Offers especially for you!

-

-

Continue to Bank on us wherever you go

Continue/ Convert your Account to Salary Account

Salary Account

Click here

Home Loan

Click here

Personal Loan

Click here

Auto Loan

Click here

- Digital Platform for enabling Higher education journey

- A comprehensive 360 degree coverage for all your Higher Educational needs

- Specially curated solutions for Top Study Destinations such as Canada, US, UK and Germany

- Value added services on test prep, admission counselling, travel and accommodation

- Global Accounts - Digitally open local bank accounts in Canada and UK from India

- NRI Accounts - Once you attain NRI status, you can convert your Resident Account to a Non-Resident Ordinary (NRO) Account and then open a Non-Resident External (NRE) Account to avail taxation & repatriability benefits

- Remittances – Secure international money transfer with preferential exchange rates for employees

Forex Prepaid Card:

Browse through our range of forex prepaid cards and pick the perfect travel companion for all your international trips.

Money2World

A convenient online facility for residents as well as non residents for sending money online from India to overseas

- No minimum balance required on Family Plus Accounts

- Complimentary Debit Card with high transaction limits

- Complimentary Personal Accident Insurance & Air Accident Insurance same as primary account

- Access to payment solutions through iMobile Pay

- Discount on 1st Year Locker Rentals (based on availability)

(Visit your nearest ICICI Bank Branch to enrol for Family Plus Account)

- Extend banking benefits to your family with ICICI Bank Family 360 programme

- Discover your ideal retirement corpus & identify any gap to ensure your financial future

- Premium Cards to suit your lifestyle desires

- Save more with customised HL solution options like flexible loan instalment plan, money saver HL

- Comprehensive health policy HS360 with 30 days waiting period for PED

- Investment solutions to grow your wealth through 3-in-1 ICICI bank demat account, FDs, SGBs, NPS,PPF

Power Pay Account

- No minimum balance required in your Salary Account

- Complimentary Debit Card with unlimited free access to all the Banks ATMs network

- Complimentary Air Insurance and Personal Accident Insurance with no clause on Debit Card spends/ activation

- 3-in-1 Demat and Trading Account with no account opening charges and waiver on AMC for the first year

- Extend benefits of the Salary Account to your family members.

Family 360° Banking

- Extend benefits of the Salary Account to your family members

- Processing fee waiver to discounted processing fee.

- Complimentary Air Insurance and Personal Accident Insurance with no clause on Debit Card spends/ activation

- Get a complimentary Debit Card with lounge access on linking family accounts

- 3-in-1 Demat and Trading Account with no account opening charges and waiver on AMC for the first year

- A dedicated relationship manager for salary greater than Rupees 1 lakh per month

Wealth Management Account

- Dedicated Relationship Manager and Service Relationship Manager

- Complimentary International World Debit card with Lounge access

- Preferential rate and processing fee discount on loans and forex

- Complimentary Amazon Pay and Sapphiro Credit Card basis eligibility

Fixed Deposit

- Simple investment product, which offers safety, liquidity, flexibility and assured returns.

- Multiple FD variants available, which caters wide range of customers

- Available on multiple Channels like iMobile, internet banking, iBizz, ATM, etc.

- FD can be opened with amount as low as ₹10,000 and FD tenure starting from just 7 days

- Get loan up to 90% of your FD amount.

Recurring Deposit

- Recurring deposit (RD) help you save up consistently and conveniently from today, so you can reap benefits tomorrow.

- With ICICI bank RD facility, you can keep a track of your recurring transactions to plan and track your long-term invest goals.

- You have an option to avail a loan against your RD account.

iWish

- A goal based savings product offered to ICICI Bank savings account users

- Create goals and save for your specific wishes.

- iWish offers flexibility, by allowing to deposit any amount anytime, gives assured returns.

- A goal in iWish can be made ranging from ₹ 5000 - ₹ 500000 with tenure ranging from 6 months to 5 years

Loan against Securities

- Avoid liquidation of investments, avail Instant liquidity at your disposal through overdraft facility against securities’

- No EMI. Only interest servicing on a monthly basis subject to limit utilization as it is an Overdraft facility

- No pre-payment charges

ICICI Bank Coral Credit Card

- 4 complimentary Domestic Airport Access in a year

- 25% off on BookMyShow and INOX (2 times per month)

- 1% fuel surcharge waiver on all transactions below ₹4,000 at HPCL fuel stations

- 4 complimentary Domestic Railway Lounge access in a year

- Upto 10,000 ICICI Bank Reward Points per year

ICICI Bank Rubyx Credit Card

- Welcome vouchers worth over ₹ 5000

- 25% off up to ₹ 150 on BookMyShow and INOX (2 times per month)

- 2 complimentary domestic airport & railway lounge visit per quarter

- 2 Complimentary rounds of golf (on spend of every ₹ 50,000 in previous month)

