conducted a materiality assessment in fiscal 2022. Some of these issues are also aligned with the Bank’s priority areas to ensure sustainable growth in business and creating a positive impact on the environment and society.

| Material Issues | Management Approach on Top Material Issues | Refer Page Number |

| Compliance with Regulations and Other Laws | We strive to be a responsible organisation with continued efforts towards embedding a strong risk and compliance culture. The Bank remains vigilant about the evolving regulatory landscape while ensuring that operations follow standards established by regulatory bodies. The Bank's control functions ensure that businesses and operations are aligned with the best practices. | 55-58 of this report |

| Digital Innovation/ Transformation | We aspire to create digital innovations with rich features and functionalities for customers. The Bank’s digital platforms have transformed to provide seamless digital journeys. The open architecture platforms have enabled us to extend banking services to non-ICICI Bank account holders. | 19-25 of ICICI Bank Annual Report 2023-24 |

| Data Privacy and Cybersecurity | Dealing with cyber risks forms an integral part of the Bank’s enterprise risk management framework. The Bank is committed to working towards aligning itself with the changing landscape and has a dedicated team for cyber/information risk management. | 69-71 of this report |

| Corporate Governance and Business Ethics | We have established effective policies and frameworks that encourage employees to act in accordance with the highest professional and ethical standards. Regular communication and training of employees is also undertaken. | 50-73 of this report |

| Transparency and Disclosures | We recognise the criticality of transparency and disclosures, whether about the products we offer, our engagement with stakeholders, or our contribution to society. The Bank aims to maintain robust governance and ethical and transparent relationships with all stakeholders. The Bank also aims to ensure fair and balanced disclosures of its financial performance, with additional relevant disclosures made as and when required. | 74-82 of this report |

| Improving Customer Experience and Satisfaction | Our Customer 360° approach and digital capabilities have strengthened the Bank’s value proposition for customers. Actively listening to our customers has helped improve the Bank’s offerings to customers and reflects in the advocacy scores of the Bank. | 66-68 of this report |

| Customer Fairness and Right-selling | The Bank’s philosophy of ‘Fair to Customer, Fair to Bank’ emphasises the need to deliver fair value to customers, including selling products and offering services which meet societal needs and are in the interest of customers. | 32-35 of ICICI Bank Annual Report 2023-24 |

| Financial Performance | Our strategic focus is on strengthening the profit before tax excluding treasury within the guardrails of risk and compliance. We are investing in areas that are critical for improving productivity and operational efficiency. | 4-5 of ICICI Bank Annual Report 2023-24 |

| Stability of Risk Management and Risk Outcomes | The Bank continuously reviews the operating environment and closely monitors the significant risks that could impact business. The Bank's Enterprise Risk Management and Risk Appetite Framework articulate the risk appetite, and drill down the same into a limit framework for various risk categories under which various business lines operate. | 36-43 of ICICI Bank Annual Report 2023-24 |

| Leadership Development and Succession Planning | The Bank has adopted the principle of ‘One Bank, One Team’, and has accordingly structured its human resource management practices, including key performance indicators, providing operating flexibility and accountability to business centres and a shift from grades to functional designations at senior levels. These are aimed at greater agility and synergy across the organisation, and are supporting improved business performance and financial results. | 52-59 of ICICI Bank Annual Report 2023-24 |

| Promoting Environment Positive Projects | The Bank has been supporting capacity creation in environmentfriendly areas, such as renewable energy, use of electric vehicles, and development of green buildings, with an appropriate risk-return assessment. There is also a focus on promoting biodiversity and protecting our ecology through the Bank’s CSR initiatives. | 14-32 of this report |

| Carbon Emissions and Resource Efficiency in the Bank’s Own Operations | The Bank is committed to minimising the environmental impact of its operations and facilities. It is working towards meeting this objective by adopting the best practices and certifications for green standards in the Bank’s operations. The Bank has set itself a target to become carbon neutral in Scope 1 and Scope 2 emissions by fiscal 2032. | 14-22 of this report |

| Exposure of the Bank to Climate-Related Risks in its Loan Portfolio | The Bank has established adequate policies and frameworks for evaluating climate-related risks in the lending book. At the same time, assessment of the portfolio to climate risks has been included as part of stress testing as well as the capital planning exercise. | 67 of ICICI Bank Annual Report 2023-24 61-65 of this report |

Previous Topic

Next Topic

Nuturing Environmental Sustainability