Addressing Needs of Rural Ecosystems

The Bank has reached out to over 3 lakh farmers, engaged in animal husbandry, across 5,000 villages since inception. The Bank has also tied-up with more than 2,000 Village Level Cooperative Societies (VLCS) comprising about 2 lakh active members.

The rural strategy has focussed on serving rural value chains by leveraging opportunities in different ecosystems within the rural markets. At the heart of this approach were four main ecosystems identified in the rural market which included the agriculture value chain, corporates, the government and the microfinance business. The Bank has developed different products and services taking into consideration the needs of every participant and leveraging banking opportunities across all business activities.

The agriculture ecosystem includes participants like seed producers, agri-input dealers, farmers, warehouses, agri-equipment dealers, commodity traders and millers. We have designed different products for each player to meet their specific financial needs so that the entire agri-value chain is well financed. Farmer financing is the primary focus within this ecosystem with products like working capital loans through the Kisan Credit Card (KCC) and gold loans, and term loans for farm equipment, dairy livestock purchase and farm development.

In fiscal 2020, the Bank started funding electronic negotiable warehousing receipts (eNWR) to provide better credit opportunities to farmers against their post-harvest produce. Lending against eNWR is a quick, hassle-free and convenient solution that we offer to the borrowers. Farmers can use eNWR to get loans against underlying commodities. It protects them from volatility and provides opportunities to realise better prices for their produce. The Warehousing Development and Regulatory Authority has a well-defined mechanism to empanel eNWR issuing warehouses.

The ecosystem of rural corporates includes manufacturing and processing units, employees, dealers and suppliers who are present across rural India. The government ecosystem comprises of government offices, employees and institutions that implement various government schemes. We closely engage with government at all levels to develop products and processes, including technology solutions to serve their requirements for rural markets.

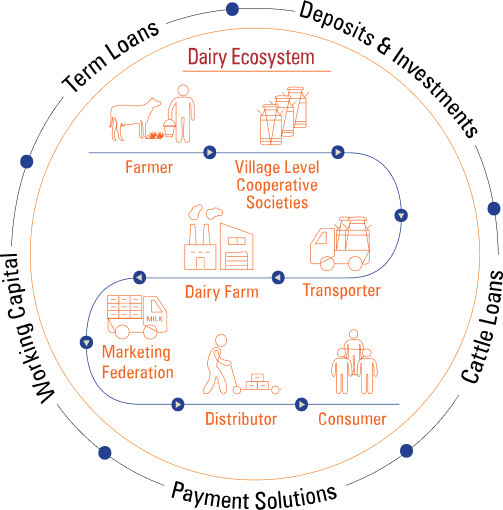

Catalysing the Dairy Value Chain

As mentioned earlier, we are continuously identifying large value chains in rural India and adopting a 360-degree approach to meet the end-to-end financial requirements of the customers. This approach is best exemplified by our financial solutions that catalyse all parts of the dairy value chain. We provide credit solutions including term loans and working capital loans to dairy unions, customise payment solutions and promote investments in animal husbandry. These solutions are complemented by imparting skill training in dairy farming and vermicomposting through ICICI Foundation Rural Livelihood Programme.