- ₹1

- ₹1 Cr

- 1 Year

- 50 Years

- 1%

- 100%

Please note, these calculators are designed to provide you an approximate amount. Consult an advisor/tax consultant prior to investing.

Total amount invested

₹10,000

Returns

₹10,000

What is an SIP Calculator?

An SIP Calculator is an online tool that allows you to estimate the returns on your Mutual Fund investments, usually before you invest in them through one or more Systematic Investment Plans. It is simply a roadmap to help an investor seamlessly integrate SIP investments in his/her portfolio. However, the actual returns offered by a Mutual Fund scheme varies depending on various factors.

Benefits of the SIP Calculator

- Easy to use

SIP calculator is very user friendly. It provides an indicative value of your investments instantaneously and allows you to consider different scenarios by changing the input variables such as monthly SIP amount, expected rate of return, tenure, etc.

- Helps in deciding the SIP Amount

SIP calculator helps you to make the decision about how much money you need to invest in Mutual Funds via SIP to earn the desired returns.

- User-Oriented

You can easily estimate your investment needs with our user-friendly SIP Calculator. It is suitable for anyone, is completely free of cost and can be used any number of times.

How does the SIP calculator work

Step 1: Choose your target or investment amount

Step 2: Enter your investment or SIP amount

Step 3: Select the SIP duration

Step 4: Enter the expected rate of return.

After entering all the values, click ‘Calculate’. The calculator will instantly display the estimated maturity value or the required investment amount to achieve your goal.

Explore Our SIP Videos

SIP Calculator FAQs

Can an SIP calculator guarantee accurate future returns?

No, an SIP calculator cannot guarantee accurate future returns. It can provide estimates based on historical data and assumptions, but market conditions are unpredictable and investments carry risks. Actual returns may vary significantly from the calculator's projections, making it essential to use SIP calculators as a rough planning tool rather than a guarantee of future performance.

What is the importance of the expected rate of return in an SIP return calculator?

The expected rate of return in an SIP calculator is crucial because it helps investors estimate their future wealth growth. A higher expected return can lead to a larger corpus, while a lower return may necessitate higher contributions. Accurate rate predictions are vital for setting realistic investment goals and making informed financial decisions.

How much can I invest in an SIP?

You can invest any amount in a Systematic Investment Plan (SIP), starting from as low as Rs 500 per month. There is no upper limit, providing flexibility to invest according to your financial goals and capabilities. Whether you are a conservative or an experienced investor, SIPs offer an accessible and customisable investment option.

SIP Related Blogs

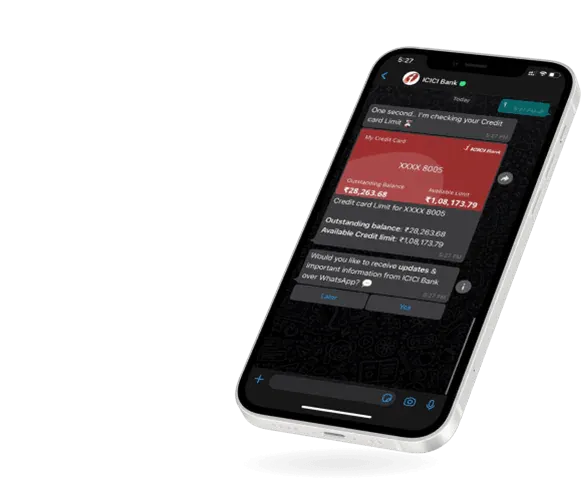

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

WhatsApp Banking

Disclaimer

Mutual fund investments are subject to market risks, please read all scheme related documents carefully. ICICI Bank Limited shall not be liable or responsible for any loss or shortfall resulting from the operations of the Mutual Fund scheme. Terms and conditions of ICICI Bank and third parties apply.