- 18

- 60

- ₹ 500

- ₹ 500000

- 40%

- 100%

- 60

- 75

- 5%

- 15%

- 5%

- 15%

45

₹42,125

₹1,68,50,012

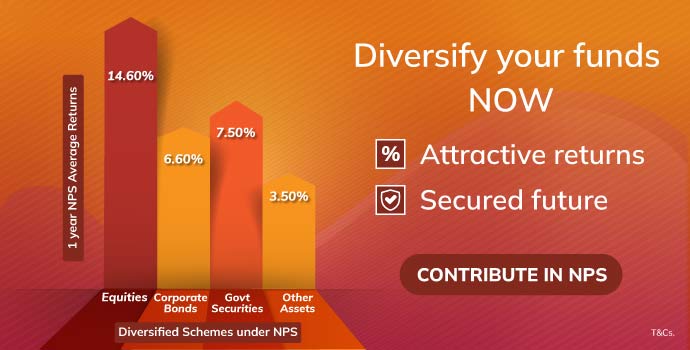

Why Invest in National Pension System (NPS)?

How does National Pension System (NPS) work?

Start investing in National Pension System (NPS) as early as the age of 18 and get great,

steady returns by the time you turn 60!

How to invest in

National Pension System (NPS)?

- 01. Login to ICICI Bank iMobile Pay app> Invest and Insure> Instant NPS

- 02. Fill all the required details (Investment, Personal, Nominee details & Upload your photo and signature)

- 03. Confirm all your details and then submit.

- 01. Login to ICICI Bank Net Banking> Investments and Insurance> National Pension System

- 02. Fill all the required details (Investment, Personal, Nominee details & Upload your photo and signature)

- 03. Confirm all your details and then submit.

How to make contribution in National Pension System (NPS)?

- Login to ICICI Bank Net Banking> Investments and Insurance> National Pension System

- Click on Make Contribution & fill all the mandatory details.

- Preview the details filled and click on ‘Submit’ to register the biller and fund the NPS Account.

Please Note: First contribution towards National Pension System (NPS) needs to be made online within 45 days of PRAN generation or the Account will be frozen.

National Pension System (NPS) FAQs

What is National Pension System (NPS)?

NPS is an easily accessible, low cost, tax-efficient, flexible and portable, voluntary defined-contribution, retirement savings scheme introduced by the Government of India and regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

What are the key features of NPS?

1. Regulated - NPS is regulated by PFRDA, which is established through an Act of Parliament (PFRDA Act 2013)

2. Pension for all - can be voluntarily subscribed by any Indian citizen (resident/non-resident/overseas citizen)

3. Low cost – NPS is one of the low cost pension schemes in the world

4. Flexible - Subscribers have various options to choose from - Point of Presence (PoP), Central Recordkeeping Agency (CRA), Pension Fund and Asset Allocation, etc. The choices exercised can be changed subsequently

5. Portable – NPS Account can be transferred across employment, location(s)/geography(ies)

6. Tax efficient – Tax incentives are available to the subscribers under the Income Tax Act 1961.

7. Optimum returns – Market linked returns based on the investment choice made by the subscriber

8. Transparent – Subscribers can access their NPS Accounts online 24X7 and public disclosures are mandated.

What is the eligibility criteria for NPS?

- Any Indian citizen (resident or non-resident) and overseas citizen of India (OCI)

- Aged between 18-70 years

- Compliant to Know Your Customer (KYC) norms.

Hindu Undivided Families (HUFs) and Persons of Indian Origin (PIO) are not eligible for subscribing to NPS.

NPS is an Individual Pension Account and cannot be opened on behalf of a third person. The applicant should be legally competent to execute a contract as per the Indian Contract Act.

Related Videos