Features of ‘EMI on Call’ facility

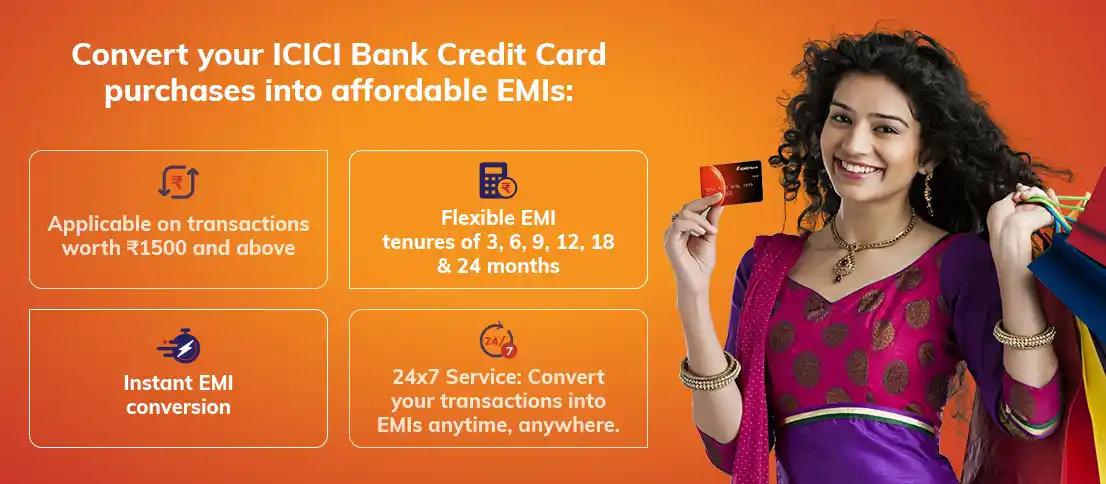

- Transactions of ₹ 1,500 and more can be converted into EMIs through the iMobile Pay app, Internet Banking, WhatsApp Banking and ICICI Bank Customer Care under the ‘EMI On Call’ facility.

- Transactions of ₹3,000 and more can be converted into EMIs, through the 3D Secure page/OTP page under the ‘EMI On Call’ facility.

- Convert your transactions into EMIs and pay interest at the rate of 1.5% per month on a monthly reducing balance basis and enjoy a lower rate of interest than the revolving rate you would normally pay on your Credit Card.

- A one-time Processing Fee of 2% of the transaction value is charged at the time of EMI conversion.

- Gold, jewellery, fuel purchases, gambling and cash transactions won’t be eligible for EMIs.

- Transactions older than 30 days cannot be converted into EMIs.

How to avail the ‘EMI on Call’ facility?

Through digital modes:

iMobile Pay app:

- Step 1: Log in to ICICI Bank iMobile app

- Step 2: Click on ‘Cards & Forex’ and select your Credit Card

- Step 3: Click on the ‘Manage Card’ section

- Step 4: Select ‘Convert to EMI’ from ‘More Options’

- Step 5: Select the Credit Card Number from the dropdown & select the transaction

- Step 6: Choose a convenient tenure for the EMIs and click on ‘Submit’.

WhatsApp Banking

Send a message with the keyword ‘Hi’ on (+91 86400 86400) through WhatsApp

Click All Services > Credit Card Services > Convert Txn to EMI > Select Credit Card > Select Transaction for EMI Conversion > Select EMI Plan/ Tenure > Click on ‘Confirm’ > Enter the OTP sent to your Registered Mobile No. > Enter last 4-digits of PAN.

Internet Banking:

- Step 1: Log in to ICICI Bank Internet Banking

- Step 2 : Go to Credit Cards under the ‘Cards & Loans’ section and click on ‘Convert to EMI’.

- Step 3 : Choose the card and click on ‘Submit’

- Step 4 : Select the transactions, click on calculate EMI, select EMI tenure and acknowledge on T & C and click on ‘Convert to EMI’.

Through 3D Secure/ OTP Page:

- Credit Cardholders can opt for converting an online transaction into EMI, with plans for 6, 12 and 24 months on the 3D Secure/ OTP page

- Select ‘Tenure’, read & click on the ‘T&Cs’ checkbox, enter the OTP and click on the ‘Submit’ button to opt for EMI conversion

- EMI will be converted within <4> working days.

Through voice modes:

Customer Care:

- Call our Customer Care on 1800 1080 and get the eligible transaction converted to EMI.

Missed Call/ Transaction Alert SMS:

- Give a missed call on 9537667667 from your Registered Mobile Number

- On receiving your request through a missed call, our representative will call you within two working days and explain the details related to EMI charges before the EMI Conversion.

A retail transaction of ₹1,500 and above can be converted to EMI On Call. Transactions older than 30 days cannot be converted to EMI On Call. Certain categories of transactions like cash, gambling, fuel transactions are not eligible for the EMI On Call facility. In particular, jewellery and gold transactions cannot be converted into EMIs as per the guidelines issued by the Reserve Bank of India from time to time.

This facility offers EMI payments with an interest rate of 1.5% per month on a monthly reducing balance basis. A one-time Processing Fee of 2% of the transaction value is charged at the time of EMI conversion. A foreclosure fee of 3% and advance EMI interest and GST as applicable shall be chargeable if you opt for EMI pre-closure.

Customer need not pay for the EMIs separately. EMIs are billed as a part of the Credit Card statement that is generated every month as per the billing cycle.

You can deduct the converted amount from the statement bill and pay the differential amount.

Converting to EMI does not negatively impact your credit score as long as you make timely EMI payments. However, late payments can affect your credit score.

RECOMMENDED PRODUCTS FOR YOU

Pre-Approved Credit Card

Instantly approved Credit Card offer based on pre-screened creditworthiness without a formal application.

Personal Loan On Credit Card

Get access to an Loan on credit card facility allowing cardholders to borrow cash from their credit limit with flexible repayment terms.

EMI On Call

Take advantage of this facility and convert your purchases into easy EMIs over the phone for convenient repayment.