- Air accident insurance cover of up to ₹ 1 Crore

ICICI Bank Emeralde Credit Card

- Unlimited complimentary international & domestic lounge access

- Unlimited complimentary spa access at airports in India

- No cancellation charges on any domestic flight, hotel travel and movie ticket bookings

- Buy 1 ticket and get up to ₹750 off on purchase of second ticket through BookMyShow (4 times a month)

Emeralde Private Metal Credit Card

- 1 complimentary night stay with Taj Epicure Plus Membership (validity of 1 year)

- Complimentary EazyDiner Prime Membership every year

- 12,500 ICICI Bank Reward Points as Joining Bonus and Annual Bonus

- Receive 2 EaseMyTrip Air Travel vouchers worth ₹ 3,000 each on your first spends of ₹ 4,00,000 and then on the consecutive spends of ₹ 4,00,000

An Invite only Credit Card

Auto Loan

- Loan of up to 100%, of on-road price

- Customized Repayment Scheme available

- End-to-End instant digital loan disbursement/sanction

- Funding on accessories & extended warranty/AMC

- Customized Repayment scheme

- Nil Foreclosure & Part prepayment Charges post repayment of 24 EMIs.

3-in-1 Demat & Trading

- Integrated Savings+Demat+Trading account for hassle free investing experience

- Open online account in few minutes with zero account opening charges

- Instant payout of 75% within 5 minutes of selling shares at no extra cost

- Diversify your investments in theme based baskets of stocks and ETFs

- Choose from Prime & Neo brokerage plan to suit your investment style

- Enhance your buying power upto 4 times with Margin Trade Funding for 360 days

Mutual Funds

- Invest anytime, anywhere in Mutual Funds

- Choose top-rated funds across 30+ Asset Management Companies (AMCs)

- Get recommendation of funds based on your risk profile

- Completely paperless purchase in less than a minute

- 2,500+ schemes to choose from and invest in

- View all your details in one place like portfolio constituents, asset allocation, riskometer, exit load, etc.

- Investment calculator to determine the amount required to be invested.

National Pension System

- Market linked retirement plan with multiple tax benefits

- Portability and flexibility between retail, corporate and multiple fund managers and asset allocation

- Up to ₹ 2 lakh tax exemption. Tax benefit under Section 80CCD (1B) of up to ₹ 50,000 can be claimed over and above the deductions available under Section 80CCD(1) of up to ₹ 1.5 lakh

- Additional tax benefits up to 10% of basic pay under corporate model under both old and new tax regime

- Up to 60% tax free lump sum withdrawal on maturity

Pradhan Mantri Suraksha Bima Yojana

- An insurance scheme that offers accidental insurance cover

- Apply online & get a life cover of ₹ 2 lakhs (1 lakh for partial disability and 2 lakh for permanent disability)

- Enrol in PMSBY with an annual premium is ₹ 20

- Customers between the age group of 18-70 years can apply for the scheme

Special Offers from top brands

Make your spends rewarding with exciting offers round the year on your favourite brands.

Make your spends rewarding with exciting offers round the year on your favourite brands.

Special Offers from top brands

Make your spends rewarding with exciting offers round the year on your favourite brands.

Get access to endless offers across multiple sectors exclusivel for ICICI Customers!

DIY Banking with iPlay

Digital Banking at your convenience

-

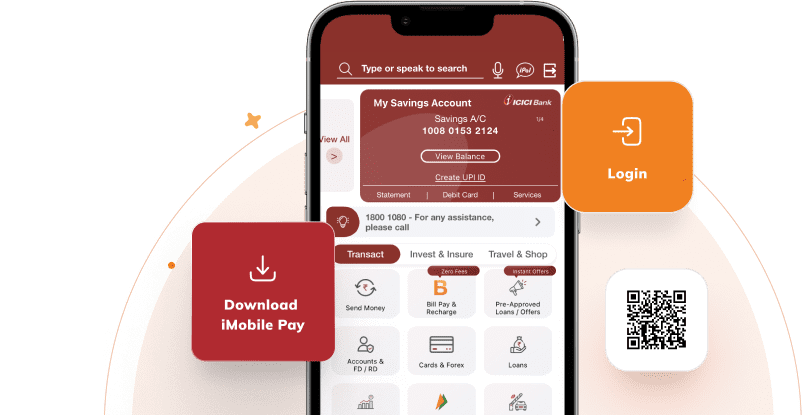

Mobile Banking

- Download iMobile Pay app

- Activate iMobile Pay app

- Authenticate and Login

-

Net Banking

- Call Customer Care and authenticate yourself

- Choose 'Self Banking' or click' I want my User ID'

- Generate your password instantly, online

-

WhatsApp Banking

- Send "SAL" to 86400 86400 to get started

Scan this QR on your mobile to download/open iMobile Pay

Scan to download the App

Click here to enlarge

Scan to download the iMobile App